2014 Chrysler 200 Lx 4 Cyl, Sedan, Gold In Brand New Condition on 2040-cars

Wareham, Massachusetts, United States

|

This is a one owner vehicle in brand new condition still has new car smell. It is a 4 cyl, great on gas with a 2.4L engine front wheel drive. Vehicle was used as a fleet vehicle. Comes with a factory warranty and our dealer warranty as well. We also have autocheck report summary listing a full history of vehicle. This is a new vehicle without the new vehicle price tag. We have been in business for over 30yrs and have been in the same place for 19 yrs with a history of repeat customers. Come on down for a test drive today. Financing available on most vehicles. |

Chrysler 200 Series for Sale

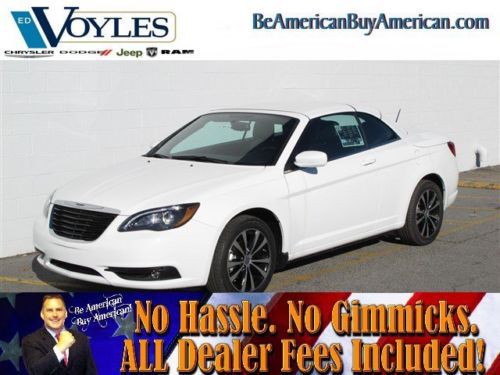

Billet silver metallic *brand new 2015* chrysler 200 "s" 9-speed automatic(US $20,285.00)

Billet silver metallic *brand new 2015* chrysler 200 "s" 9-speed automatic(US $20,285.00) S new convertible 3.6l cd front wheel drive power steering abs brake assist a/c

S new convertible 3.6l cd front wheel drive power steering abs brake assist a/c We finance!!! 2012 chrysler 200 limited convertible nav 33k mile texas auto(US $22,998.00)

We finance!!! 2012 chrysler 200 limited convertible nav 33k mile texas auto(US $22,998.00) We finance! 2013 touring used certified 2.4l i4 16v automatic fwd convertible

We finance! 2013 touring used certified 2.4l i4 16v automatic fwd convertible 2012 chrysler lx

2012 chrysler lx 2014 chrysler lx

2014 chrysler lx

Auto Services in Massachusetts

Woody`s Tire Service ★★★★★

Walnut Hill Auto Body ★★★★★

Sudbury Volvo Service ★★★★★

Southeast Truck Ctr Inc ★★★★★

Sal`s Auto & Truck Repair ★★★★★

S & L Auto Service ★★★★★

Auto blog

Chrysler defies NHTSA, says it won't recall 2.7M Jeep Grand Cherokee, Liberty models

Wed, 05 Jun 2013Facing a possible recall totaling around 2.7 million of its most popular SUVs, Chrysler remains insistent that the 1993-2004 Jeep Grand Cherokee and 2002-2007 Jeep Liberty are safe vehicles. This comes on the heels of a recall request from the National Highway Traffic Safety Administration for these two models due to fuel tanks mounted behind the rear axle, which could possibly be ruptured during severe rear-end collisions, leading to an increased risk of fire. In response to the allegations, Chrysler says that it does not agree with NHTSA nor does it plan on recalling either vehicle.

Chrysler said both SUVs "met and exceeded" the requirements for fuel-system integrity, and cooperated fully with NHTSA since the investigation was opened in 2010. While 15 deaths and 46 injuries have been reported from fires caused by rear-end collisions on these models, Chrysler is claiming that the vast majority of incidents cited by NHTSA were "high-energy crashes," including one where a stopped Grand Cherokee was rear-ended by a tractor trailer going 65 miles per hour.

The automaker wraps up by saying "NHTSA seems to be holding Chrysler Group to a new standard for fuel tank integrity that does not exist now and did not exist when the Jeep vehicles were manufactured." Scroll down for Chrysler's official response to NHTSA, but we're pretty sure this isn't the last we've heard on this issue.

Share price falls on skepticism of Chrysler-Fiat five-year plan

Thu, 08 May 2014Following this week's Fiat Chrysler extravaganza, where the Italian-American manufacturer announced its plans for the next five years, the Autoblog staff was cautiously optimistic of the company's future. Investors? Not so much.

Fiat saw its shares tumble 12 percent in Wednesday's trading, falling from 8.67 euros ($12.06 at today's rates) to 7.44 euros ($10.35) as of this writing, with blame partly going to the Italian half of the FCA marriage, which recorded a pretty significant drop in profits during the first quarter of this year.

The plan, which will cost around $77 billion over the next several years, is facing criticism from investors thanks in part to a 1.4-percent drop in Fiat's first-quarter profits, to 622 million euros ($862 million). That figure is also short of Bloomberg analysts' projections, which predicted $1.18 billion in profits before taxes, interest and one-time items.

Ferrari and FCA are officially separated

Mon, Jan 4 2016It's been a long time in the making, but it's officially happened: Ferrari is no longer part of Fiat Chrysler Automobiles. Following the Italian automaker's initial public offering, it has officially split off from its former parent company. As part of the spin-off, FCA's stakeholders will each receive one common share in Ferrari for every ten they hold in Fiat Chrysler. Special voting shares will be distributed in the same proportions to certain shareholders as well. Those shares being distributed will account for 80 percent of the company's ownership. Another ten percent was floated as part of the company's IPO, while the remaining 10 percent is held by Enzo's son Piero Ferrari (pictured above at center), who serves as vice chairman of the company. The shares will continue to be traded under the ticker symbol RACE on the New York Stock Exchange, and will begin trading this week as well under the same symbol on the Mercato Telematico Azionario, part of the Borsa Italiana in Milan. Since the extended Agnelli family headed by chairman John Elkann (above, right) holds the largest stake in FCA, expect it to continue controlling the largest portion of Ferrari shares as well. Between them, nearly half of the shares in the supercar manufacturer – and we suspect a little more than half of the voting rights – will be controlled by the Agnelli and Ferrari families, who are expected to cooperate to ensure the remaining shareholders don't attempt a takeover of the company. Similar to its former parent company, which operates out of Turin and Detroit, the Ferrari NV holding company is nominally incorporated in the Netherlands, but the automaker will continue to base its operations in Maranello, Italy. That's where it's always been headquartered, on the outskirts of Modena. For the time being, Sergio Marchionne (above, left) remains both chairman of Ferrari and chief executive of FCA – a position to which he is not unaccustomed, having previously headed both Fiat and Chrysler before the two officially merged. Related Video: Separation of Ferrari from FCA Completed LONDON, January 3, 2016 /PRNewswire/ -- Fiat Chrysler Automobiles N.V. ("FCA") (NYSE: FCAU / MTA: FCA) and Ferrari N.V. ("Ferrari") (NYSE/MTA: RACE) announced today that the separation of the Ferrari business from the FCA group was completed on January 3, 2016. FCA shareholders are entitled to receive one common share of Ferrari for every 10 FCA common shares held.