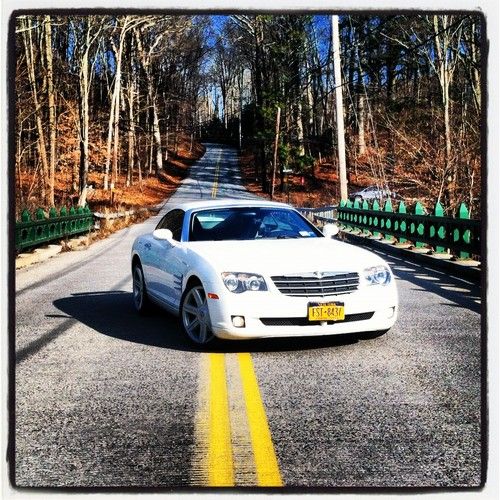

2006 Chrysler Crossfire on 2040-cars

Sarasota, Florida, United States

Engine:3.2L 3200CC 195Cu. In. V6 GAS SOHC Naturally Aspirated

Body Type:Convertible

Fuel Type:GAS

Warranty: Unspecified

Make: Chrysler

Model: Crossfire

Options: Leather Seats, CD Player, Convertible

Trim: Limited Convertible 2-Door

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Drive Type: RWD

Number of Doors: 2

Mileage: 18,369

Drivetrain: RWD

Sub Model: Limited

Exterior Color: Gold

Number of Cylinders: 6

Interior Color: Black

Chrysler Crossfire for Sale

2005 chrysler crossfire base convertible 2-door 3.2l

2005 chrysler crossfire base convertible 2-door 3.2l 2004 chrysler crossfire coupe leather chrome wheels 3.2l v6(US $9,500.00)

2004 chrysler crossfire coupe leather chrome wheels 3.2l v6(US $9,500.00) 2004 chrysler crossfire base coupe 2-door 3.2l(US $11,500.00)

2004 chrysler crossfire base coupe 2-door 3.2l(US $11,500.00) 2006 limited 3.2l grey(US $12,477.00)

2006 limited 3.2l grey(US $12,477.00) 2004 chrysler crossfire/loaded/57,000 miles/great driving car

2004 chrysler crossfire/loaded/57,000 miles/great driving car 2004 chrysler crossfire ltd 2dr coupe 1 owner low mileage leather loaded(US $10,900.00)

2004 chrysler crossfire ltd 2dr coupe 1 owner low mileage leather loaded(US $10,900.00)

Auto Services in Florida

Zych`s Certified Auto Svc ★★★★★

Yachty Rentals, Inc. ★★★★★

www.orlando.nflcarsworldwide.com ★★★★★

Westbrook Paint And Body ★★★★★

Westbrook Paint & Body ★★★★★

Ulmerton Road Automotive ★★★★★

Auto blog

Fiat and UAW back at negotiating table over Chrysler stake

Mon, 23 Dec 2013We knew there'd be no Chrysler IPO before the end of this year, but Fiat is determined to get the best run going into 2014 and is back at the poker table with the UAW. The delay was said to be Chrysler's desire to clean up a tax issue with the IRS; turns out that also bought the carmaker time to try and close a deal for the UAW's 48.5-percent stake in the company before the IPO happens.

Whereas the price Chrysler was willing to pay was once more than $1 billion under the UAW's asking price, the gap has closed to just $800 million of late. A recent valuation of the company at $10 billion - a valuation the UAW has disputed - means Fiat would be looking to pay about $4.2 billion instead of the $5 billion that the UAW seeks. But the UAW needs to hold out for the highest amount it can get because its pension obligations through the Voluntary Employee Benefit Association (VEBA) are $3.1 billion greater than the VEBA's assets, which include the Chrysler stake.

There's a clause in the agreement that Fiat can buy the VEBA shares for $6 billion, but Fiat CEO Sergio Marchionne has said that the UAW "should buy a ticket for the lottery" if they even want $5 billion. The UAW, though, has more time to wait; it's Fiat that wants access to Chrysler's $11.9-billion war chest and that would like to avoid the risk of paying the full $6 billion for the UAW share if the float really takes off. With other valuations of Chrysler as high as $19 billion, a hot IPO could make that $6 billion look like a bargain.

