*mega Savings* 2013 "motown" Edition - Navigation - 8 Speed Auto -heated Leather on 2040-cars

Hollywood, Florida, United States

Chrysler 300 Series for Sale

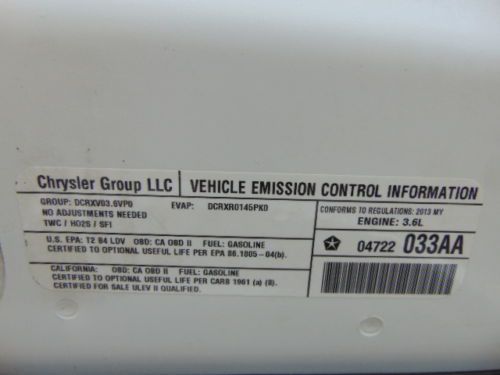

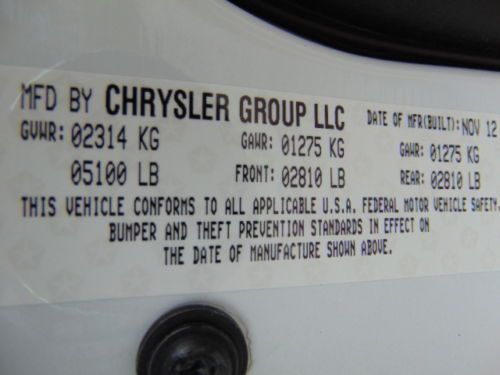

4dr sdn rwd low miles sedan automatic 3.6l v6 sfi dohc 24v bright white

4dr sdn rwd low miles sedan automatic 3.6l v6 sfi dohc 24v bright white Touring 3.5l cd 17" x 7" aluminum wheels leather trimmed bucket seats 4 speakers

Touring 3.5l cd 17" x 7" aluminum wheels leather trimmed bucket seats 4 speakers 1962 chrysler 300 golden lion 383 factory ac fully restored at ps pb

1962 chrysler 300 golden lion 383 factory ac fully restored at ps pb '12 chrysler 300 srt-8,20"black chrome wheels,470hp,safetytec,pano roof,hk radio(US $43,900.00)

'12 chrysler 300 srt-8,20"black chrome wheels,470hp,safetytec,pano roof,hk radio(US $43,900.00) 2008 chrysler 300 touring(US $13,500.00)

2008 chrysler 300 touring(US $13,500.00) 13 chrysler 300c awd leather navigation back up camera uconnect price reduced

13 chrysler 300c awd leather navigation back up camera uconnect price reduced

Auto Services in Florida

Zephyrhills Auto Repair ★★★★★

Yimmy`s Body Shop & Auto Repair ★★★★★

WRD Auto Tints ★★★★★

Wray`s Auto Service Inc ★★★★★

Wheaton`s Service Center ★★★★★

Waltronics Auto Care ★★★★★

Auto blog

Autonomous Chrysler Pacficas join Lyft test fleet

Sun, Nov 10 2019Lyft has another year of building out its autonomous driving program under its belt, and the ride-hailing company has been expanding its testing steadily throughout 2019. The company says that it's now driving four times more miles on a quarterly basis than it was just six months ago, and has roughly 400 people worldwide dedicated to autonomous vehicle technology development. Going into next year, it's also expanding the program by adding a new type of self-driving test car to its fleet: Chrysler's Pacifica hybrid minivan, which is also the platform of choice for Waymo's current generation of self-driving car. The Pacifica makes a lot of sense as a ridesharing vehicle, since it's a perfect passenger car with easy access via the big sliding door and plenty of creature comforts inside. Indeed, Lyft says that it was chosen specifically because of its "size and functionality" and what those offer to the Lyft AV team when it comes to "experiment[ing] with the self-driving rideshare experience. Lyft says it's currently working on building these test vehicles out in order to get them on the road. Lyft's choice of vehicle is likely informed by its existing experience with the Pacificas, which it encountered when it partnered with Waymo starting back in May, with that company's autonomous vehicle pilot program in Phoenix, Arizona. That ongoing partnership, in which Waymo rides are offered on Lyft's ride-hailing network, is providing Lyft with plenty of information about how riders experience self-driving ride-hailing, Lyft says. In addition to Waymo, Lyft is also currently partnering with Aptiv on providing self-driving services commercially to the public through that company's Vegas AV deployment. In addition to adding Pacificas to its fleet alongside the current Ford Fusion test vehicles it has in operation, Lyft is opening a second facility in addition to its Level 5 Engineering Center, the current central hub of its global AV development program. Like the Level 5 Engineering Center, its new dedicated testing facility will be located in Palo Alto, and having the two close together will help "increase the number of tests we run," according to Lyft. The new test site is designed to host intersections, traffic lights, roadway merges, pedestrian pathways and other features of public roads, all reconfigurable to simulate a wide range of real-world driving scenarios.

2014 Chrysler 200 to set design tone for brand

Sun, 20 Jan 2013Speaking with Wards Auto at this year's Detroit Auto Show, Chrysler design chief Ralph Gilles said that the next-generation Chrysler 200 will launch a whole new styling direction for the brand when it arrives for the 2014 model year. Gilles did not reveal any specific design cues or elements that will be found on the next 200, only saying that the new car "shares no surface language with any previous Chrysler we've ever seen."

Indeed, the current 200 isn't exactly setting the world on fire with any sort of clever, emotive design, but Gilles knows that. "The current Chryslers on the road today certainly don't reflect where we're headed," he told Wards Auto. Instead, Gilles said that "we are deviating from where we are today, completely. It's a very different feeling (and) look."

The launch of the new Chrysler 200 will officially mean the death of its Dodge Avenger counterpart, though Gilles says that the company is working on an all-new product to replace that vehicle down the road. Still, Chrysler will need a successful player in the popular midsize segment, and Gilles fully expects the new 200 to be up to the task. "I think it's going to be a beautiful and relevant vehicle."

Here's what the UAW will be angling for in next year's contract negotiations

Mon, Dec 15 2014The United Auto Workers union is about to enter a new round of negotiations with the Detroit Three automakers, and this time, the focus is on the end of the two-tier wage system. Introduced in 2007, the two-tier wage system was enacted to allow General Motors, Ford and Chrysler to categorize its hourly employees under two categories: Tier 1 for veteran employees with full rights and benefits, and Tier 2 for short-term or entry-level employees compensated under a different schedule. The idea was that the system would permit the automakers to invest more in their plants and hire new employees as part of their respective recovery plans without being saddled with all the costs associated with hiring full-time employees. Now that the automakers are (more or less) back on their proverbial feet, however, the UAW wants to see an end to the two-tier system, and will likely make that a center-point of its negotiations next year to replace the current arrangement that is scheduled to end in September 2015. Not all members of the UAW will necessarily be interested in ending the two-tier system, however. According to The Detroit News, some Tier 1 workers may be more interested in negotiating a raise in their hourly rate – something which they haven't received in almost a decade. Tier 2 workers, meanwhile, may be more motivated to keep the tiered system in place, as their arrangement includes provisions for profit-sharing payments that have seen the automakers pay out billions to so-called short-term employees in lump-sum payments. Reconciling the two competing demands from two categories of union members and presenting a united front in negotiations may prove the biggest challenge for the UAW's new president, Dennis Williams. And with the right to strike – something which was suspended during the last round of negotiations in 2011 – the union has a bigger bargaining chip in its pocket.