2014 Chrysler 300 Base on 2040-cars

1875 E Edwardsville Rd, Wood River, Illinois, United States

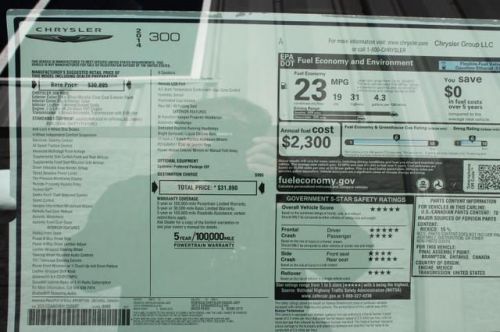

Engine:3.6L V6 24V MPFI DOHC

Transmission:8-Speed Automatic

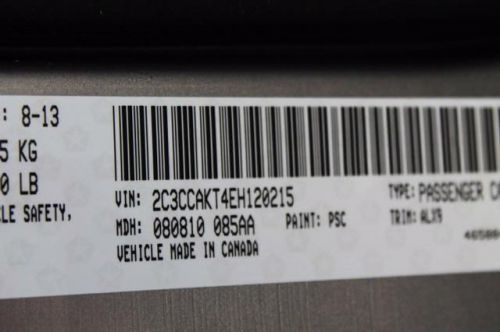

VIN (Vehicle Identification Number): 2C3CCAAG4EH255537

Stock Num: 15915

Make: Chrysler

Model: 300 Base

Year: 2014

Exterior Color: Billet Silver Metallic Clearcoat

Interior Color: Black

Options: Drive Type: RWD

Number of Doors: 4 Doors

CALL DAVID SANDERS TO CHECK AVAILABILITY AND PRICING. No one beats us on price!Free loaner cars*, free shuttle service,internet access in our business center,every 5th oil change is FREE! Call DAVID SANDERS for more info at 855-564-8045. All or part of the information contained in these ads may be inaccurate as some information is supplied by 3rd party providers.

Chrysler 300 Series for Sale

2014 chrysler 300c base(US $29,910.00)

2014 chrysler 300c base(US $29,910.00) 2014 chrysler 300c base(US $39,219.00)

2014 chrysler 300c base(US $39,219.00) 2006 chrysler 300 touring(US $12,500.00)

2006 chrysler 300 touring(US $12,500.00) 2014 chrysler 300c john varvatos luxury(US $42,818.00)

2014 chrysler 300c john varvatos luxury(US $42,818.00) 2014 chrysler 300c john varvatos luxury(US $39,792.00)

2014 chrysler 300c john varvatos luxury(US $39,792.00) 2014 chrysler 300 s(US $40,072.00)

2014 chrysler 300 s(US $40,072.00)

Auto Services in Illinois

Vega Auto Repair ★★★★★

Ultimate Deals Vehicle Sales ★★★★★

Tredup`s Inc ★★★★★

Terry`s Service ★★★★★

Stan`s Repair Service ★★★★★

St Louis Dent Company ★★★★★

Auto blog

Chrysler's mysterious limo spotted in trailer for new Wolverine movie

Fri, Oct 21 2016Way back in the warm, sunny days of June, we reported on a rather strange looking Chrysler-badged limousine spotted during filming for the latest installment in the Wolverine saga. Now, with the first trailer for Logan (or Wolverine 3, if you prefer its informal name) hitting the internet, we're getting another look at the odd limo, along with a few other offerings from Fiat Chrysler Automobiles. There's a flock of "Federal Police" Rams and a spinning, bluish-green Rebel – we're guessing Wolverine and Professor Xavier stole it from some kind of work crew – judging by the gold-ish decals on the door and the work box in the bed. Our look at the Chrysler limo isn't great, although it does appear in two scenes of the trailer. We're thinking these shots are connected, and here's why. Our first sighting comes in a cemetery, where the hulking limo sits in the background while Wolverine takes a pull from a pint of liquor. This scene ties in neatly with the images from June – we've embedded the tweet that posted the original shots at the bottom – which shows Wolverine wearing the same clothing. Comparing the shape of the limo's mirrors in June with a later scene in the trailer, we can safely say that Wolverine eventually ends up driving the limo, with a worried Professor Xavier in the backseat. While FCA hasn't been shy about wanting to hook up with Hollywood blockbusters, Logan is quite a lot different than Star Wars, Episode VII: The Force Awakens, or even Batman vs. Superman: Dawn of Justice. The tone of this entire trailer, from Johnny Cash's baleful cover of Nine Inch Nails' Hurt to the dire medical condition of Patrick Stewart's Professor Xavier, is depressing and emotional. That's a far cry from the super-successful superhero blockbusters that roll out of Marvel Studios every year. You can spot the exterior of the limo at 0:17, the interior at 1:03 (the scene is cut to make it look like Logan and Professor X are driving the Ram Rebel that appears at 1:02), and the police Rams at 0:48. Aside from the new FCAs, there's also a lovely first-gen Ford Bronco. Logan hits theaters on March 3, 2017. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Related Video:

