2005 Chrysler 300c Base on 2040-cars

1240 E Prien Lake Rd, Lake Charles, Louisiana, United States

Engine:5.7L V8 16V MPFI OHV

Transmission:5-Speed Automatic

VIN (Vehicle Identification Number): 2C3JA63H05H615631

Stock Num: 615631

Make: Chrysler

Model: 300C Base

Year: 2005

Exterior Color: Blue

Interior Color: Dark Slate Gray / Medium Slate Gray

Options: Drive Type: RWD

Number of Doors: 4 Doors

Mileage: 88000

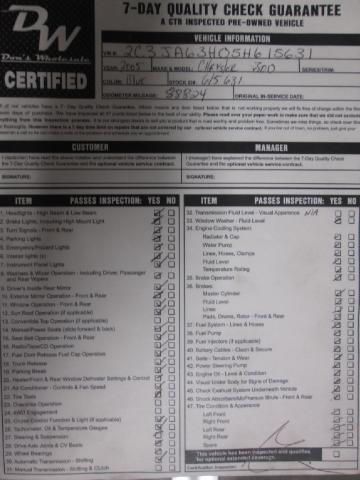

HERE AT DON'S WHOLESALE WE ARE EXPERTS IN THE AUTO INDUSTRY. WE PRIDE OURSELVES IN KNOWING THAT THE VEHICLE YOU ARE PURCHASING HAS GONE THROUGH A RIGOROUS TOTAL UNIT INSPECTION. THIS GIVES BOTH OF US A PEACE OF MIND KNOWING THAT THE VEHICLE YOU ARE PURCHASING FROM THE DON'S WHOLESALE FAMILY WILL GIVE YOU COMPLETE SATISFACTION.Visit Don's Wholesale online at www.donswholesalela.com to see more pictures of this vehicle or call us at 866-797-8519 today to schedule your test drive. Visit Don's Wholesale #5 online at www.donswholesalelc.com to see more pictures of this vehicle or call us at 866-797-8519 today to schedule your test drive.

Chrysler 300 Series for Sale

2013 chrysler 300 srt8

2013 chrysler 300 srt8 2011 chrysler 300 limited(US $21,371.00)

2011 chrysler 300 limited(US $21,371.00) 2012 chrysler 300 limited(US $20,995.00)

2012 chrysler 300 limited(US $20,995.00) 2007 chrysler 300 touring(US $9,900.00)

2007 chrysler 300 touring(US $9,900.00) 2010 chrysler 300c(US $18,900.00)

2010 chrysler 300c(US $18,900.00) 2010 chrysler 300c srt-8(US $23,900.00)

2010 chrysler 300c srt-8(US $23,900.00)

Auto Services in Louisiana

University Car Care Center ★★★★★

Top Shop The ★★★★★

Tim`s Auto Salvage ★★★★★

Steve`s Lube & Tire Center LLC ★★★★★

Sterling Auto Repair ★★★★★

Service Plus Auto Glass ★★★★★

Auto blog

Takata adds millions to recall expansion in US [UPDATE]

Thu, May 28 2015UPDATE: Ford spokesperson Kelli Felker has advised Autoblog that of the 1,509,535 total vehicles worldwide that the company is recalling, 966,504 of them are new additions for this expanded safety campaign. Last week, the National Highway Traffic Safety Administration announced that the Takata airbag inflator recalls would expand to an estimated 33.8 million vehicles in the US. However at the time, automakers weren't sure specifically which of their models might be affected under this enlarged campaign. Now, the numbers for BMW, FCA, Ford, and Mitsubishi are being released by the agency. Additionally, Honda is outlining the broadening of its own campaign. BMW's recall amounts to 420,661 vehicles in the US, an increase from 140,696 previously. All of the following models need their front, driver's side airbag replaced: 2002-2005 BMW 325i/325xi/330i/330xi Sedan 2002-2005 BMW 325xi/325i Sportswagon 2002-2006 BMW 330Ci/325Ci/M3 Convertible 2002-2006 BMW 325i/330i/M3 Coupe 2002-2003 BMW M5/540i/525i/530i Sedan 2002-2003 BMW 540i/525i Sportswagon 2003-2004 BMW X5 3.0i/4.4i BMW has received no reports of any injures or deaths from this problem in its vehicles. FCA has 5,224,845 vehicles globally in need of inflator replacements, according to its statement. However, the company is only aware of one injury related to the issue, which occurred in a 2006 Dodge Charger in southern Florida. There are 4,747,202 vehicles worldwide from the company that are affected on the front, driver's side. Among these, 4,066,732 are in the US, 374,508 are in Canada, and the rest are in other countries. The models are: 2005-2009 Dodge Ram 2500 Pickup 2004-2008 Dodge Ram 1500 Pickup 2006-2009 Dodge Ram 3500 Pickup 2007-2009 Dodge Ram 3500 Cab Chassis 2008-2010 Dodge Ram 4500/5500 Cab Chassis 2008-2009 Sterling 4500/5500 Cab Chassis 2004-2008 Dodge Durango 2007-2008 Chrysler Aspen 2005-2010 Chrysler 300/300C/SRT8 2005-2010 Dodge Charger/Magnum 2005-2011 Dodge Dakota 2006-2010 Mitsubishi Raider Also, there are 438,156 vehicles in the US, according to the NHTSA documents, that need their front passenger's side inflators replaced in the expansion of an earlier regional recall: 2003 Dodge Ram 1500 2003 Dodge Ram 2500 2003 Dodge Ram 3500 The total number of vehicles from Ford now covered under these campaigns stands at 1,509,535 worldwide. Of this total, there are 1,380,604 in the United States, 93,207 in Canada and 16,953 in Mexico.

