2015 Chrysler 200 S on 2040-cars

1041 Greenup Ave, Ashland, Kentucky, United States

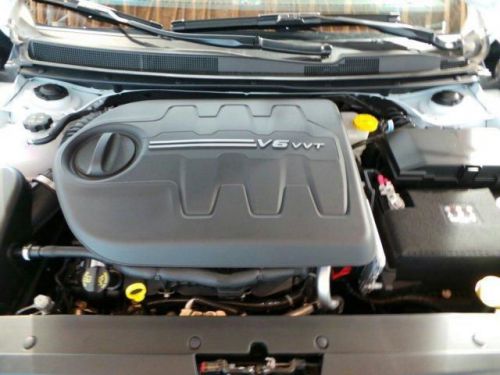

Engine:3.6L V6 24V MPFI DOHC

Transmission:9-Speed Automatic

VIN (Vehicle Identification Number): 1C3CCCBG7FN505209

Stock Num: C4303

Make: Chrysler

Model: 200 S

Year: 2015

Exterior Color: Bright White

Interior Color: Black

Options: Drive Type: FWD

Number of Doors: 4 Doors

Price shown with Kentucky rebates. Please call for other states. Step into the 2015 Chrysler 200! This sedan hits the mark with consumers demanding economical versatility! Chrysler prioritized comfort and style by including: voice activated navigation, telescoping steering wheel, and air conditioning. It features a front-wheel-drive platform, an automatic transmission, and a refined 6 cylinder engine. We pride ourselves on providing excellent customer service. Please don't hesitate to give us a call. Call Joe McIntyre toll free 888-214-1011 before you make the trip for availability and ask Joe how you can receive your V.I.P. Package - Just for our Internet Customers.

Chrysler 200 Series for Sale

2013 chrysler 200 limited(US $23,365.00)

2013 chrysler 200 limited(US $23,365.00) 2013 chrysler 200 lx(US $16,888.00)

2013 chrysler 200 lx(US $16,888.00) 2014 chrysler 200 touring(US $19,655.00)

2014 chrysler 200 touring(US $19,655.00) 2014 chrysler 200 limited(US $23,380.00)

2014 chrysler 200 limited(US $23,380.00) 2013 chrysler 200 lx(US $16,688.00)

2013 chrysler 200 lx(US $16,688.00) 2014 chrysler 200 touring(US $19,655.00)

2014 chrysler 200 touring(US $19,655.00)

Auto Services in Kentucky

Weinle Auto Sales East ★★★★★

Troy`s Wrecker Service ★★★★★

Tony`s Body Shop ★★★★★

TH Auto Body ★★★★★

Simpsonville Automotive ★★★★★

Ritze`s Auto Service ★★★★★

Auto blog

Fiat To Pay $3.65 Billion For Remaining Chrysler Shares

Thu, Jan 2 2014Italian automaker Fiat SpA announced Wednesday that it reached an agreement to acquire the remaining shares of Chrysler for $3.65 billion in payments to a union-controlled trust fund. Fiat already owns 58.5 percent of Chrysler's shares, with the remaining 41.5 percent held by a United Auto Workers union trust fund that pays health care bills for retirees. Under the deal, Fiat will make an initial payment of $1.9 billion to the fund, plus an additional $1.75 billion upon closing the deal. Chrysler will also make additional payments totaling $700 million to the fund as part of an agreement with the UAW. The deal is expected to close on or before Jan. 20, according to a statement from Chrysler. Sergio Marchionne, CEO of both Fiat and Chrysler, has long sought to acquire the union's shares in order to combine the two companies. "The unified ownership structure will now allow us to fully execute our vision of creating a global automaker that is truly unique in terms of mix of experience, perspective and know-how, a solid and open organization," Marchionne said in a statement issued by Turin, Italy-based Fiat. The deal eliminates the need for an initial public offering of the union fund's stake, which analysts had previously valued at $5.6 billion. Fiat went to court last year seeking a judgment on the price, but the trial date was set for next September. Marchionne can't spend Chrysler's cash on Fiat's operations unless the companies merge. In recent months he made it clear that he preferred to settle the dispute without an IPO, but filed the paperwork for the offering in September at the trust's request. Chrysler's profits have helped prop up Fiat on the balance sheet as the Italian automaker struggles in a down European market. The Auburn Hills, Mich., automaker earned $464 million in the third quarter on U.S. sales of the Ram pickup and Jeep Grand Cherokee, its ninth-straight profitable quarter. The results boosted Fiat, which earned $260 million in the quarter. Without Chrysler's contribution, Fiat would have lost $340 million. UAW/Unions Chrysler Fiat

Next-gen Jeep Wrangler to pack 300-hp Hurricane turbo four

Mon, May 9 2016Fiat Chrysler has been working for some time now on a new turbocharged four-cylinder engine. Dubbed "Hurricane," the engine is now said to produce nearly 300 horsepower. And its first application could be in the next-generation Jeep Wrangler. With that much power coming from such a small engine, the Hurricane would offer an even higher level of specific output than the 1.75-liter engine in the Alfa Romeo 4C – one of FCA's highest-stressed engines – far eclipsing the 4C's 120 horsepower per liter with 150 hp/l. By way of comparison, the latest 2.0-liter, four-cylinder version of Ford's EcoBoost engine produces "only" 245 hp (122.5 hp/l). The 2.0-liter turbo four in the latest Mercedes-AMG CLA45 and GLA45, however, produces 375 hp. To get so much out of so little an engine, FCA will utilize a twin-scroll turbocharger and variable valve timing. That could make it ideally suited towards a compact performance model, but according to Automotive News, its first application could be in the new the Wrangler. The larger 3.6-liter Pentastar V6 produces 285 hp, nearly as much as the Hurricane will. But with a smaller engine, an eight-speed transmission, and aluminum construction, the new Jeep will likely benefit from dramatically-improved fuel consumption. Related Video:

Treasury says auto bailout tally drops to $20.3 billion

Tue, 12 Feb 2013In December, the US Treasury announced that it was going to sell all of its shares in General Motors within 12 to 15 months. The first tranche of the 500-million total shares was purchased by GM, which took 200 million of them at $27.50 per share. That price represents an eight-percent premium over the market price at the time. The remaining 300 million shares will be sold "through various means in an orderly fashion."

Of the $418 billion disbursed through the Troubled Asset Relief Program (TARP), a report in Automotive News indicates that "about 93 percent" has been paid back, and the latest figures put Treasury's loss from the program overall at $55.58 billion. That's a $4.1 billion improvement on the last figure, when the expected red ink added up to $59.68 billion. The auto industry's portion of that loss is estimated to be $20.3 billion, a 16-percent drop from the earlier estimate of $24.3 billion.

The Treasury now owns 19 percent of GM, but if all goes well, there will be no more cause for anyone to utter "Government Motors" by the end of Q1 next year. A loss of some kind is still expected, however. Although GM's stock price is close to $29 at the time of this writing, that's still $4 below its IPO price and well below the $72 share price necessary for the government to come out even on its GM investment. On second thought, maybe the ribbing will continue.