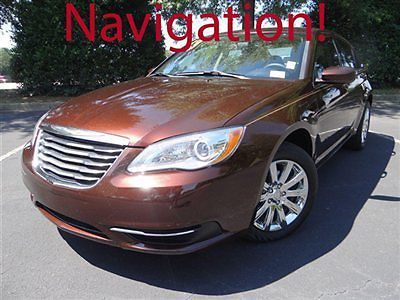

4dr Sedan C Fwd New Automatic Gasoline 3.6l V6 Cyl Engine Granite Crystal on 2040-cars

Hendrick Chrysler Dodge Jeep RAM, 1624 Montgomery Hwy, Hoover, AL 35216

Chrysler 200 Series for Sale

4dr sedan limited fwd new automatic gasoline 2.4l 4 cyl engine billet silver

4dr sedan limited fwd new automatic gasoline 2.4l 4 cyl engine billet silver Chrysler 200 touring low miles 4 dr sedan automatic gasoline 2.4l l4 sfi dohc 16

Chrysler 200 touring low miles 4 dr sedan automatic gasoline 2.4l l4 sfi dohc 16 Touring 2.4l 4 cylinder automatic remote start 4 door cruise tilt certified

Touring 2.4l 4 cylinder automatic remote start 4 door cruise tilt certified All-new 200c awd loaded with everything!(US $35,705.00)

All-new 200c awd loaded with everything!(US $35,705.00) *super savings* 2013 chrysler 200 touring edition v6 - accident free 1 owner(US $11,900.00)

*super savings* 2013 chrysler 200 touring edition v6 - accident free 1 owner(US $11,900.00) *mega deal* 2013 chrysler 200 touring series - accident free 1 owner sedan(US $9,900.00)

*mega deal* 2013 chrysler 200 touring series - accident free 1 owner sedan(US $9,900.00)

Auto blog

NHTSA looking into non-Takata airbag shrapnel case

Tue, Jul 14 2015The global airbag inflator recall from Takata has been one of the biggest topics in auto safety for months. Now, the National Highway Traffic Safety Administration is opening a preliminary evaluation into the components from Arc Automotive to investigate whether two reported ruptures and two injuries signal a wider problem. So far, only the 2002 Chrysler Town & Country and 2004 Kia Optima are believed to be affected. If a safety campaign is deemed necessary, it could cover an estimated 420,000 of the minivans and 70,000 of the Korean sedans. NHTSA first noticed these ruptures in December 2014. The agency received a complaint of a 2009 case in Ohio about the bursting of the driver's side inflator in a 2002 Town & Country. According to the report, the incident broke the woman's jaw and sent shrapnel into her chest. The government investigated the case, and this was found to be the only known occurrence in these vehicles. The analysis indicated the part's gases were possibly blocked somehow and caused the component to explode. FCA US spokesperson Eric Mayne told Autoblog that the company is "cooperating fully" with NHTSA. "Also, we no longer use that inflator," he said. A second incident came to NHTSA's attention in June 2015 with the driver's side rupture in a 2004 Optima in New Mexico. The agency lists fewer details about the case, and a root cause isn't known. This is also the only currently known example in a Kia vehicle. According to a statement from Kia to Autoblog, "We are taking this matter very seriously and support NHTSA's action and will continue working cooperatively with the agency and suppliers throughout the process." Arc's components are sealed within a steel housing that's meant to protect them from "external atmospheric conditions," according to NHTSA. Multiple suppliers also use them. In the Chrysler, the airbag module came from Key Safety Systems and from Delphi in the Kia. In a statement to Autoblog the company said, "We have received NHTSA's notification and are cooperating fully with its Preliminary Evaluation." At this time, NHTSA admits that it doesn't know for certain whether these two cases are linked. The agency is conducting this preliminary evaluation to learn more.

Strike looms for FCA workers as soon as Wednesday night

Wed, Oct 7 2015A strike is on the very near horizon for at least some United Auto Workers members at FCA US. On October 6, the union sent a letter to the automaker that officially announced the termination of its agreements with the company as of 11:59 PM on Wednesday, October 7. Assuming that a deal or extension hasn't happened by that time, workers could hit the picket line. While neither side is talking much publicly, it does appear that negotiations are still underway. In a very brief statement, the automaker simply says: "FCA US confirms that it has received strike notification from the UAW. The Company continues to work with the UAW in a constructive manner to reach a new agreement." The UAW seems equally receptive, and it says in a post on Facebook: "Negotiations with FCA continue. Your bargaining team is hard at work and we will continue to post updates when there is more to report." If a strike happens, it could put a serious financial burden on FCA US. Economist Sean McAlinden from the Center for Automotive Research estimates the cost at as much as $40 million per week, according to Reuters. The union hasn't clarified at this time whether all of its workers with the automaker would stop working or if the picket lines would only be at specific plants. The first tentative agreement posted to UAW members working with FCA US utterly failed in voting. Raises and a healthcare co-op would have been among the new benefits. However, the employees were upset that the proposed deal retained a two-tier wage structure, and they also didn't like the lack of details about rumors of major production changes.

Fiat Chrysler's London offices will be small, with financial focus

Tue, 20 May 2014Fiat Chrysler's decision to locate its new corporate headquarters in jolly old London won't herald a sprawling relocation effort. Instead, it's very likely that the FCA outfit will be a small one, primarily focused on finance.

The report comes from Automotive News Europe, which claims FCA's London office will employ about 50 people with backgrounds in finance. CEO Sergio Marchionne and Fiat Group Chairman John Elkann will both have offices at the corporate headquarters, as well.

ANE cites an anonymous source that claims the people employed at the London office will focus primarily on treasury operations. It's unlikely that FCA will take on any additional employees specifically for its UK offices. That said, FCA isn't likely to downsize either its Turin or Auburn Hills offices once London comes online.