Why FCA-PSA merger is no quick fix for their China problem

Sun, Nov 3 2019BEIJING — Fiat Chrysler and Peugeot owner PSA's merger is unlikely to provide a quick fix to their problems in China, as both companies have long struggled to find the right products at the right price for the world's top car market, analysts say. The companies said on Thursday they aimed to reach a binding deal in the coming weeks to create the world's fourth-biggest automaker by production volume. But scale alone will not make Italian-American Fiat Chrysler Automobiles (FCA) and France's PSA Group more competitive in a market where they have been slow to adapt to trends and win over consumers, leading their sales to lag far behind foreign rivals such as Volkswagen and General Motors. PSA does not have enough competitive SUV models, and neither company has enough electric and plug-in hybrid vehicles, or enough cars packed with hi-tech features for Chinese tastes, analysts say. In a market where 28 million cars were bought in 2018, FCA sold just 155,215, while PSA sold 257,723, according to consultancy LMC Automotive. At the end of September, FCA had a market share of 0.5% in China's passenger car market, while PSA's was 0.6%. Analysts say they have been squeezed by Japanese and local brands, which have product line-ups better suited to Chinese tastes at cheaper prices. "Both companies are very home-market centred and have failed to adapt to shifts in Chinese market preferences," said Bill Russo, head of Shanghai-based consultancy Automobility Ltd and a former senior Asia-based Chrysler executive. "Neither company has recognized and delivered on the trends of shared, connected and electric vehicles,” Russo said. That makes them ill-prepared to deal with further shifts in the Chinese market, which saw annual sales contract for the first time since the 1990s last year and is expected to see another drop this year. "China's overall market is experiencing a transmission and adjustment period," said Alan Kang, a Shanghai-based senior analyst at LMC Automotive. "It is very hard for these two companies, which do not have enough competitive up-to-date products, to quickly recover with the merger." FCA has a partnership in China with Guangzhou Automobile Group, which said on Thursday it backed the merger. PSA has been trying to reboot its operations in China.

Fiat Chrysler shares get a boost after revised Stellantis merger deal with PSA

Tue, Sep 15 2020MILAN — Shares in Fiat Chrysler (FCA) rose sharply in Milan on Tuesday after the car maker and French partner PSA revised the terms of their merger deal, with FCA's shareholders getting a smaller cash payout but a stake in another business. FCA and PSA, which last year agreed to merge to give birth to Stellantis, the world's fourth largest car manufacturer, said late on Monday they had amended the accord to conserve cash and better face the COVID-19 challenge to the auto sector. Milan-listed shares in Fiat Chrysler rose almost 8% by 1000 GMT, while PSA gained 1.5%. Under the revised terms, FCA will cut from 5.5 billion euros ($6.5 billion) to 2.9 billion euros the cash portion of a special dividend its shareholders are set to receive on conclusion of the merger. However, PSA will for its part delay the planned spinoff of its 46% stake in car parts maker Faurecia until after the deal is finalized. That means all Stellantis shareholders — and not just the current PSA investors - will get shares in a company which has a market value of 5.8 billion euros. Based on Stellantis' 50-50 ownership structure, FCA and PSA respective shareholders will each receive a 23% stake in Faurecia. Analysts welcomed the 2.6 billion euros in additional liquidity for Stellantis' balance sheet as well as the increase in projected synergies to more than 5 billion euros from 3.7 billion. There was also further reassurance as the two companies confirmed they expected the deal to close by the end of the first quarter of 2021. "All told, the two players emerge as winners," broker ODDO BHF said in a note. "Of the two, FCA might be a bit more of a winner in the short term given the structure of the deal and the numerous payouts to shareholders to come in the quarters ahead (potentially close to 5 billion euros versus the current capitalization of around 16 billion euros)." The special dividend for FCA shareholders had proved contentious after Italy offered state guarantees for a 6.3 billion euro loan to the company's Italian business. "These announcements should, at last, end the debate over the financial terms of the merger, which had become a big topic and was still penalizing the two groups' share performances," ODDO BHF said. PSA and FCA said they would consider paying out 500 million euros to shareholders in each firm before closing or else a 1 billion euro payout to Stellantis shareholders afterwards, depending on market conditions and company performance and outlook.