2023 Chrysler 300 Series Touring on 2040-cars

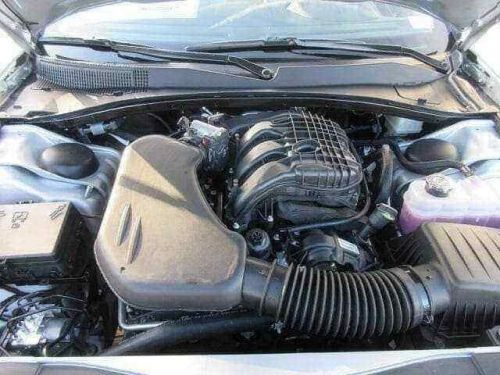

Engine:3.6L V6 24V VVT Engine

Fuel Type:Gasoline

Body Type:4dr Car

Transmission:8-Spd Auto 8HP50 Trans (Buy)

For Sale By:Dealer

VIN (Vehicle Identification Number): 2C3CCAAGXPH707560

Mileage: 14

Make: Chrysler

Trim: TOURING

Drive Type: Touring RWD

Features: ENGINE: 3.6L V6 24V VVT, LINEN/BLACK, CLOTH BUCKET SEATS, QUICK ORDER PACKAGE 2EE, TIRES: P215/65R17 LOW ROLLING RESISTANCE, TRANSMISSION: 8-SPEED AUTOMATIC 8HP50, WHEELS: 17" X 7.0" PAINTED CAST ALUMINUM

Power Options: --

Exterior Color: Silver

Interior Color: Black

Warranty: Unspecified

Model: 300 Series

Chrysler 300 Series for Sale

2023 chrysler 300 series 300s(US $32,873.00)

2023 chrysler 300 series 300s(US $32,873.00) 2023 chrysler 300 series touring(US $33,200.00)

2023 chrysler 300 series touring(US $33,200.00) 1968 chrysler 300 series 2dr soft top convertible(US $1,000.00)

1968 chrysler 300 series 2dr soft top convertible(US $1,000.00) 2006 chrysler 300 series c(US $1.00)

2006 chrysler 300 series c(US $1.00) 2012 chrysler 300 series(US $2,500.00)

2012 chrysler 300 series(US $2,500.00) 2018 chrysler 300 series s(US $33,987.00)

2018 chrysler 300 series s(US $33,987.00)

Auto blog

U.S. auto sales in April expected to drop despite big discounts

Thu, Apr 26 2018DETROIT — U.S. auto sales in April likely fell nearly 8 percent from the same month in 2017 despite big discounts for consumers, industry consultants J.D. Power and LMC Automotive said on Thursday. For much of the past two years, the discounts offered by automakers have remained at levels that industry analysts say are unsustainable and unhealthy in the long term. April U.S. new vehicle sales will likely be about 1.31 million units, down from 1.42 million units a year earlier, the consultancies said. The forecast was based on the first 17 selling days of April. Automakers, including Ford and Fiat Chrysler Automobiles, will release April U.S. sales results on May 1. Earlier this month, No. 1 U.S. automaker General Motors said it will stop reporting monthly U.S. sales because the 30-day snapshot does not accurately reflect the market. GM will instead issue quarterly sales reports. U.S. new vehicle sales fell 2 percent in 2017 to 17.23 million units after hitting a record high in 2016. Sales are expected to drop further in 2018 as interest rates rise and more late-model used cars return to dealer lots to compete with new ones. LMC expects full-year 2018 U.S. new vehicle sales to come in at around 17 million units. "Uncertainty and unfavorable factors appear to be mounting for autos, including a volatile stock market, rising interest rates, rising oil prices and potential trade roadblocks," Jeff Schuster, LMC's head of global vehicle forecasts, said in a statement. The seasonally adjusted annualized rate of sales for April will be 16.6 million vehicles, down more than 2 percent from 17 million units in April 2017, the consultancies said. Retail sales to consumers, excluding lower-margin fleet sales to rental agencies, businesses and government, were set to decline about 9 percent in April. The level of consumer discounts, which can erode profit margins and undercut resale values, "remains the larger concern," the consultancies said. The average discount was $3,698, up $187 from April 2017. Discounts on trucks and SUVs were up $426, but down $226 on passenger cars. Reporting by Nick CareyRelated Video: Image Credit: Reuters Earnings/Financials Chrysler Ford GM JD Power

Dodge offering novel 1-year lease on '14 Challenger and Charger models

Mon, 14 Apr 2014Dodge is just days away from unveiling refreshed versions of the Charger and Challenger at the 2014 New York Auto Show, models promising updated styling and new powertrain options. Depending on how you look at it, the company is either so confident in its forthcoming 2015 models that it's offering an interesting Double-Up lease deal on the current vehicles, or it's so eager to clear out existing stock that it's resorting to novel lease deals. In any case, what they present is an interesting scenario, one which allows buyers to get the existing model right now, and then trade up to the facelifted 2015 models in one year.

Starting April 17, when the refreshed cars debut through the end of August, buyers can lease a 2014 Charger or Challenger for one year and exchange it for a three-year lease on a 2015 model next year, with no additional money down and the same monthly payment. Customers can even switch vehicles when the new lease starts. If drivers want to buy the '15, they get $1,000 off the purchase price. To be eligible, both leases must use the same dealership and be financed through Chrysler Capital. The Double-Up deal excludes the SRT versions of both cars and Charger SE models.

To offset the flood of one-year-old models coming back to dealerships, Dodge has struck a deal with rental car agency Enterprise, which has agreed to buy them all. "One-year leases are highly unusual in the industry," said company spokesperson Ralph Kisiel, and the fleet sale deal is what makes it possible.

Stellantis wants to trim 3,500 hourly U.S. jobs, UAW says

Wed, Apr 26 2023WASHINGTON — Chrysler-parent Stellantis NV wants to cut approximately 3,500 hourly U.S. jobs and is offering voluntary exit packages, according to a United Auto Workers union letter made public Tuesday. The automaker is looking to reduce its hourly workforce offering incentive packages that include $50,000 payments for workers hired before 2007, UAW Local 1264 said in a letter dated Monday posted on its Facebook page. Stellantis spokeswoman Jodi Tinson declined to comment. A person briefed on the matter said the figure might be lower than the figure cited in the UAW letter. In late February, Stellantis indefinitely halted operations at an assembly plant in Illinois, citing rising costs of electric vehicle production. The action impacted about 1,350 workers at the Belvidere, Illinois, plant that built the Jeep Cherokee SUV and resulted in indefinite layoffs. The automaker has warned it may not resume operations as it considers other options. The UAW letter said openings created by workers leaving would be filled by workers on indefinite layoff. Stellantis said in February that about 40,000 U.S. hourly workers were eligible for profit sharing. Last week, UAW President Shawn Fain said Stellantis' decision to idle the Illinois plant was "a flat-out violation" of the union's contract with the UAW and is unacceptable. The UAW will enter talks with the Detroit Three before labor contracts expire in mid-September. Earlier this month, General Motors said about 5,000 salaried workers accepted buyouts to leave the automaker. GM CEO Mary Barra said February job cuts of a few hundred jobs and the 5,000 buyouts "provided approximately $1 billion towards" a $2 billion cost cutting target. Ford Motor Co recently announced significant job cuts in Spain, Germany and other parts of Europe and in August said it would cut a total of 3,000 salaried and contract jobs, mostly in North America and India. Hirings/Firings/Layoffs UAW/Unions Chrysler Dodge Fiat Jeep Maserati RAM Stellantis