Fiat Chrysler expands Takata airbag recall to 3.3M vehicles

Fri, Dec 19 2014Fiat Chrysler Automobiles is expanding its recall of vehicles equipped with Takata airbags, moving beyond Florida, Hawaii, Puerto Rico and the US Virgin Islands to the greater US, as well as Mexico, Canada and beyond. The affected vehicles, some 3.3 million in total, were built between 2004 and 2007, with many models, including the Dodge Ram 1500, 2500 and 3500, Durango and the Chrysler 300, having been affected by Chrysler's previous recall. Despite the somewhat alarming nature that comes with a recall of this many vehicles, it seems that Chrysler is moving more out of an abundance of caution (and federal pressure) than anything else, saying: "Neither FCA US, nor Takata Corporation, the supplier, has identified a defect in this population of inflators. These components also are distinct from Takata inflators cited in fatalities involving other auto makers. More than 1,000 laboratory tests have been performed on these components. All deployed as intended, but FCA US continues to study the suspect inflators, which are not used in the Company's current production vehicles." Owners of affected vehicles will be notified and asked to report to dealers for a free replacement driver's side airbag. Scroll down for the official press release from FCA. Statement: Global Air-Bag Inflator Replacement December 19, 2014 , Auburn Hills, Mich. - FCA US LLC will replace driver's-side air-bag inflators in an estimated 3.3 million older-model vehicles worldwide, in an expansion of an ongoing regional field action. Neither FCA US, nor Takata Corporation, the supplier, has identified a defect in this population of inflators. These components also are distinct from Takata inflators cited in fatalities involving other auto makers. More than 1,000 laboratory tests have been performed on these components. All deployed as intended, but FCA US continues to study the suspect inflators, which are not used in the Company's current production vehicles. Outside of Florida, one of the areas covered by the original action, no FCA US vehicle has been linked to an air-bag deployment of the type that has raised public concern. Nevertheless, the Company is replacing the Takata components tied to that concern. FCA US is aware of one related injury involving one of its vehicles, an older-model sedan. It occurred in a southern Florida region marked by persistent, high, absolute humidity – a condition believed to be a contributing factor in the air-bag deployments under investigation.

The next steps automakers could take after sales drop again in April

Tue, May 2 2017DETROIT (Reuters) - Major automakers on Tuesday posted declines in U.S. new vehicle sales for April in a sign the long boom cycle that lifted the American auto industry to record sales last year is losing steam, sending carmaker stocks down. The drop in sales versus April 2016 came on the heels of a disappointing March, which automakers had shrugged off as just a bad month. But two straight weak months has heightened Wall Street worries the cyclical industry is on a downward swing after a nearly uninterrupted boom since the Great Recession's end in 2010. Auto sales were a drag on U.S. first-quarter gross domestic product, with the economy growing at an annual rate of just 0.7 percent according to an advance estimate published by the Commerce Department last Friday. Excluding the auto sector the GDP growth rate would have been 1.2 percent. Industry consultant Autodata put the industry's seasonally adjusted annualized rate of sales at 16.88 million units for April, below the average of 17.2 million units predicted by analysts polled by Reuters. General Motors Co shares fell 2.9 percent while Ford Motor Co slid 4.3 percent and Fiat Chrysler Automobiles NV's U.S.-traded shares tumbled 4.2 percent. The U.S. auto industry faces multiple challenges. Sales are slipping and vehicle inventory levels have risen even as carmakers have hiked discounts to lure customers. A flood of used vehicles from the boom cycle are increasingly competing with new cars. The question for automakers: How much and for how long to curtail production this summer, which will result in worker layoffs? To bring down stocks of unsold vehicles, the Detroit automakers need to cut production, and offer more discounts without creating "an incentives war," said Mark Wakefield, head of the North American automotive practice for AlixPartners in Southfield, Michigan. "We see multiple weeks (of production) being taken out on the car side," he said, "and some softness on the truck side." Rival automakers will be watching each other to see if one is cutting prices to gain market share from another, he said, instead of just clearing inventory. INVESTORS DIGEST BAD NEWS Just last week GM reported a record first-quarter profit, but that had almost zero impact on the automaker's stock. The iconic carmaker, whose own interest was once conflated with that of America's, has slipped behind luxury carmaker Tesla Inc in terms of valuation.