Chrysler Pacifica Limited Awd Navigation Backup Camera 3rd Row No Reserve on 2040-cars

Philadelphia, Pennsylvania, United States

Vehicle Title:Clear

Engine:4.0L 3952CC 241Cu. In. V6 GAS SOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Sport Utility

Fuel Type:GAS

Year: 2008

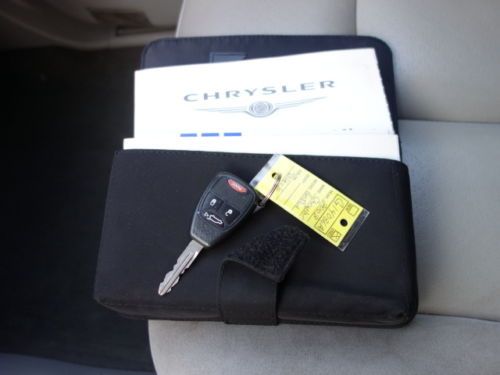

Make: Chrysler

Warranty: Vehicle does NOT have an existing warranty

Model: Pacifica

Trim: Limited Sport Utility 4-Door

Options: Sunroof

Power Options: Power Locks

Drive Type: AWD

Mileage: 158,819

Sub Model: 4dr Wgn Limi

Number of Cylinders: 6

Exterior Color: Black

Interior Color: Gray

Chrysler 200 Series for Sale

2001 chrysler sebring lxi convertible 2.7l v6 auto low mileage leather loaded(US $5,900.00)

2001 chrysler sebring lxi convertible 2.7l v6 auto low mileage leather loaded(US $5,900.00) 2011 chrysler 300 c sedan 4-door 5.7l

2011 chrysler 300 c sedan 4-door 5.7l 2011 chrysler 200 touring sedan 4-door 3.6l(US $14,500.00)

2011 chrysler 200 touring sedan 4-door 3.6l(US $14,500.00) Used chrysler 300 c automatic luxury 4dr sedan hemi autos we finance auto cars(US $11,874.00)

Used chrysler 300 c automatic luxury 4dr sedan hemi autos we finance auto cars(US $11,874.00) Leather, heated seats, all power, chrome wheels 5.7 hemi v8 only! 63k miles(US $10,499.00)

Leather, heated seats, all power, chrome wheels 5.7 hemi v8 only! 63k miles(US $10,499.00) Loaded black 2007 chrysler 300 touring sedan 4-door 3.5l with custom wheels/nav!

Loaded black 2007 chrysler 300 touring sedan 4-door 3.5l with custom wheels/nav!

Auto Services in Pennsylvania

Young`s Auto Body Inc ★★★★★

Van Gorden`s Tire & Lube ★★★★★

Valley Seat Cover Center ★★★★★

Tony`s Transmission ★★★★★

Tire Ranch Auto Service Center ★★★★★

Thomas Automotive ★★★★★

Auto blog

Time to catch up with Jay Leno's Garage, including his Lamborghini Espada restoration

Tue, Dec 23 2014If you're already jealous of the time, effort and money that Jay Leno can devote to his massive car collection, prepare to get a little greener with envy with this latest video from Jay Leno's Garage. Instead of the usual format of discussing a model for about ten minutes and then taking it out for a test drive, this week Leno gives viewers on a tour of over a dozen projects concurrently happening in his stable. The breadth of the vehicles shown and the things being done to them run the entire span of the automotive hobby. At the same time, Jay's shop is working on just a simple restoration of his 1969 Lamborghini Espada (pictured), and at the other side of the building, the team is rebuilding a wood-bodied 1914 Detroit Electric from scratch. He eventually plans to slot a more modern electric drivetrain into it. If bikes are more your interest, there's a freshly completed Brough Superior just waiting for a ride, and if American models are your thing, a Ford Bronco is getting a Coyote V8 installed into it. You have some very specific tastes if you can't watch this clip and start wishing at least one of these vehicles could be in your own garage. Other than the personal projects his mechanics are working on in the shop, Jay gets to have them all, plus plenty more.

