2013 Chrysler 300c Varvatos Collection on 2040-cars

500 Admiral Weinel Blvd, Columbia, Illinois, United States

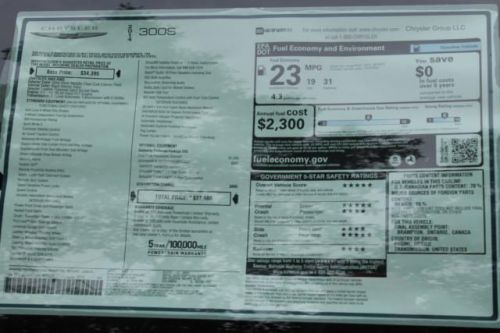

Engine:3.6L V6 24V MPFI DOHC

Transmission:8-Speed Automatic

VIN (Vehicle Identification Number): 2C3CCADG1DH661933

Stock Num: C84036

Make: Chrysler

Model: 300C Varvatos Collection

Year: 2013

Exterior Color: Phantom Black Tri Coat Pearl

Interior Color: Black

Options: Drive Type: RWD

Number of Doors: 4 Doors

Climb inside the 2013 Chrysler 300C! Offering an alluring bundle of luxury while maintaining efficiency, safety and style! Top features include front dual zone air conditioning, power front seats, automatic dimming door mirrors, and remote keyless entry. Smooth gearshifts are achieved thanks to the refined 6 cylinder engine, and for added security, dynamic Stability Control supplements the drivetrain. We pride ourselves in consistently exceeding our customer's expectations. Stop by our dealership or give us a call for more information. "1ST FOR A REASON" On Price and Selection-No other dealer will beat Royal gate of Columbia on price. Give us a chance to save you some money on the car you want!

Chrysler 300 Series for Sale

2014 chrysler 300 s(US $32,609.00)

2014 chrysler 300 s(US $32,609.00) 2014 chrysler 300 s(US $37,675.00)

2014 chrysler 300 s(US $37,675.00) 2014 chrysler 300c base(US $48,085.00)

2014 chrysler 300c base(US $48,085.00) 99 chrysler 300m for $2000.00 (columbia, mo)(US $2,000.00)

99 chrysler 300m for $2000.00 (columbia, mo)(US $2,000.00) 2011 chrysler 300 c awd hemi 22k no reserve salvage rebuildable damaged project

2011 chrysler 300 c awd hemi 22k no reserve salvage rebuildable damaged project Rare 06 chrysler 300c hemi 6.1l navigation cd changer 20 inch wheels must see!!!(US $13,995.00)

Rare 06 chrysler 300c hemi 6.1l navigation cd changer 20 inch wheels must see!!!(US $13,995.00)

Auto Services in Illinois

White Eagle Auto Body Shop ★★★★★

Tremont Car Connection ★★★★★

Toyota Of Naperville ★★★★★

Today`s Technology Auto Repair ★★★★★

Suburban Tire Auto Repair Center ★★★★★

Steve`s Tire & Service Center ★★★★★

Auto blog

FCA CEO Mike Manley will take undefined new role after PSA merger

Wed, Dec 18 2019MILAN — Fiat Chrysler Chief Executive Mike Manley will remain with the new group set to result from a planned merger with French rival PSA-Peugeot, Chairman John Elkann said on Wednesday. In a letter to Fiat Chrysler (FCA) employees on the day the two companies announced a binding agreement for a $50 billion tie-up to create the world's fourth-largest carmaker, Elkann said he was "delighted" that the combined group would be led by current PSA CEO Carlos Tavares. "And Mike Manley, who has led FCA with huge energy, commitment and success over the past year, will be there alongside him," he said. He did not say what position Manley would hold. Elkann — who will chair the new group — said there was still much to be done to complete the merger. "Over the coming months we must work tirelessly and determinedly to fulfill all the approval requirements needed to finalize the commitment we have signed," he said. Related Video:   Hirings/Firings/Layoffs Chrysler Dodge Fiat Jeep RAM Citroen Peugeot FCA PSA merger Mike Manley carlos tavares

Ford tumbles to second worst in Consumer Reports reliability survey, list dominated by Japanese [w/video]

Mon, 29 Oct 2012It's no secret that MyFord Touch has had its share of problems since being introduced, but the most recent reliability survey from Consumer Reports shows just how much this infotainment system has affected Ford. Just two years ago, the automaker was in the top 10 for the institute's reliability rankings, but since then, it has tumbled to the second-lowest rung just above dead-last Jaguar. In addition to MyFord Touch, CR also attributes a handful of new products that have had issues right out of the gate.

Compiled from 1.2 million subscriber surveys, this year's auto reliability survey heavily favors Japanese automakers, with eight of the 10 spots hailing from Japan. Toyota brands grabbed the top three spots (Scion, Toyota and Lexus - in that order) with Mazda, Subaru, Honda and Acura filling the next four spots. The only non-Asian automaker cracking the top 10 was Audi at number eight.

Audi climbed a total of 18 spots from last year, and Cadillac and GMC round out this year's top gainers breaking into the top 15. Helping Cadillac's upward movement, the CTS Coupe was named the most reliable domestic car. Lincoln, Volvo and Chrysler join Ford on this year's biggest loser list.

Autoblog's Editors' Picks: Our complete list of the best new vehicles

Mon, May 13 2024It's not easy to earn an “EditorsÂ’ Picks” at Autoblog as part of the rating and review process that every new vehicle goes through. Our editors have been at it a long time, which means weÂ’ve driven and reviewed virtually every new car you can go buy on the dealer lot. There are disagreements, of course, and all vehicles have their strengths and weaknesses, but this list features what we think are the best new vehicles chosen by Autoblog editors. We started this formal review process back in 2018, so there's quite of few of them now. So what does it mean to be an EditorsÂ’ Pick? In short, it means itÂ’s a car that we can highly recommend purchasing. There may be one, multiple, or even zero vehicles in any given segment that we give the green light to. What really matters is that itÂ’s a vehicle that weÂ’d tell a friend or family member to go buy if theyÂ’re considering it, because itÂ’s a very good car. The best way to use this list is is with the navigation links below. Click on a segment, and you'll quickly arrive at the top rated pickup truck or SUV, for example. Use the back button to return to these links and search in another segment, like sedans. If youÂ’ve been keeping up with our monthly series of the latest vehicles to earn EditorsÂ’ Pick status, youÂ’re likely going to be familiar with this list already. If not, welcome to the complete list that weÂ’ll be keeping updated as vehicles enter (and others perhaps exit) the good graces of our editorial team. We rate a new car — giving it a numerical score out of 10 — every time thereÂ’s a significant refresh or if it happens to be an all-new model. Any given vehicle may be impressive on a first drive, but we wait until itÂ’s in the hands of our editors to put it through the same type of testing as every other vehicle that rolls through our test fleet before giving it the EditorsÂ’ Pick badge. This ensures consistency and allows more voices to be heard on each individual model. And just so you donÂ’t think weÂ’ve skipped trims or variants of a model, we hand out the EditorsÂ’ Pick based on the overarching model to keep things consistent. So, when you read that the 3 Series is an EditorsÂ’ Pick, yes, that includes the 330i to the M3 and all the variants in between. If thereÂ’s a particular version of that car we vehemently disagree with, we make sure to call that out.