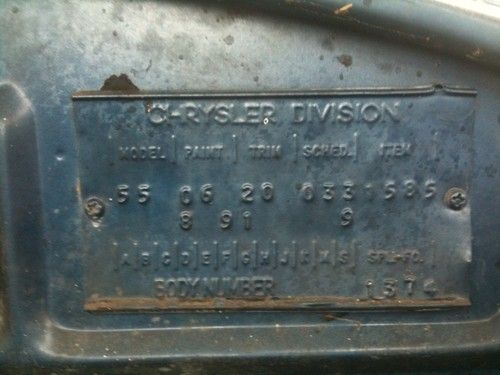

1953 Chrysler Custom Imperial Four Door Sedan on 2040-cars

Royston, Georgia, United States

Engine:Hemi V-8

Body Type:Limousine

Vehicle Title:Clear

Exterior Color: Blue

Make: Chrysler

Interior Color: Brown

Model: Imperial

Number of Cylinders: 8

Trim: Crown

Drive Type: RWD

Mileage: 80,506

Warranty: Vehicle does NOT have an existing warranty

Sub Model: Custom Sedan

Chrysler Imperial for Sale

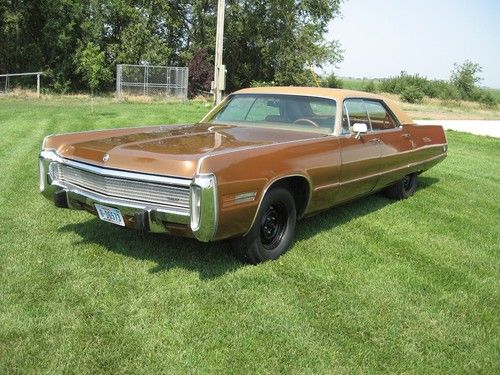

1973 chrysler imperial 4dr hardtop 440-4 bbl car

1973 chrysler imperial 4dr hardtop 440-4 bbl car 1963 chrysler crown imperial southamptom hardtop sedan

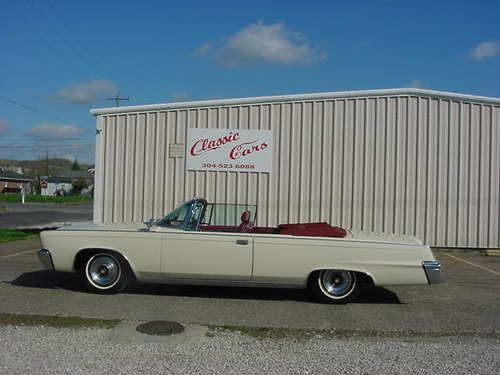

1963 chrysler crown imperial southamptom hardtop sedan Chrysler imperial crown convertible 1959

Chrysler imperial crown convertible 1959 1957 chrysler imperial sedan - hemi powered! great driver!

1957 chrysler imperial sedan - hemi powered! great driver! 1964, beautiful, all original, imperial crown, excellent condition(US $7,500.00)

1964, beautiful, all original, imperial crown, excellent condition(US $7,500.00) 1965 crown imperial convertible(US $28,500.00)

1965 crown imperial convertible(US $28,500.00)