FCA recalls Fiat 500e to fix cruise control

Thu, Jun 11 2015Fiat is recalling almost 4,000 of its 500e electric vehicles because of a malfunction related to the model's cruise-control feature. The glitch causes the car's powertrain to be put into neutral under certain situations. It's the second recall on the 500e this year. Specifically, Chrysler-Fiat is recalling 3,975 cars. The issue is that the car's system can misread the motor's torque figures in cruise control, causing the sprightly EV to mistakenly shift into neutral in what was designed as a safety-precaution measure. The good news is that restarting the vehicle gets the car back to normal, but being dropped into neutral in highway mode is certainly no fun. Chrysler-Fiat said in a statement this week that it was "unaware" of injuries, accidents, or customer complaints caused by the issue. In April, the 500e was subject to a recall that impacted about 5,600 vehicles and stemmed from a March 2015 update. The update allowed the car to go into so-called "Limp Home Mode" to better extend range. The problem is that it inadvertently caused the car to stall. Range anxiety, indeed. Take a look at Chrysler-Fiat's press release on the most recent recall below. Related Video: Statement: Software Upgrade June 9, 2015 , Auburn Hills, Mich. - FCA US LLC is voluntarily recalling an estimated 3,975 cars to upgrade cruise-control software. A review of warranty data led to an investigation by FCA US LLC engineers. The investigation discovered certain Fiat 500e hatchbacks were inadvertently equipped with software that may misread torque levels generated by their motors, causing them to shift into neutral – a prescribed failsafe mode. This condition may occur only while cruise-control is engaged and the driver attempts to override the feature with accelerator-pedal applications or rapid tapping of the accelerate/decelerate buttons. Restarting the vehicle restores normal function. The campaign is limited to certain model-year 2013-2015 vehicles. The Company is unaware of any related injuries, accidents or customer complaints. New software will be available when affected customers are advised of this action by FCA US. Service instructions are being sent to FCA US dealers today. Customers with questions may call the FCA US Customer Information Center at 1-800-853-1403.

Trump Administration will look 'very carefully' at FCA/Peugeot deal

Sat, Nov 2 2019WASHINGTON — U.S. President Donald Trump's administration will look very closely at the planned merger between Fiat Chrysler and Peugeot owner PSA, White House economic adviser Larry Kudlow said on Friday. The deal, announced on Thursday, would create the world's fourth-largest automaker. "We will obviously look at it very, very carefully," Kudlow said on Bloomberg. "The president has not commented on the deal ... We're not afraid of doing business with international companies, Lord knows." When asked about the 12.2% equity stake and 19.5% voting stake China's Dongfeng Motors holds in PSA, Kudlow said: "With respect to the Chinese story, we obviously are alert and on guard." The deal, which would be structured as a 50-50 merger, would create the fourth-largest global automaker with annual sales of nearly 9 million vehicles. Fiat Chrysler told employees the deal could generate synergies of 3.7 billion euros but added "these synergies are NOT based on closing plants." Fiat Chrysler declined to comment. There has been speculation Dongfeng might sell its holdings, which could help ease the deal's passage through U.S. regulators, given U.S.-Chinese trade tensions. "We will welcome a good deal. We hope it will get more production in the United States, more factories and workers and employment in the U.S. And with respect to the Chinese angle, we will take a careful look at it," Kudlow said. Fiat Chrysler said on Thursday that "teams at both companies are working to finalize discussions and reach a Memorandum of Understanding in the coming weeks."