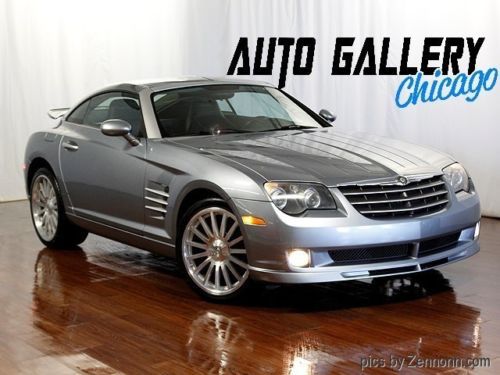

2004 Chrysler Crossfire - Sapphire Blue, 2 Sets Of Wheels on 2040-cars

Rocky Mount, Virginia, United States

|

This has been a great car but I need something with a backseat now. Comes with the Vossen wheels pictured (VVC084 - 2500$ new) and the original set of wheels. The Vossen's have new Yoko S-drive radials. The rear Vossens are 20s and the fronts are 19s where the originals wheels are rear 19, and front 18. Feel free to email with any questions or for more pics.

|

Chrysler Crossfire for Sale

2005 chrysler crossfire roadster limited convertible bluetooth usb cd 5-speed(US $14,950.00)

2005 chrysler crossfire roadster limited convertible bluetooth usb cd 5-speed(US $14,950.00) 05 blaze red 3.2l v6 autostick convertible *alloy wheels *low miles *florida

05 blaze red 3.2l v6 autostick convertible *alloy wheels *low miles *florida 330 hp srt-6,(US $11,990.00)

330 hp srt-6,(US $11,990.00) 2005 chrysler crossfire srt-6 convertible 2-door 3.2l(US $19,250.00)

2005 chrysler crossfire srt-6 convertible 2-door 3.2l(US $19,250.00) 2005 chrysler crossfire base convertible 2-door 3.2l(US $11,500.00)

2005 chrysler crossfire base convertible 2-door 3.2l(US $11,500.00) 2004 chrysler crossfires,white, estate sale ,clean title.

2004 chrysler crossfires,white, estate sale ,clean title.

Auto Services in Virginia

Xtensive Body & Paint ★★★★★

Tread Quarters Discount Tire ★★★★★

Taylor`s Automotive ★★★★★

Sterling Transmission ★★★★★

Staples Automotive ★★★★★

Stanton`s Towing ★★★★★

Auto blog

2015 Chrysler 200 gets 36 mpg with Tigershark four-cylinder

Thu, 27 Mar 2014Chrysler has come out with the official fuel economy information on the new 200 following the info that was leaked from the EPA earlier this week. It turns out that our initial report of 18 miles per gallon in the city and 29 mpg on the highway for the all-wheel-drive V6 was correct.

What we didn't know at the time, though, was what sort of economy the 200's other powertrain options managed. Outfitted with the 2.4-liter four-pot, Chrysler is promising 23 mpg in the city and 36 mpg on the highway, with a combined rating of 28 mpg. Those figures are fairly impressive; besting figures of the 2.5-liter Ford Fusion and tying the 1.5-liter, EcoBoost, non-start-stop model. It's also beats the four-cylinder Toyota Camry's 35-mpg highway figure while tying its combined efficiency.

Stepping up to the 295-horsepower Pentastar V6 pushes the economy down to 19 mpg in the city, while the highway figure is a respectable 32 mpg for the front-driver. The combined rating for the FWD V6 is 23 mpg. Those figures can't quite match the 270-horsepower 2.0-liter, EcoBoost four of the Fusion, which nets 22 city and 33 highway. In fact, the V6 200 has trouble besting even the 3.5-liter V6 of the Camry, which returns 21 mpg city and 31 mpg highway. Again, though, the 200 is noticeably more powerful.

Detroit Three to lose dominance of North American auto output in 2017

Wed, Sep 27 2017DETROIT — North American vehicle production by the unionized Detroit Three automakers will fall behind the combined North American output of Tesla and automakers from Europe and Asia for the first time this year, IHS Markit forecast on Wednesday. In 2017, the Detroit Three could build 8.6 million vehicles in North America, while Tesla and foreign automakers build 8.7 million, IHS Markit analyst Joe Langley said. By 2024, the gap will widen, with Asian and European automakers and Tesla combining to build about 9.8 million vehicles in North America. General Motors, Ford and the North American operations of Fiat Chrysler Automobiles NV will combine to build 8.1 million vehicles, down 6 percent from this year. Mexico is on track to increase its share of North American vehicle production, Langley said, moving to 4.5 million vehicles a year by 2024 from about 4 million vehicles currently. The milestone for the growth of Tesla and foreign automakers in North America comes as the Trump administration is pushing to limit imports of vehicles from Mexico in negotiations to overhaul the North American Free Trade Agreement. The declining share of North American vehicle production for the Detroit automakers also challenges U.S. and Canadian unions that represent their workers. Canadian workers are on strike at a GM factory in Ontario to protest the automaker's decision to cut jobs and move to Mexico some production of sport utility models built there. Foreign automakers over the past year have announced plans for a wave of new or expanded plants in North America, while Tesla is ramping up to build as many as 500,000 cars a year at its plant in Fremont, Calif. Often referred to as "transplants," the foreign-owned factories are poised to become the mainstream of the North American auto industry. Automakers are increasingly using factories in China or Mexico to build vehicles that used to be assembled solely in the United States, Langley said. He cited as an example Ford's decision to shift production of the Focus small car for North America to a Chinese assembly plant. Reporting by Joseph WhiteRelated Video: Image Credit: Reuters Plants/Manufacturing Chrysler Ford GM

Maserati's new North American CEO is Chrysler's dealer guru

Wed, 13 Nov 2013There's been a bit of a shakeup among the executive ranks at Chrysler and Maserati, as the Italian sports car manufacturer has appointed Peter Grady as its new North American CEO. Grady, who we imagine is about to get a very nice upgrade to his company car, will retain his role as vice president of dealer network development for Chrysler and Chrysler Capital, and is replacing Bob Graczyk at Maserati.

"It is with pleasure and anticipation that I welcome Peter to Maserati. He brings to our company nearly 30 years of leadership and experience. His background and industry expertise will be a great basis for the continued expansion of Maserati in North America," said Maserati CEO Harald Wester in a statement.

Also joining the team at Maserati is Saad Chehab, who previously worked for the Chrysler and Lancia brands and will be the new head of marketing for the Italian brand. He'll be replaced by Al Gardner, the former boss of Chrysler's southeast business center, as the head of Chrysler brand, according to Automotive News.