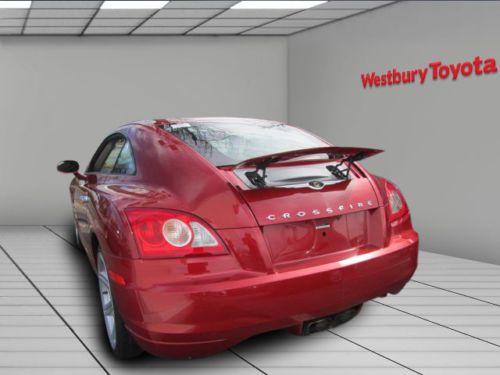

2dr Cpe Manual Coupe Cd A/c Cruise Control Heated Mirrors Heated Seats Abs on 2040-cars

Westbury, New York, United States

Chrysler Crossfire for Sale

Only 13k miles.this is the one ! clean car fax service up to date a rare find(US $16,600.00)

Only 13k miles.this is the one ! clean car fax service up to date a rare find(US $16,600.00) 2005 chrysler crossfire base coupe 2-door 3.2l(US $13,500.00)

2005 chrysler crossfire base coupe 2-door 3.2l(US $13,500.00) 2005y chrysler crossfire srt-6 coupe 2-door supercharged amg 3.2l(US $11,950.00)

2005y chrysler crossfire srt-6 coupe 2-door supercharged amg 3.2l(US $11,950.00) Limited crossfire.. clean carfax.. low mileage.

Limited crossfire.. clean carfax.. low mileage. 2005 chrysler crossfire base convertible 2-door 3.2l(US $8,200.00)

2005 chrysler crossfire base convertible 2-door 3.2l(US $8,200.00) 2004 chrysler crossfire base coupe 2-door 3.2l

2004 chrysler crossfire base coupe 2-door 3.2l

Auto Services in New York

Whitesboro Frame & Body Svc ★★★★★

Used-Car Outlet ★★★★★

US Petroleum ★★★★★

Transitowne Misibushi ★★★★★

Transitowne Hyundai ★★★★★

Tirri Motor Cars ★★★★★

Auto blog

Chrysler 200 configurator already online

Wed, 15 Jan 2014A preliminary configurator for the 2015 Chrysler 200 is already up and greeting Internet visitors. The totally re-envisioned sedan that we got to know in our Deep Dive starts with an LX base trim for $22,695, which comes out to an MSRP of $21,700 plus $995 for destination. That number will get you entry to a party that comes with keyless entry, ambient LED lighting inside, a five-inch Uconnect touschcreen system with Bluetooth, a six-speaker stereo, eight-way power driver's seat, safety features like brake assist and an electronic parking brake and eighteen-inch wheels on all-season tires.

The features list isn't yet broken down by model, but including destination, the other three trims retail for $24,250 for the Limited, $25,990 for the S and $26,990 for the C. All-wheel drive adds $4,200 on the S and the C.

You can build an LX pretty quickly because there aren't many options. There are two interior choices, black or black/linen, five exterior color options, and just two choices after that: you can opt for the $495 five-inch Uconnect system that adds features like voice command and a rearview mirror with a microphone, and an engine block heater for $95.

Is Chrysler's 'America's Import' campaign outdated or offensive? [w/poll]

Tue, 04 Nov 2014Chrysler launched its America's Import campaign with a splashy ad during the Super Bowl starring Bob Dylan and featuring a whole bunch of patriotic imagery that included Marilyn Monroe, James Dean, factory employees and, of course, the city of Detroit. Since then, the brand has followed the original spot with even more ads using the same tagline. Not everyone is pleased, it seems, including The Detroit Free Press auto critic Mark Phelan, who's fed up with the marketing. In an editorial for the newspaper, Phelan claims that it's insulting to the US auto industry and its workers.

"The phrase 'America's import,' with its suggestion that 'import' equals 'better,' feels terribly dated, a relic of the 1980s. It's the rhetorical equivalent of hanging a pastel-hued 'Miami Vice' poster on your office wall," writes Phelan in the piece. Also, since some of the brand's cars are made in Canada, the line isn't even entirely true, he claims. Phelan goes on to praise the company's earlier Imported from Detroit commercials for getting the right message across and showing pride in the city.

While "America's Import" might be the tagline for Chrysler's ads, it's not the whole message. Subsequent ads keep the hard-working, patriotic imagery from the original Super Bowl spot but put a bigger emphasis on the Chrysler 200 that the commercials are meant to sell.

Chrysler appoints new heads of Alfa Romeo and Ram

Mon, 18 Aug 2014Chrysler has announced to two key appointments to its senior leadership, both of them taking immediate effect. First up is Reid Bigland, who has been named head of the Alfa Romeo brand for North America. Bigland has served until now as head of the Ram Truck brand, a portfolio he now hands over to Robert Hegbloom, who had served until now as its director.

As a result of the appointments, both Bigland and Hegbloom will take up seats on Chrysler's NAFTA Leadership Team, and Bigland will also join the Fiat Chrysler Group Executive Council - the highest decision-making body in the Fiat Chrysler Automobiles empire.

As per Sergio Marchionne's leadership style, Bigland will continue to serve in two major capacities, maintaining his role as president and CEO of Chrysler Canada. Other senior executives who hold multiple key portfolios include Harald Wester (who serves as the group's Chief Technology Officer and also overseas Alfa Romeo, Maserati and Abarth), Olivier Francois (group Chief Marketing Officer and head of the Fiat brand) and Michael Manley (head of the Asia-Pacific region and the Jeep brand).