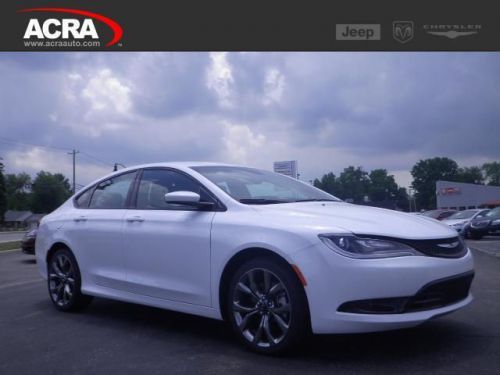

2014 Chrysler 200 Touring on 2040-cars

1407 N Lincoln St, Greensburg, Indiana, United States

Engine:3.6L V6 24V MPFI DOHC

Transmission:Automatic

VIN (Vehicle Identification Number): 1C3CCBBG1EN128613

Stock Num: N14129

Make: Chrysler

Model: 200 Touring

Year: 2014

Exterior Color: Deep Cherry

Interior Color: Black

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 10

This 2014 Chrysler 200 is ready for the road with features like an Auxiliary Audio Input, a whole new world of mobile entertainment turned on with Satellite Radio, and Steering Wheel Audio Controls. It also has Traction Control, an Anti-Theft System, and Steering Wheel Cruise Controls. It also has Side Airbags for increased protection, an MP3 Player / Dock, and Heated Outside Mirrors which come in extra handy during the cold winter months. As well as Automatic Climate Control, Child Locks, and Keyless Entry. This vehicle also includes: Tire Pressure Monitoring System - Bucket Seats - Cruise Control - Front Wheel Drive - Garage Door Opener - Power Seat - Power Windows - Rear Head Air Bag - Disc Brakes - Air Conditioning - Power Locks - Power Mirrors - CD Single-Disc Player - Compass - Leather Wrapped Steering Wheel - Cloth Seats - Flexible Fuel Capability - Rear Window Defrost - Remote Trunk Release - Tilt Wheel - Vanity Mirrors - Bench Seat - Trip Computer

Chrysler 200 Series for Sale

2015 chrysler 200 s(US $26,484.00)

2015 chrysler 200 s(US $26,484.00) 2014 chrysler 200 limited(US $23,653.00)

2014 chrysler 200 limited(US $23,653.00) 2014 chrysler 200 limited(US $23,653.00)

2014 chrysler 200 limited(US $23,653.00) 2011 chrysler 200 limited(US $15,995.00)

2011 chrysler 200 limited(US $15,995.00) 2013 chrysler 200 touring(US $15,999.00)

2013 chrysler 200 touring(US $15,999.00) 2013 chrysler 200 touring(US $16,999.00)

2013 chrysler 200 touring(US $16,999.00)

Auto Services in Indiana

Wood`s Battery & Auto Elctrc ★★★★★

Wilsons Auto Repair ★★★★★

Tread Express Tires Inc ★★★★★

The Zone Honda Kawasaki ★★★★★

Ted Brown`s Quality Paint & Body Shop ★★★★★

Swinehart Auto Service ★★★★★

Auto blog

Chrysler to accelerate production of 2013 Ram and V6 engines

Fri, 16 Nov 2012Chrysler is adding a third shift at its Warren Truck plant to meet demand for the new 2013 Ram pickup. And with tight supplies of its Pentastar V6, the company is also boosting output at its Mack Engine plant.

The expansions will add 1,250 jobs and are part of a $238 million investment by Chrysler in the Detroit area. Warren's third shift will begin work sometime in the spring, a Chrysler rep told Automotive News. Mack's increased Pentastar production a could include both 3.6 and 3.2-liter engines.

The company says it also plans to invest $40 million in its Trenton Engine plant to allow for production of a 3.2-liter V6 as well as the Tigershark inline-four for the upcoming Jeep Liberty replacement.

Mopar celebrates 50 years of the 426 Hemi

Thu, 09 Jan 2014Think of Chrysler performance and the names Mopar and Hemi are bound to come to mind. Chrysler and its Mopar performance parts division first introduced the original Hemi (so named for its hemispherical combustion chambers) back in 1951, celebrating its 60th anniversary in 2011. But it was thirteen years later - 50 years ago - that the Pentastar automaker rolled out the most iconic Hemi of them all: the Gen II 426.

The massive 7.0-liter V8 engine instantly became a muscle car icon and went on to become a favorite of racecar constructors. Two competition versions of the Gen II 426 Hemi were made: one for the track and one for the drag strip, and both went on to illustrious strings of victories. The race engine first debuted at the 1964 Daytona 500 where it powered Richard Petty's Plymouth to the checkered flag and on to the NASCAR championship.

Meanwhile on the drag strip, the Gen II 426 Race Hemi propelled Don Garlits past 200 miles per hour and down the quarter-mile in 7.78 seconds. Changes in NASCAR regulations meant that Chrysler devoted the engine to NHRA drag racing, and to this day the Gen II 426 Race Hemi is still used in Funny Car and Top Fuel dragsters.

FCA earnings improve in first quarter

Thu, Apr 30 2015Following on the recent global financial releases from Ford and from General Motors for the first quarter of 2015, FCA is now putting out its own numbers, and things look quite good for the company. The automaker posted adjusted earnings before taxes and interest of $895 million, a 22-percent jump from Q1 2014, and net profits of $103 million, a $296-million boost from last year. Revenue was also up 19 percent to $30 billion. Despite the favorable figures, actual worldwide shipments fell slightly by 2 percent to 1.1 million vehicles. FCA is giving some credit for these strong Q1 results to the automaker's performance in the NAFTA region. Shipments grew 8 percent to 633,000 vehicles, and net revenue jumped a strong 38 percent to $18.1 billion. Adjusted earnings reached $672 million, compared to $425 million in 2014. The company especially praised the Jeep Renegade, Chrysler 200, and Ram 1500 for helping the bottom line. The numbers could have been even higher, but the corporation admitted that "higher warranty and recall costs" partially drug things down. For the full year in 2015, FCA expects to ship between 4.8 and 5 million vehicles worldwide and post up to $5 billion in adjusted earnings. There should be about $1.3 billion in net profit, as well. FCA CLOSED Q1 WITH NET REVENUES OF ˆ26.4 BILLION, UP 19% AND ADJUSTED EBIT AT ˆ800 MILLION, UP 22% 30/04/15 FCA closed Q1 with net revenues of ˆ26.4 billion, up 19% and adjusted EBIT at ˆ800 million, up 22%. Net industrial debt was ˆ8.6 billion, up ˆ0.9 billion. Full year guidance confirmed. Worldwide shipments were 1.1 million units, 2% lower than Q1 2014, reflecting strong performance in NAFTA and weak market conditions in LATAM. Jeep's positive performance continued with worldwide shipments up 11% and sales up 22%. Net revenues were up 19% to ˆ26.4 billion (+4% at constant exchange rates, or CER). Adjusted EBIT was ˆ800 million, up ˆ145 million from Q1 2014, with all segments except LATAM posting positive results. The positive impact of foreign exchange translation was offset by negative impacts at a transactional level. Net profit was ˆ92 million, up ˆ265 million compared to the net loss of ˆ173 million in Q1 2014. Net industrial debt was ˆ8.6 billion, up ˆ0.9 billion from year-end mainly due to timing of capital expenditures and working capital seasonality. Liquidity remained strong at ˆ25.2 billion. The Group confirms its full-year guidance.