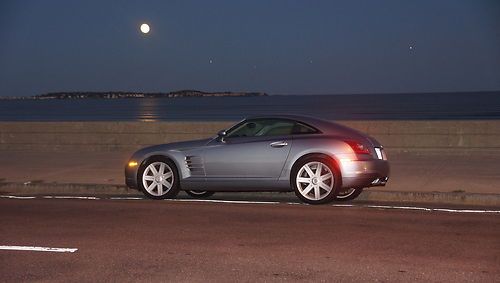

Florida Low 79k Limited Sport Leather Alloys Heated Seats Super Nice!!! on 2040-cars

Pompano Beach, Florida, United States

Engine:3.2L 3200CC 195Cu. In. V6 GAS SOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Coupe

Fuel Type:GAS

Transmission:Automatic

Year: 2004

Warranty: Vehicle does NOT have an existing warranty

Make: Chrysler

Model: Crossfire

Options: Leather Seats

Trim: Base Coupe 2-Door

Safety Features: Side Airbags

Power Options: Power Windows

Drive Type: RWD

Mileage: 79,926

Number of Doors: 2

Sub Model: LIMITED

Exterior Color: Black

Number of Cylinders: 6

Interior Color: Gray

Chrysler Crossfire for Sale

2007 chrysler crossfire limited - $212 p/mo, $200 down!(US $11,990.00)

2007 chrysler crossfire limited - $212 p/mo, $200 down!(US $11,990.00) Florida low 47k crossfire roadster limited leather navi heated super nice!(US $13,950.00)

Florida low 47k crossfire roadster limited leather navi heated super nice!(US $13,950.00) No reserve 2005 chrysler crossfire srt6 convertible navi absolute sale repo!

No reserve 2005 chrysler crossfire srt6 convertible navi absolute sale repo! 2004 chrysler crossfire limited low price!(US $7,700.00)

2004 chrysler crossfire limited low price!(US $7,700.00) 2004 chrysler crossfire coupe red

2004 chrysler crossfire coupe red Super charged

Super charged

Auto Services in Florida

Zip Automotive ★★★★★

X-Lent Auto Body, Inc. ★★★★★

Wilde Jaguar of Sarasota ★★★★★

Wheeler Power Products ★★★★★

Westland Motors R C P Inc ★★★★★

West Coast Collision Center ★★★★★

Auto blog

FCA and UAW deal could mean huge production shakeups

Thu, Sep 17 2015The big labor contract between Fiat Chrysler Automobiles and the United Auto Workers is likely to lead to some very serious production shakeups across the company's North American manufacturing operations. That's according to a new report from Automotive News, which details the sweeping changes at no fewer than five production facilities in Michigan, Illinois, Ohio, Mexico, and Poland. So without further ado, here's what's going where, presented in easy to digest bullet form. Ram 1500 production would move from Warren, MI to Sterling Heights, MI Warren, MI would be retooled for unibody production and would handle the Jeep Grand Wagoneer and could potentially build Grand Cherokees to ease the strain on Detroit's Jefferson North factory Chrysler 200 production would move from Sterling Heights, MI to Toluca, Mexico Dodge Dart production would move from Belvidere, IL to Toluca, Mexic Fiat 500 production, which is currently handled by Toluca, would be concentrated in Poland, where the Euro-spec Cinquecento is built Jeep Cherokee production would move from Toledo, OH to Belvidere, IL to make room for Wrangler and Wrangler Pickup production Like we said, those are some big changes. But, as FCA CEO Sergio Marchionne said in an earlier interview with Automotive News, this kind of shakeup would make a lot of sense. In that August interview the exec said that automakers moved truck production to Mexico because they were "threatened" by the UAW. "The only thing [the UAW] want is to move the truck back. Which is right. If you move the truck back here, which is [the UAW's] domain, [and move] all the cars that we get killed on somewhere else, we could actually make sense of this bloody industry and actually increase the number of people employed in this country and really share wealth because we are making money," Marchionne told AN. News Source: Automotive News - sub. req.Image Credit: Bill Pugliano / Getty Images Plants/Manufacturing UAW/Unions Chrysler Dodge Fiat Jeep RAM Sergio Marchionne FCA toluca warren sterling heights

2013.5 Chrysler 200 S Special Edition is a Sebring swan song

Wed, 27 Mar 2013

The world is set to get an all-new Chrysler 200 next year, thereby finally putting the bones of the long-serving Sebring to rest. To tide us all over until then, the automaker has released the 2013.5 200 S Special Edition. As a collaboration between Chrysler and the Imported from Detroit clothing line, the sedan features plenty of aesthetic tweaks to give it a bit more attitude. Those include tinted headlamp and taillamp housings, body-color door sills and 18-inch gloss black wheels. There's also a revised front fascia with a black mesh grille, while the tail end gets a decklid spoiler and a revised valance.

Indoors, the seats are clad in black, water-resistant fabric courtesy of Carhartt. Expect to see the 2013.5 200 S Special Edition in dealers soon with a price tag of $28,870. While there are plenty of questions to be asked here, one is more nagging than the others. Why bother buying the special edition when an all-new model is mere months away? It's an age-old question, but it still bears asking. Check out the full press release below for more information.

Chrysler 300 SRT dead in US, updated elsewhere

Sat, Aug 29 2015The Chrysler 300 SRT is officially dead here in the US, but the sedan's big V8 continues to rumble in a handful of other markets around the world. In fact, the model just received a refresh abroad to fit the standard version's recently updated styling. According to Car and Driver, customers in countries like Australia, Japan, South Africa, South Korea, and a few other places can stop by their local Chrysler dealer soon to pick up some of this imported muscle. For the refresh, the 300 SRT's 6.4-liter V8 remains under the hood producing 470 horsepower, and it's now hooked up to an eight-speed automatic gearbox. The styling also gets some updates like LED lights in the lower air dam, a reshaped mesh grille with the SRT logo, and a simplified design for the taillights. If it seems odd to go to the work of updating the 300 SRT's styling, while killing off the model in the US, the reason has to do with FCA's brand strategy here. Dodge is supposed to be the automaker's performance marque in America, and according to Car and Driver, Jeep gets to keep SRT branding on the Grand Cherokee because of the brawny SUV's popularity. That might not last much longer, because reports suggest a Hellcat-powered Trackhawk is on the way. Related Video:

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.104 s, 7902 u