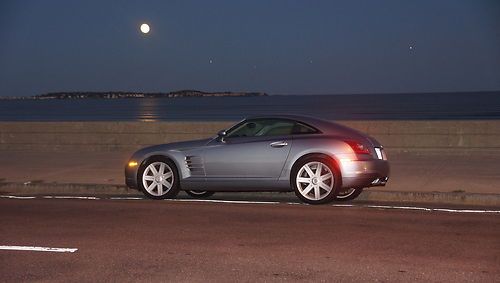

2007 Chrysler Crossfire Limited - $212 P/mo, $200 Down! on 2040-cars

Newton, North Carolina, United States

Vehicle Title:Clear

For Sale By:Dealer

Engine:3.2L 3200CC 195Cu. In. V6 GAS SOHC Naturally Aspirated

Body Type:Coupe

Fuel Type:GAS

Year: 2007

Make: Chrysler

Model: Crossfire

Trim: Limited Coupe 2-Door

Transmission Description: 6-SPEED MANUAL TRANSMISSION

Number of Doors: 2

Drive Type: RWD

Drivetrain: Rear Wheel Drive

Mileage: 64,923

Sub Model: Limited

Number of Cylinders: 6

Exterior Color: Blue

Interior Color: Black

Chrysler Crossfire for Sale

Florida low 47k crossfire roadster limited leather navi heated super nice!(US $13,950.00)

Florida low 47k crossfire roadster limited leather navi heated super nice!(US $13,950.00) No reserve 2005 chrysler crossfire srt6 convertible navi absolute sale repo!

No reserve 2005 chrysler crossfire srt6 convertible navi absolute sale repo! 2004 chrysler crossfire limited low price!(US $7,700.00)

2004 chrysler crossfire limited low price!(US $7,700.00) 2004 chrysler crossfire coupe red

2004 chrysler crossfire coupe red Super charged

Super charged 2007 chrysler crossfire base coupe 2-door 3.2l(US $10,900.00)

2007 chrysler crossfire base coupe 2-door 3.2l(US $10,900.00)

Auto Services in North Carolina

Wood Tire & Alignment ★★★★★

Wilhelm`s ★★★★★

Wilcox Auto Sales ★★★★★

Town & Country Radiator ★★★★★

The Transmission Shop ★★★★★

The Auto Finders ★★★★★

Auto blog

FCA updates 700k-vehicle recall to replace ignition switches

Mon, Mar 9 2015FCA US is revising a previously announced recall of 702,578 minivans and SUVs; now specifying that owners replace their ignition switches, rather than just a component. The campaign affects the 2008-2010 Chrysler Town & Country, 2008-2010 Dodge Grand Caravan and 2009-2010 Dodge Journey. The National Highway Traffic Safety Administration initially opened an investigation last summer following complaints about the ignition switches in these models. FCA US (then Chrysler Group) responded with a recall of 695,957 examples of these vehicles because the key could appear to be in the "Run" position but not be fully engaged. If it slipped out, and there was an accident, then the airbags might not deploy. The company had initially planned to install a new detent ring to fix the problem. According to the timeline in a NHTSA document (available here as a PDF), the government agency and FCA US continued their research into the problem. The automaker found that the time needed to create a new ring design and updated software would be longer than replacing the whole ignition switch. The company worked with the supplier Marquardt to negotiate an accelerated schedule to manufacture the extra replacement parts. According to NHTSA, the investigation has now been closed because of FCA's recall. Company spokesperson Eric Mayne confirms to Autoblog via email, "No additional vehicles are affected and all affected customers have already been made aware their vehicles are subject to recall." FCA US sent out an initial notification advising owners of the problem in September 2014. The company will now send out a second letter in April and will replace the parts in two phases. Repairs for affected models from the 2008 and 2009 model years will begin in April, and 2010 examples will start being fixed in August. RECALL Subject : Ignition Switch may Turn Off , 1 INVESTIGATION(S) Report Receipt Date: JUN 26, 2014 NHTSA Campaign Number: 14V373000 Component(s): AIR BAGS , ELECTRICAL SYSTEM Potential Number of Units Affected: 702,578 All Products Associated with this Recall Vehicle Make Model Model Year(s) CHRYSLER TOWN AND COUNTRY 2008-2010 DODGE GRAND CARAVAN 2008-2010 DODGE JOURNEY 2009-2010 Details Manufacturer: Chrysler Group LLC SUMMARY: This defect can affect the safe operation of the airbag system. Until this recall is performed, customers should remove all items from their key rings, leaving only the ignition key.

That thing got a Hemi? Mopar engine kits make it easier to say yes

Wed, Nov 2 2016Thanks to a new kit from Mopar, classic car owners will have an easier time dropping Hemis into their muscle cars. The kit works with Mopar's 345 and 392 Hemi engines (5.7 and 6.4 liters respectively) and with cars built before 1975. The kit will run $1,795 and has everything needed to get one of the above engines running. The parts include a power distribution system, engine computer, engine and chassis wiring harnesses, O2 and intake air temperature sensors, ground wiring and a gas pedal. The kit is also designed to work with a manual transmission, but Mopar says a transmission such as the Torqueflite 727 and 904 can be made to work with the system. As for examples of the kit in action, take a look at the Jeep CJ66 and Dodge Challenger Shakedown that Mopar revealed this week at the SEMA show. Mopar also offers a few other parts to help complete the project, including various oil pans to clear subframes, a set of headers, and accessory drives for power steering and air conditioning. All of these parts are extra cost though. You'll also need an engine, and the 345 starts at $6,070, and the 392 runs $9,335. However, if you happen to already have one from 2014 or newer, that will work, too. Muscle car fans are getting more choices for their engine conversions. Chevrolet Performance already sells crate engines with "Connect and Cruise" kits to get its engines working in classic cars. The General also offers it with more engines. However, for people who want to keep a Mopar engine in their classic Chrysler, Dodge, Plymouth, or Jeep, this is a cool new option. Related Video: Featured Gallery Mopar Hemi V8 Engine Swap Kit Image Credit: FCA Aftermarket SEMA Show Chrysler Dodge Performance Classics FCA engine swap SEMA 2016

Chrysler to accelerate production of 2013 Ram and V6 engines

Fri, 16 Nov 2012Chrysler is adding a third shift at its Warren Truck plant to meet demand for the new 2013 Ram pickup. And with tight supplies of its Pentastar V6, the company is also boosting output at its Mack Engine plant.

The expansions will add 1,250 jobs and are part of a $238 million investment by Chrysler in the Detroit area. Warren's third shift will begin work sometime in the spring, a Chrysler rep told Automotive News. Mack's increased Pentastar production a could include both 3.6 and 3.2-liter engines.

The company says it also plans to invest $40 million in its Trenton Engine plant to allow for production of a 3.2-liter V6 as well as the Tigershark inline-four for the upcoming Jeep Liberty replacement.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.03 s, 7841 u