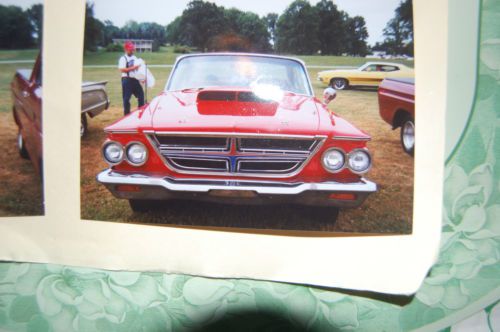

1964 Chrysler 300 Muscle Car on 2040-cars

Willow Street, Pennsylvania, United States

|

1964 CHRYSLER 300. ENGINE 413-30 OVER. BLOCK DECKED. 906 HEADS SHAVED. EDELBROCK INTAKE WITH 730 HOLLEY. 727 TORQUE FLITE REVERSE MANUAL VALVE BODY. 4.56 RICHMOND GEARS. UNDER 2000 MILES ON DRIVE TRAIN. HAS 2 HOODS; ORIGINAL AND FIBERGLASS TO ACCOMMODATE HIGH RISE MANIFOLD. INTERIOR IN GOOD SHAPE, GLASS AND TIRES GOOD. HAS ORIGINAL 300 EMBLEMS AND CHROME. BUMPERS ARE A LITTLE FADED BUT NOT RUSTY.

CAR HAS BEEN GARAGED FOR 20 YEARS. Can email additional photos to interested buyer |

Chrysler 300 Series for Sale

1979 chrysler 300 9,8xx miles t-tops (2)(US $11,250.00)

1979 chrysler 300 9,8xx miles t-tops (2)(US $11,250.00) 1955 chrysler c300(US $19,000.00)

1955 chrysler c300(US $19,000.00) 2012 chrysler srt8 mint condition(US $43,500.00)

2012 chrysler srt8 mint condition(US $43,500.00) 2012 chrysler 300 limited, v6, navigation, adaptive cruise control!!!(US $17,200.00)

2012 chrysler 300 limited, v6, navigation, adaptive cruise control!!!(US $17,200.00) 2008 chrysler 300 srt8 hemi one owner(US $23,988.00)

2008 chrysler 300 srt8 hemi one owner(US $23,988.00) 2008 chrysler 300 limousine 140" ***excellent condition****(US $25,000.00)

2008 chrysler 300 limousine 140" ***excellent condition****(US $25,000.00)

Auto Services in Pennsylvania

Zirkle`s Garage ★★★★★

Young`s Auto Transit ★★★★★

Wolbert Auto Body and Repair ★★★★★

Wilkie Lexus ★★★★★

Vo Automotive ★★★★★

Vince`s Auto Service ★★★★★

Auto blog

Weekly Recap: Obama reflects on the auto bailout's legacy

Sat, Jan 23 2016President Obama took a victory lap of sorts this week at the Detroit Auto Show, lauding the industry's progress and reflecting on the decision to bail out General Motors and Chrysler seven years ago. While the rescue was controversial at the time, historians will likely judge the president's actions to help save two of America's industrial symbols in a positive light. Much like Theodore Roosevelt's trust-busting tactics were controversial in the early 20th century, Obama's plan drew fire from critics who argued the free market should be left to its own devices. But providing financial aid and forcing the automakers to restructure had an enduring impact on the US economy. The auto industry has added more than 646,000 jobs since the companies emerged from bankruptcy, including manufacturing and retail positions. Make no mistake, GM and Chrysler were nearly dead in 2009. Now, GM is a powerhouse that's set to capitalize on a market that could see 18 million vehicles sold this year. Chrysler, which was renamed FCA US, survived as part of the Italian-American Fiat Chrysler Automobiles conglomerate. It's also performed well amid the strong industry conditions, though CEO Sergio Marchionne very publicly went looking for alliance partners last year, something from which he's since backed off. While Obama can claim a win, the bailout was actually started by George W. Bush, who provided short-term loans to GM and Chrysler in December 2008. Without that, they might not have made it much past Obama's inauguration. NEWS & ANALYSIS News: Spy Shooters captured the next-gen BMW Z4 during extreme cold weather testing. Analysis: The upcoming Z4 (which might be called the Z5) looks sharp. But the big deal is that BMW's much-anticipated sports-car project with Toyota is coming to fruition. Refresher: BMW and Toyota agreed to work together back in December 2011 and then announced an expansion of that deal to include sports cars in June 2012. Ultimately, it will provide BMW with a new Z4 and Toyota with another sports car, perhaps the Supra replacement. BMW is developing the platform, while Toyota is expected to chip in with hybrid technology. Big picture, this project is a good thing. It's providing enthusiasts with two modern sports cars that Toyota and BMW might not chose to develop on their own. This template has been shown to work, as the Fiat-Mazda alliance produced the MX-5 Miata and 124 Spider. News: The Jeep Grand Cherokee Hellcat was also spied, briefly.

How Renault, Fiat Chrysler, and yes, Nissan, could save through sharing

Wed, May 29 2019If French automaker Renault green-lights a proposed merger with Fiat Chrysler Automobiles, the companies almost immediately could begin saving money by consolidating components and basic structures on many of their most popular vehicles, an industry analyst said on Tuesday. The synergies could multiply if they invite Japanese automaker Nissan, currently Renault's alliance partner, to join the merger, according to a former Renault and Nissan executive. Renault and Italian-American rival Fiat Chrysler Automobiles are in talks to tackle the costs of far-reaching technological and regulatory changes by creating the world's third-biggest automaker. A Renault-Fiat Chrysler combination "would mean a greater sharing of parts (which) could really boost the profitability of Fiat Chrysler's smaller vehicles," said Sam Fiorani, vice president, AutoForecast Solutions. Building similar models on a common vehicle architecture, Fiorani said, "would give both companies a lot more freedom in manufacturing. They could mix brands and vehicle sizes on the same assembly line, switch vehicles between plants to balance production, and even shift production from one country to another, depending on changes in demand, tariffs or other considerations." Fiorani said Fiat Chrysler could benefit from sharing the French automaker's expertise in electric vehicles and powertrains, where Renault and Nissan have jointly invested more than $5 billion. These are areas in which Fiat Chrysler has little in the way of components or intellectual property. Another sector that is ripe for consolidation is light commercial vehicles, where Renault and Fiat Chrysler could build a variety of vans in several sizes on common platforms that could be assembled and sold in global markets. Ford Motor Co and Volkswagen AG began their alliance discussions a year ago by focusing on potential collaboration in light commercial vehicles. Getting Nissan's blessing Fiorani said Renault's CMF architecture, which was jointly developed with Nissan and underpins many of Renault's passenger cars and crossovers, could be used by Fiat Chrysler on a wide variety of vehicles. As an example, he said the CMF could provide a new single foundation for at least five Jeep models, including the Renegade, Compass and Cherokee, which now are based on four different platforms.

Stellantis ready to kill brands and fix U.S. problems, CEO Tavares says

Thu, Jul 25 2024Â MILAN — Stellantis is taking steps to fix weak margins and high inventory at its U.S. operations and will not hesitate to axe underperforming brands in its sprawling portfolio, its chief executive Carlos Tavares said on Thursday. The warning for lossmaking brands is a turnaround for Tavares, who has maintained since Stellantis was created in 2021 from the merger of Italian-American automaker Fiat Chrysler and France's PSA that all of its 14 brands including Maserati, Fiat, Peugeot and Jeep have a future. "If they don't make money, we'll shut them down," Carlos Tavares told reporters after the world's No. 4 automaker delivered worse-than-expected first-half results, sending its shares down as much as 10%. "We cannot afford to have brands that do not make money." The automaker now also considers China's Leapmotor as its 15th brand, after it agreed to a broad cooperation with the group. Stellantis does not release figures for individual brands, except for Maserati which reported an 82 million euro adjusted operating loss in the first half. Some analysts say Maserati could possibly be a target for a sale by Stellantis, while other brands such as Lancia or DS might be at risk of being scrapped given their marginal contribution to the group's overall sales. Stellantis' Milan-listed shares were down as much as 12.5% on Thursday, hitting their lowest since August 2023. That brings the loss for the year so far to 22%, making them the worst performer among the major European automakers. Few automotive brands have been killed off since General Motors ditched the unprofitable Saturn and Pontiac during a U.S. government-led bankruptcy in the global financial crisis in 2008. Tavares is under pressure to revive flagging margins and sales and cut inventory in the United States as Stellantis bets on the launch of 20 new models this year which it hopes will boost profitability. Recent poor results from global carmakers have heightened worries about a weakening outlook for sales across major markets such as the U.S., whilst they also juggle an expensive transition to electric vehicles and growing competition from cheaper Chinese rivals. Japan's Nissan Motor saw first-quarter profit almost completely wiped out on Thursday and slashed its annual outlook, as deep discounting in the United States shredded its margins. Tavares said he would be working through the summer with his U.S. team on how to improve performance and cut inventory.