Fiat Chrysler's profit boosted by Ram and Jeep in North America

Wed, Jul 31 2019MILAN/DETROIT — Fiat Chrysler took the market by surprise by sticking to its full-year profit guidance on Wednesday after a strong performance from its Ram pickup truck in North America helped it defy an industry slowdown. Chief Executive Mike Manley, in FCA's first earnings release since a failed attempt to merge with France's Renault, also left the door open to that or other deals. "We are open to opportunity," Manley said on a call with analysts. "I have no doubt why there still would be interest in it," he added, when pressed on what it would take to revive talks with Renault. Manley declined to comment further. FCA last month abandoned its $35 billion merger offer for Renault, blaming French politics for scuttling what would have been a landmark deal to create the world's third-biggest automaker. Manley said a merger was not a must-have and Fiat Chrysler's business plan was strong. The company said it remained confident its adjusted earnings before interest and tax (EBIT) would top last year's 6.7 billion euros ($7.5 billion). Given disappointing forecasts from other automakers this earnings season, FCA's confirmation of the outlook sent Milan-listed shares in the Italian-American automaker, whose other brands include Jeep, up over 4%. A broad-based auto sales downturn has rattled the sector, forcing FCA's competitors — including Renault, Daimler and Aston Martin — to cut their sales forecasts after second-quarter results, while U.S. carmaker Ford gave a weaker-than-expected 2019 profit outlook. Japan's Nissan, a long-term partner of Renault, said it would cut 12,500 jobs by 2023 after its earnings collapsed. In the second quarter FCA's adjusted EBIT totaled 1.52 billion euros, versus analysts' expectations of 1.43 billion euros, according to a Reuters poll. FCA's U.S. shipments were down 12% in the second quarter but the group said that the successful performance of its Ram brand resulted in an enhanced share of the large pickup truck market of 27.9%, up 7 percentage points from last year. Adjusted EBIT margin in North America rose to 8.9% from 6.5% in the first quarter, thanks to strong demand for the heavy-duty Ram and the new Jeep Gladiator pickup. Chief Financial Officer Richard Palmer also said FCA expected to report up to 10% margins in the region in both the third and fourth quarters.

Ferrari borrows $2.6 billion to finance FCA spinoff

Tue, Dec 1 2015Ferrari announced Monday that it is borrowing about $2.6 billion to finance its spinoff from Fiat Chrysler Automobiles. Here's how it breaks down: Ferrari NV, the automaker's parent company based in the Netherlands, is taking out loans totaling 2.5 billion euros. That's equivalent to $2.64 billion at current exchange rates, and is divided between a term loan of $2.12 billion and a revolving credit facility of $529 million. The larger term loan "will be used to refinance indebtedness owing to Fiat Chrysler Automobiles," among other purposes. That ought to constitute the lion's share of the $2.38 billion which the Prancing Horse marque was, according to reports last year, slated to pay its current parent company in order to help FCA fund its ambitious growth plans. The separate line of credit is earmarked "to be used from time to time for general corporate and working capital purposes of the Ferrari group." Though Ferrari is not expected to take any other Fiat Chrysler properties with it, the "group" in this case would include its various financial services and distribution arms around the world that may have been separately incorporated. As noted in the statement below, the financial arrangement "represents a further step towards the separation of Ferrari from the FCA Group," following the separate stock issues from both companies as independent from each other. FERRARI N.V. SIGNS ˆ2.5 BILLION SYNDICATED CREDIT FACILITY Ferrari N.V. (NYSE: RACE) ("Ferrari") announced today that it has entered into a ˆ2.5 billion syndicated loan facility with a group of ten bookrunner banks. The facility comprises a bridge loan (the "Bridge Loan") and a term loan (the "Term Loan") of ˆ2 billion in aggregate and a revolving credit facility of ˆ500 million (the "RCF"). Proceeds of the Bridge Loan and Term Loan will be used to refinance indebtedness owing to Fiat Chrysler AutomobilesN.V. (NYSE: FCAU) ("FCA") and other indebtedness and for other general corporate purposes. Proceeds of the RCF may be used from time to time for general corporate and working capital purposes of the Ferrari group. The Bridge Loan has a 12 month maturity with an option for Ferrari to extend once for a six-month period. Ferrari intends to refinance the Bridge Loan prior to its maturity with longer term debt, including through capital markets or other financing transactions. The Term Loan, which comprises a majority of the total facility, and the RCF each have a maturity of five years.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.541 s, 7887 u