Auto Services in Georgia

Zbest Cars Atlanta ★★★★★

Your Personal Mechanic ★★★★★

Wilson`s Body Shop ★★★★★

West Georgia Discount Tire ★★★★★

Vineville Tire Co. ★★★★★

Trinity Tire & Auto ★★★★★

Auto blog

Marchionne now considering 'Plan B' partners for FCA merger

Thu, Jun 11 2015Okay Sergio, just stop. With the sting of rejection from General Motors CEO Mary Barra still fresh, Fiat Chrysler Automobiles CEO Sergio Marchionne is moving on and trying to find another automaker to merge with. FCA may not be giving up hope on a merger with GM, but that doesn't mean it isn't at least considering alternatives. Sergio's so-called "Plan Bs" include the Volkswagen Group, as well as smaller Asian outfits, like Mazda, Honda, Suzuki, and Hyundai. Bloomberg reports that France's beleaguered PSA Peugeot Citroen could as a sort of "fallback" option due to its relative lack of volume, an unidentified source claimed. There are, of course, problems with each option. According to Bloomberg, Volkswagen expects complete control of a company, but the Agnelli family, which holds a large portion of FCA stock, is loathe to relinquish its stake in the company. On top of that, VAG just isn't looking to make a deal right now. Mazda, meanwhile, is enjoying a new partnership with Toyota and Suzuki is partially owned by VW. Honda and Hyundai have never expressed any interest in a partnership with a western automaker. That kind of just leaves the French then, but even that remains a long shot. As Bloomberg tells it, PSA boss Carlos Tavares is still working on a turn-around plan, and would want at least another six months to execute before even considering a deal with FCA. And even then, Tavares hasn't given any indication that he's considering a pairing. News Source: BloombergImage Credit: Paul Sancya / AP Chrysler Fiat GM Honda Hyundai Mazda Suzuki Citroen Peugeot Sergio Marchionne FCA Mary Barra psa peugeot citroen

Wish you had a world-famous auto exec give your commencement speech? Watch this

Sat, 02 Feb 2013We've seen some pretty great commencement speeches over the years. There was Steve Jobs' incredibly inspiring Stanford address in 2005, John Stewart's insightful speech to the graduating class of William and Mary in 2004 and Steven Colbert's hilarious 2011 address at Northwestern, but automotive executives aren't strangers to honorary degrees. Former General Motors CEO Rick Wagoner spoke at Virginia Commonwealth University in 2011, and Chrysler CEO Sergio Marchionne recently gave the keynote at Walsh College's 100th Commencement Ceremony. The executive knows a thing or two about success and following one's beliefs to fulfillment.

"I constantly encourage my co-workers at Fiat and Chrysler to go beyond the cliche and the conventional to try new approaches and change perspective each and every day," Marchionne said. "I exhort them not to repeat the same things, the same approaches, and I remind them they are indeed free. The freedom I am talking about is something inside you. It is determined by how open minded you remain, how receptive you are to the new and to the different, to the infinite possibilities that present themselves even if you don't go looking for them or could never have imagined. Being free means that you have the strength not to be conditioned by what others want you to do or by what may seem to be the easiest choice."

Amen to that. You can check out the brief press release on the address below as well as a video of a few highlights from the speech.

FCA facing class-action lawsuit over Grand Cherokee shifters

Fri, Jun 24 2016Fiat Chrysler Automobiles is now facing a multi-million-dollar class-action lawsuit over the recalled shifter design in the 2014 and 2015 Jeep Grand Cherokee, and the 2012 to 2014 Dodge Charger and Chrysler 300. Grand Cherokee owners, galvanized by Star Trek actor Anton Yelchin's fatal accident, filed the suit. According to The Wall Street Journal, the owners allege that FCA concealed the shifter's problems. On top of restitution, the class action suit is demanding a court order force FCA to issue a do-not-drive warning to owners of affected vehicles until it fixes the problem. FCA started distributing a software fix to dealers last week – according to the WSJ, the update will add more warnings about the shifter's position and will automatically kick the vehicle into park if the driver steps out. FCA's shifter problems have been bubbling under the surface as part of the company's recall issues. The US government dinged FCA with a $105 million fine last year for its recall practices (or lack thereof) last year, but things have exploded this week after Yelchin's death. The 27-year-old, best known for playing Ensign Pavel Chekov in the rebooted Star Trek film series, was killed after his 2015 Grand Cherokee rolled down his driveway and pinned the actor against a security gate. According to Jeep CEO Mike Manley, the company will dispatch engineers to analyze Yelchin's vehicle. Related Video: