1955 Chrysler 300 Series 1955-3n551001-hemi-first 300 Built! on 2040-cars

Pegram, Tennessee, United States

Please message me with questions at: markdudycha@programmer.net . CHRYSLER ENTHUSIASTS, PLEASE READ THIS AD THOROUGHLY. THIS IS ABSOLUTELY THE HOLY GRAIL FOR THE EARLY CHRYSLER

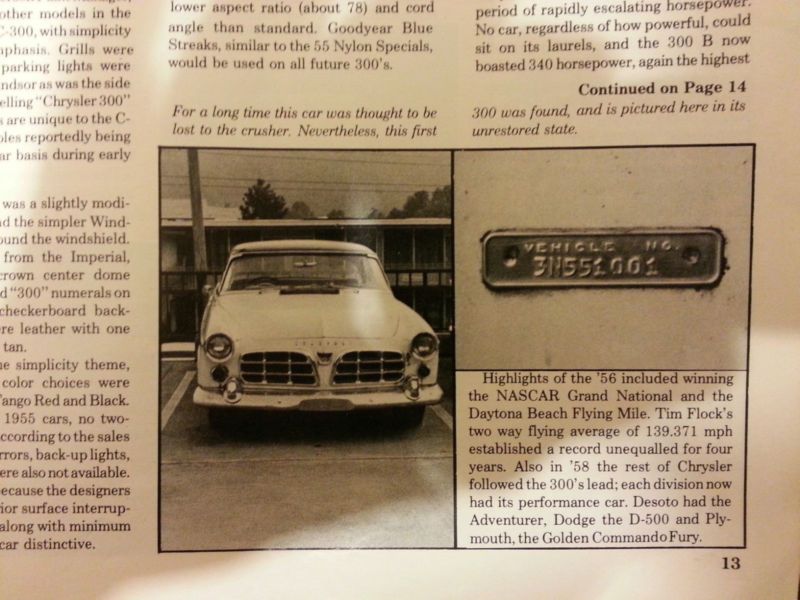

COLLECTORS. THIS IS ALSO A TRUE BARN FIND. 1955 CHRYSLER C300, VIN NUMBER 3N551001. THATíS CORRECT, THIS IS THE

FIRST REGULAR PRODUCTION 1955 CHRYSLER 300! THIS CLASSIC WAS PURCHASED IN THE EARLY í70íS BY WELL KNOWN

CHRYSLER COLLECTOR STEVE MCCLOUD, OF TENNESSEE. PARTIAL INVOICE FROM SAN JUAN MOTORS, PERIOD PHOTOS, AND MAGAZINE ARTICLES ARE ALSO WITH THE

CAR! THIS IS AN UNBELIEVABLE BARN FIND, THE RAREST CHRYSLER 300 EVER BUILT. NUMBER ONE. A 1955 331 HEMI FROM A NEW

YORKER (#NE55-11684) WAS INSTALLED IN THE CAR BEFORE MCCLOUD PURCHASED IT. HOWEVER, THE ENGINE WAS UPGRADED TO 300

HP SPECS WITH THE ADDITION OF DUAL FOUR BARRELS AND INTAKE, HEADS, AND CAM. ALSO, ANOTHER CHRYSLER 300 ENGINE

(3NE55 PREFIX) IS WITH THE CAR. THE CAR IS JUST AS IT WAS WHEN PUT AWAY OVER THREE DECADES AGO.

Chrysler 300 Series for Sale

Chrysler other touring sedan 4-door(US $10,000.00)

Chrysler other touring sedan 4-door(US $10,000.00) Chrysler 300 series 2-door sport coupe(US $14,000.00)

Chrysler 300 series 2-door sport coupe(US $14,000.00) Chrysler 300 series convertible(US $8,000.00)

Chrysler 300 series convertible(US $8,000.00) Chrysler 300 series base sedan 4-door(US $2,000.00)

Chrysler 300 series base sedan 4-door(US $2,000.00) Chrysler 300 series touring(US $2,000.00)

Chrysler 300 series touring(US $2,000.00) Chrysler 300 series leather(US $2,000.00)

Chrysler 300 series leather(US $2,000.00)

Auto Services in Tennessee

W & W Motors & Auto Parts ★★★★★

Universal Kia Rivergate Location ★★★★★

Trickett Honda ★★★★★

Swaney`s Paint & Body ★★★★★

Southern Cross Transport tow and recovery LLC ★★★★★

Sound Waves Inc ★★★★★

Auto blog

Bailout dealership cuts did their job as profits surge

Tue, 01 Oct 2013Almost five years after US taxpayers bailed out General Motors and Chrysler, a large majority of their slimmed-down dealership networks are posting soaring profits, Bloomberg reports, and contributing to the US auto industry on track this year to deliver 15.4 million vehicles, the most since 16.15 million were delivered in 2007.

Consider another important figure: Bloomberg says that more than 90 percent of GM dealerships are profitable, compared to about half of them in 2008 and 2009. At the start of 2013, GM had 4,355 US dealerships and Chrysler had about 2,600. Compare that with just a few years ago, when GM had 6,246 dealers in 2008, while Chrysler had 3,200 in 2009.

As part of their bankruptcy restructuring, both GM and Chrysler decided that their retail networks contained far too many dealerships and insisted that they be slimmed down. The resultant dealership terminations followed by a rebounding auto market - in part due to better new GM and Chrysler vehicles - have increased the number of sales per dealership to record levels. Many dealers are taking advantage of increasing profits and investing in facility renovations and updates, such as Chrysler dealership owner David Kelleher. He's spending $2 million to expand his store.

Rising aluminum costs cut into Ford's profit

Wed, Jan 24 2018When Ford reports fourth-quarter results on Wednesday afternoon, it is expected to fret that rising metals costs have cut into profits, even as rivals say they have the problem under control. Aluminum prices have risen 20 percent in the last year and nearly 11 percent since Dec. 11. Steel prices have risen just over 9 percent in the last year. Ford uses more aluminum in its vehicles than its rivals. Aluminum is lighter but far more expensive than steel, closing at $2,229 per tonne on Tuesday. U.S. steel futures closed at $677 per ton (0.91 metric tonnes). Republican U.S. President Donald Trump's administration is weighing whether to impose tariffs on imported steel and aluminum, which could push prices even higher. Ford gave a disappointing earnings estimate for 2017 and 2018 last week, saying the higher costs for steel, aluminum and other metals, as well as currency volatility, could cost the company $1.6 billion in 2018. Ford shares took a dive after the announcement. Ford Chief Financial Officer Bob Shanks told analysts at a conference in Detroit last week that while the company benefited from low commodity prices in 2016, rising steel prices were now the main cause of higher costs, followed by aluminum. Shanks said the automaker at times relies on foreign currencies as a "natural hedge" for some commodities but those are now going in the opposite direction, so they are not working. A Ford spokesman added that the automaker also uses a mix of contracts, hedges and indexed buying. Industry analysts point to the spike in aluminum versus steel prices as a plausible reason for Ford's problems, especially since it uses far more of the expensive metal than other major automakers. "When you look at Ford in the context of the other automakers, aluminum drives a lot of their volume and I think that is the cause" of their rising costs, said Jeff Schuster, senior vice president of forecasting at auto consultancy LMC Automotive. Other major automakers say rising commodity costs are not much of a problem. At last week's Detroit auto show, Fiat Chrysler Automobiles NV's Chief Executive Officer Sergio Marchionne reiterated its earnings guidance for 2018 and held forth on a number of topics, but did not mention metals prices. General Motors Co gave a well-received profit outlook last week and did not mention the subject. "We view changes in raw material costs as something that is manageable," a GM spokesman said in an email.

Italy reportedly guarantees $7.1 billion loan to Fiat Chrysler

Wed, Jun 24 2020ROME ó Italy has approved a decree offering state guarantees for a 6.3-billion euro ($7.1 billion) loan to Fiat Chrysler's (FCA)¬† Italian unit, a source said, paving the way for the largest crisis loan to a European carmaker. The source said Italy's audit court had signed off on the decree, in a final step of what had been a lengthy and contested process to get the loan approved. The court's approval follows an earlier endorsement by the economy ministry. "The audit court authorized the decree," said a source close to the matter, asking not to be named because of its sensitivity. FCA's Italian division has tapped Rome's COVID-19 emergency financing schemes to secure a state-backed, three-year facility to help the group's operations in the country, as well as Italy's car sector in which about 10,000 businesses operate, weather the crisis triggered by the coronavirus emergency. The loan will be disbursed by Italy's biggest retail bank Intesa Sanpaolo, which has already authorized it pending the approval of guarantees the government will provide on 80% of the sum through export credit agency SACE. The request for state support has sparked controversy because FCA is working to merge with French rival PSA and the holding for the Italian-American carmaker is registered in the Netherlands. FCA's global brands include Fiat, Jeep, Dodge and Maserati. It was not immediately clear what conditions, if any, Italy has set as part of the guarantees and whether they would affect FCA's planned 5.5 billion euro ($6.2 billion) extraordinary dividend, which is a key element in the merger with PSA. FCA, whose shares were down 0.5% by 0908 GMT, had no immediate comment. ¬† Earnings/Financials Chrysler Fiat Peugeot Italy