2023 Chrysler 300 Series Touring L Rwd on 2040-cars

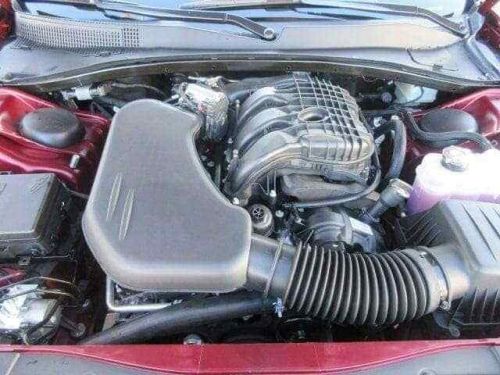

Engine:3.6L V6 24V VVT Engine

Fuel Type:Gasoline

Body Type:4dr Car

Transmission:8-Spd Auto 8HP50 Trans (Buy)

For Sale By:Dealer

VIN (Vehicle Identification Number): 2C3CCADG0PH706462

Mileage: 14

Make: Chrysler

Trim: TOURING L RWD

Drive Type: Touring L RWD

Features: COMFORT GROUP, ENGINE: 3.6L V6 24V VVT, LINEN/BLACK, LEATHER W/PERFORATED INSERT BUCKET..., QUICK ORDER PACKAGE 2EF, TRANSMISSION: 8-SPEED AUTOMATIC 8HP50

Power Options: --

Exterior Color: Red

Interior Color: Black

Warranty: Unspecified

Model: 300 Series

Chrysler 300 Series for Sale

2023 chrysler 300 series touring(US $500.00)

2023 chrysler 300 series touring(US $500.00) 1965 chrysler 300 series(US $12,322.00)

1965 chrysler 300 series(US $12,322.00) 2016 chrysler 300 series limited(US $13,766.00)

2016 chrysler 300 series limited(US $13,766.00) 2016 chrysler 300 series 300s(US $16,373.00)

2016 chrysler 300 series 300s(US $16,373.00) 2023 chrysler 300 series 300c(US $51,289.00)

2023 chrysler 300 series 300c(US $51,289.00) 2023 chrysler 300 series touring(US $37,274.00)

2023 chrysler 300 series touring(US $37,274.00)

Auto blog

FCA recalls over 200k Jeep Cherokees for windshield wiper static

Tue, Sep 1 2015Fiat Chrysler Automobiles is issuing a recall for over 200,000 versions of the 2014 Jeep Cherokee due to a problem with static buildup disabling the windshield wipers. FCA has identified 158,671 units in the United States. Another 18,366 vehicles are estimated to be affected in Canada, a further 3,582 in Mexico, and 26,049 outside of North America. The problem, according to the first statement below, results from static building up if the wipers are operated in dry conditions. The static could mess with the wipers' control module, rendering them disabled. To fix the problem, dealers will be instructed to install a ground strap to the module. In parallel, FCA is also offering incentives to the owners of certain trucks that were subject to recall but for which remedies were not immediately available. To encourage those owners to bring their older vehicles in for the required service, the automaker will disperse $100 prepaid cards for use at their discretion. The program is offered to owners of certain model year Jeep Grand Cherokee, Jeep Liberty, Chrysler Aspen, and Dodge Durango sport-utility vehicles, as well as certain Dodge Dakota and Ram trucks. Owners of the affected Grand Cherokees will have the option instead to take a $1,000 consideration toward the purchase of a new vehicle or for parts and service. The offers are only being extended under certain specific criteria, though. So if you think that could be you, you'll want to read through the conditions in the second announcement below. STATEMENT: CONTROL MODULE August 31, 2015 , Auburn Hills, Mich. - FCA US LLC is recalling an estimated 158,671 SUVs in the U.S. to help protect their control modules from static buildup that may potentially disable the vehicles' windshield wipers. An investigation by FCA US discovered static buildup may occur if the vehicles' windshield wipers are activated during dry conditions. Significant static buildup may affect a control module that powers the wipers. The Company is unaware of any related injuries or accidents. Affected are model-year 2014 Jeep Cherokee SUVs. An estimated 18,366 vehicles will be recalled in Canada, as will an estimated 3,582 in Mexico and 26,049 outside the NAFTA region. Dealers will install a ground strap to the control module to eliminate the potential for static buildup. Customers will be advised when they may schedule service, which will be performed at no cost.

Recharge Wrap-up: VW Caddy TGI BlueMotion, VR tour of Tesla Model X

Thu, Feb 25 2016Take a 360-degree virtual tour of the Tesla Model X. Best viewed in the YouTube app on your smartphone, the video above - courtesy of Canadian Press Video News – allows you to look around the inside of the Model X as though you were sitting inside it. While you're viewing it, keep in mind Tesla CEO Elon Musk's words about virtual reality: "It's quite transformative. You really feel like you're there." See the video above, and read more at Teslarati. LG Chem's batteries for the 2017 Chrysler Pacifica Hybrid minivan will be the Korean company's first time engineering and manufacturing a complete battery pack in Michigan for a volume production North American plug-in hybrid. The packs include lithium-ion cells, electronics and control units. The batteries were engineered at LG Chem's Troy, Michigan facility, and will be built at the company's Holland, Michigan plant. "Our experience with entire battery packs, including cell design and manufacturing capability, as well as our expertise in vehicle integration, makes us the ideal battery supplier for the Pacifica Hybrid," says LGCPI CEO Denise Gray. "We believe our technical strengths, engineering and manufacturing expertise, position us as a leading battery and control system provider for electric vehicles today and in the future." Read more at Green Car Congress. Volkswagen Commercial Vehicles will debut its Caddy TGI BlueMotion van at the Geneva Motor Show. The van, which is suited to family, taxi or city delivery use, can run on CNG or bio-natural gas in addition to gasoline. It also features a six-speed DSG dual-clutch transmission – a first in its class. The multiple high-pressure tanks for compressed gas are located under the floor, preserving all the Caddy's precious cargo space. A TGI version of the Caddy Alltrack will also be available, initially with a six-speed manual transmission, with the DSG option arriving in the middle of 2016. Read more at Green Car Congress, and in the press release below.

If Tesla Model 3 is successful, Sergio Marchionne will copy it

Fri, Apr 15 2016Fiat Chrysler CEO Sergio Marchionne hasn't hidden his disdain for electric vehicles, but he would copy the Tesla Model 3 if it is successful, according to Automotive News Europe. If Elon Musk "can show me that the car will be profitable at that price, I will copy the formula, add the Italian design flair and get it to the market within 12 months," Marchionne told Automotive News Europe during FCA's annual meeting in Amsterdam. In terms of pre-orders, the Model 3 is a success. Musk tweeted on April 7 that the company had over 325,000 reservations for the sedan, which he estimated were worth around $14 billion. The car will start at $35,000 before incentives. Marchionne, however, isn't optimistic Tesla can actually make the electric sedan work financially. "I'm am not surprised by the high number of reservations but you have then to build and deliver them and also be profitable," he told ANE. The FCA boss is a noted skeptic of EVs. In 2012, he said that the company only built the 500e because of California's zero-emissions vehicle mandate and to give engineers experience with the technology. He doubled-down in 2014 when he claimed FCA lost $14,000 on each 500e and said he would rather people didn't buy them. More recently, he infamously said "you'd have to shoot me first," before he'd allow a fully electric Ferrari. Related Video: