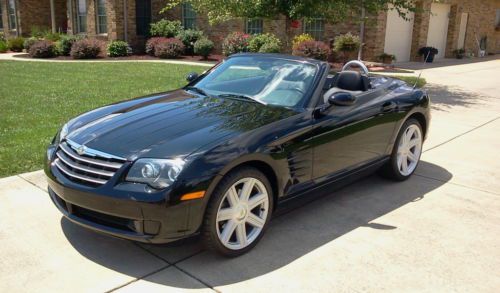

2005 Chrysler Crossfire Base Convertible 2-door 3.2l on 2040-cars

Milton, West Virginia, United States

|

This beautiful black on black 2005 Chrysler Crossfire Convertible is in mint condition. Never had any body work and is in 100% mechanical condition. Always maintained at Chrysler dealer, always garage kept. No dents or door dings, top in new condition, headlights in new condition, no wheel damage or front end damage. There are no leaks and just put 4 new tires on the car and a new battery. The previous owner bought the car new and was the president of a car club in Lexington Ky. It has been taken very good care of since new. I put new factory leather seats in the car when I purchased it.

|

Chrysler Crossfire for Sale

2005 chrysler crossfire base convertible 2-door 3.2l 30,000 miles black/black(US $13,000.00)

2005 chrysler crossfire base convertible 2-door 3.2l 30,000 miles black/black(US $13,000.00) Manual transmission financing available coupe low miles leather cd player tracti

Manual transmission financing available coupe low miles leather cd player tracti 2005 chrysler crossfire limited convertible 2-door 3.2l

2005 chrysler crossfire limited convertible 2-door 3.2l 2005 chrysler crossfire limited leather v6 coupe excellent condition

2005 chrysler crossfire limited leather v6 coupe excellent condition 2005 chrysler crossfire limited coupe(US $7,100.00)

2005 chrysler crossfire limited coupe(US $7,100.00) 2005 chrysler crossfire convertible 6 speed black only 52k miles rare find(US $9,995.00)

2005 chrysler crossfire convertible 6 speed black only 52k miles rare find(US $9,995.00)

Auto Services in West Virginia

Thumpin Car Stereo Inc ★★★★★

Saffford Chrysler Jeep Dodge ★★★★★

Roy`s Quality Car Care ★★★★★

Griff`s Auto ★★★★★

Fisher Auto Parts ★★★★★

City Cars ★★★★★

Auto blog

2013.5 Chrysler 200 S Special Edition is a Sebring swan song

Wed, 27 Mar 2013

The world is set to get an all-new Chrysler 200 next year, thereby finally putting the bones of the long-serving Sebring to rest. To tide us all over until then, the automaker has released the 2013.5 200 S Special Edition. As a collaboration between Chrysler and the Imported from Detroit clothing line, the sedan features plenty of aesthetic tweaks to give it a bit more attitude. Those include tinted headlamp and taillamp housings, body-color door sills and 18-inch gloss black wheels. There's also a revised front fascia with a black mesh grille, while the tail end gets a decklid spoiler and a revised valance.

Indoors, the seats are clad in black, water-resistant fabric courtesy of Carhartt. Expect to see the 2013.5 200 S Special Edition in dealers soon with a price tag of $28,870. While there are plenty of questions to be asked here, one is more nagging than the others. Why bother buying the special edition when an all-new model is mere months away? It's an age-old question, but it still bears asking. Check out the full press release below for more information.

Chrysler and Fiat offering $1,000 rebates to VW owners as Marchionne gets tough

Mon, 10 Dec 2012The throw-down between Fiat CEO Sergio Marchionne and Volkswagen has heated up in earnest. According to Bloomberg, Fiat and Chrysler are now offering current Volkswagen owners in the US $1,000 rebates to trade in their ride. It's the latest in a series of shots Marchionne has taken at his German rival. As you may recall, the Fiat executive entered into a spat with Volkwagen board chairman Ferdinand Piëch and CEO Martin Winterkorn in October after the duo called for Marchionne's resignation from presidency of the European Automotive Manufacturers Association (AECA). At the time, the Volkswagen executives were quoted as saying Fiat would not survive the European economic downturn.

In response, Marchionne called the German executives "reprehensible," and accused Volkswagen of using a pricing strategy that has created created a "bloodbath" in the EU. Volkswagen has taken to steep discounting to carve out ever-larger slices of market share in Europe, but the company has a much smaller foothold in the US. Marchionne may be trying to hit Volkswagen where the manufacturer is weakest with the new Fiat new incentive program.

Late last week, the Fiat executive was voted to a second term as ACEA president.

8 automakers, 15 utilities collaborate on open smart-charging for EVs

Thu, Jul 31 2014We're going to lead with General Motors here. GM is one of eight automakers working with 15 utilities and the Electric Power Research Institute (EPRI) at developing a "smart" plug-in vehicle charging system. Why did we start with GM? Because it's the first automaker whose press release we read that mentioned the other seven automakers. Points for sharing. For the record, the collaboration also includes BMW, Toyota, Mercedes-Benz, Honda, Chrysler, Mitsubishi and Ford. The utilities include DTE Energy, Duke Energy, Southern California Edison and Pacific Gas & Electric. The idea is to develop a so-called "demand charging" system in which an integrated system lets the plug-ins and utilities communicate with each other so that vehicle charging is cut back at peak hours, when energy is most expensive, and ramped up when the rates drop. Such entities say there's a sense of urgency to develop such a system because the number of plug-in vehicles on US roads totals more than 225,000 today and is climbing steadily. There's a lot of technology involved, obviously, but the goal is to have an open platform that's compatible with virtually any automaker's plug-in vehicle. No timeframe was disclosed for when such a system could go live but you can find a press release from EPRI below. EPRI, Utilities, Auto Manufacturers to Create an Open Grid Integration Platform for Plug-in Electric Vehicles PALO ALTO, Calif. (July 29, 2014) – The Electric Power Research Institute, 8 automakers and 15 utilities are working to develop and demonstrate an open platform that would integrate plug-in electric vehicles (PEV) with smart grid technologies enabling utilities to support PEV charging regardless of location. The platform will allow manufacturers to offer a customer-friendly interface through which PEV drivers can more easily participate in utility PEV programs, such as rates for off-peak or nighttime charging. The portal for the system would be a utility's communications system and an electric vehicle's telematics system. As the electric grid evolves with smarter functionality, electric vehicles can serve as a distributed energy resource to support grid reliability, stability and efficiency. With more than 225,000 plug-in vehicles on U.S. roads -- and their numbers growing -- they are likely to play a significant role in electricity demand side management.