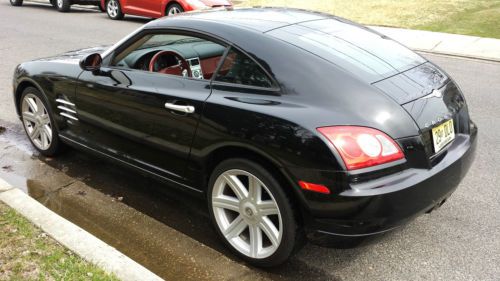

2004 Chrysler Crossfire In Excellent Condition. Only 75k Miles Private Seller on 2040-cars

Blackwood, New Jersey, United States

|

2004 Chrysler Crossfire Limited with only 75k miles

It Rear wheel drive with a V6 3.2 liter engine and MANUAL Transmission. Has every option including: Pwr everything, ABS, Telescoping Wheel, Dual & Side airbags The car is very similar to the Mercedes SLK with the same frame and engine. It is completely stock, driven by a middle aged woman, religiously maintained. There are Zero problems or issues with the car. Everything works properly Very quick little car especially fun to drive with a manual transmission. Interior and Exterior looks great. I might be interested in a trade depending on what you have. Please call if you want to come see it (856) 9O6-7448 |

Chrysler Crossfire for Sale

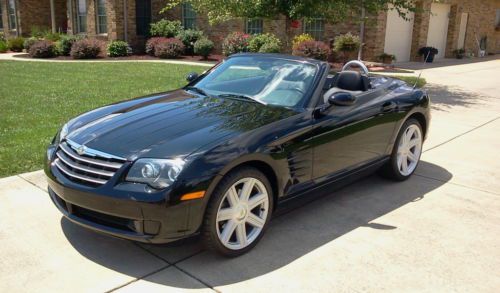

2005 chrysler crossfire base convertible 2-door 3.2l(US $14,500.00)

2005 chrysler crossfire base convertible 2-door 3.2l(US $14,500.00) 2005 chrysler crossfire base convertible 2-door 3.2l 30,000 miles black/black(US $13,000.00)

2005 chrysler crossfire base convertible 2-door 3.2l 30,000 miles black/black(US $13,000.00) Manual transmission financing available coupe low miles leather cd player tracti

Manual transmission financing available coupe low miles leather cd player tracti 2005 chrysler crossfire limited convertible 2-door 3.2l

2005 chrysler crossfire limited convertible 2-door 3.2l 2005 chrysler crossfire limited leather v6 coupe excellent condition

2005 chrysler crossfire limited leather v6 coupe excellent condition 2005 chrysler crossfire limited coupe(US $7,100.00)

2005 chrysler crossfire limited coupe(US $7,100.00)

Auto Services in New Jersey

Zp Auto Inc ★★★★★

World Automotive Transmissions II ★★★★★

Voorhees Auto Body ★★★★★

Vip Honda ★★★★★

Total Performance Incorporated ★★★★★

Tony`s Auto Service ★★★★★

Auto blog

FCA and UAW deal could mean huge production shakeups

Thu, Sep 17 2015The big labor contract between Fiat Chrysler Automobiles and the United Auto Workers is likely to lead to some very serious production shakeups across the company's North American manufacturing operations. That's according to a new report from Automotive News, which details the sweeping changes at no fewer than five production facilities in Michigan, Illinois, Ohio, Mexico, and Poland. So without further ado, here's what's going where, presented in easy to digest bullet form. Ram 1500 production would move from Warren, MI to Sterling Heights, MI Warren, MI would be retooled for unibody production and would handle the Jeep Grand Wagoneer and could potentially build Grand Cherokees to ease the strain on Detroit's Jefferson North factory Chrysler 200 production would move from Sterling Heights, MI to Toluca, Mexico Dodge Dart production would move from Belvidere, IL to Toluca, Mexic Fiat 500 production, which is currently handled by Toluca, would be concentrated in Poland, where the Euro-spec Cinquecento is built Jeep Cherokee production would move from Toledo, OH to Belvidere, IL to make room for Wrangler and Wrangler Pickup production Like we said, those are some big changes. But, as FCA CEO Sergio Marchionne said in an earlier interview with Automotive News, this kind of shakeup would make a lot of sense. In that August interview the exec said that automakers moved truck production to Mexico because they were "threatened" by the UAW. "The only thing [the UAW] want is to move the truck back. Which is right. If you move the truck back here, which is [the UAW's] domain, [and move] all the cars that we get killed on somewhere else, we could actually make sense of this bloody industry and actually increase the number of people employed in this country and really share wealth because we are making money," Marchionne told AN. News Source: Automotive News - sub. req.Image Credit: Bill Pugliano / Getty Images Plants/Manufacturing UAW/Unions Chrysler Dodge Fiat Jeep RAM Sergio Marchionne FCA toluca warren sterling heights

UAW chooses FCA as lead bargaining company

Mon, Sep 14 2015The United Auto Workers has chosen Fiat Chrysler Automobiles as its lead bargaining company as it seeks to finalize new contracts with the 140,000 or so workers represented by the union. That doesn't mean the UAW won't continue to talk with Ford and General Motors. "All three companies have been working with UAW bargaining teams toward a collective bargaining agreement and continue to do so," UAW President Dennis Williams said in a statement. It does mean, however, that any deal the UAW strikes with FCA will form the basis of bargaining talks with the other two American automakers. Contracts between the UAW and the Detroit Three automakers are set to expire tonight at midnight. If no deal is made, both parties may vote to extend the previous contract. Industry analysts polled by The Detroit News suggest that a deal with FCA might be the most difficult to reach, since it is the smallest and least profitable of the three US car companies, and because of its high percentage of second-tier workers. There's a super short statement on the matter from the UAW, and there's an equally concise confirmation from FCA. Feel free to read them below. Detroit – The UAW this afternoon announced that FCA US LLC will be the lead target in Big Three auto talks. "All three companies are working hard toward a collective bargaining agreement. At this time, the UAW has selected FCA US LLC to be the lead bargaining company," said Dennis Williams, President of the UAW. "All three companies have been working with UAW bargaining teams toward a collective bargaining agreement and continue to do so." -------- Statement regarding the Status of Contract Talks between FCA US LLC and the UAW FCA US LLC confirms that it has been selected as the company to set pattern on a collective bargaining agreement with the UAW. As negotiations are ongoing, the Company can offer no further comment at this time.

Federal judge throws out GM's racketeering lawsuit against Fiat Chrysler

Thu, Jul 9 2020Â DETROIT — A federal judge on Wednesday threw out a racketeering lawsuit General Motors had filed against smaller rival Fiat Chrysler Automobiles, saying the No. 1 U.S. automaker's alleged injuries were not caused by FCA's alleged violations. GM officials said in statement they "strongly disagree" with the order by U.S. District Court Judge Paul Borman, whom the automaker had sought to have removed from the case, and would appeal. "There is more than enough evidence from the guilty pleas of former FCA executives to conclude that the company engaged in racketeering, our complaint was timely and showed in detail how their multi-million dollar bribes caused direct harm to GM," GM said in a statement. The Detroit company added that Borman's decision "would let wrongdoers off the hook." GM filed the racketeering lawsuit against FCA last November, alleging its rival bribed United Auto Workers (UAW) union officials over many years to corrupt the bargaining process and gain advantages, costing GM billions of dollars. GM was seeking "substantial damages" that one analyst said could have totaled at least $6 billion. FCA had called the case meritless and asked Borman to dismiss it. On Wednesday, Borman dismissed the lawsuit "with prejudice," meaning GM cannot refile the complaint. "The direct victims of defendants' alleged bribery scheme are FCA's workers," Borman wrote of FCA. "GM's high labor costs were not an injury proximately caused by FCA's bribes, and any competitive injury that GM suffered as a result of FCA's advantage in labor costs is an indirect injury." "The dismissal of GM's complaint with prejudice earlier today vindicates our position," FCA said in a statement. On Monday, the Sixth U.S. Circuit Court of Appeals denied GM's petition to remove Borman from the case, but said the two automakers' chief executives didn't have to meet to try to settle the case as Borman had ordered. In calling for that, Borman had called the lawsuit "a waste of time and resources." Â Government/Legal UAW/Unions Chrysler Fiat GM