2014 Chrysler 200 Lx on 2040-cars

3621 Veterans Memorial Pkwy, Saint Charles, Missouri, United States

Engine:2.4L I4 16V MPFI DOHC

Transmission:4-Speed Automatic

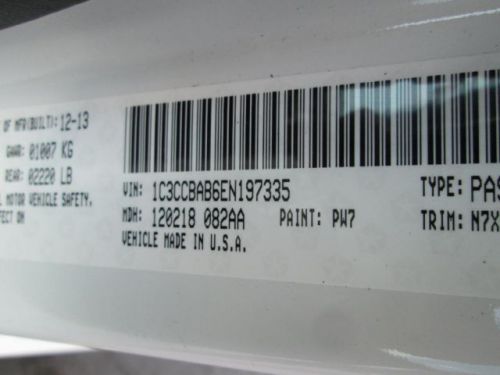

VIN (Vehicle Identification Number): 1C3CCBAB6EN197335

Stock Num: 45533

Make: Chrysler

Model: 200 LX

Year: 2014

Exterior Color: Bright White

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 2601

Chrysler 200 Series for Sale

2015 chrysler 200 s(US $31,980.00)

2015 chrysler 200 s(US $31,980.00) 2015 chrysler 200 s(US $27,440.00)

2015 chrysler 200 s(US $27,440.00) 2014 chrysler 200 limited(US $28,880.00)

2014 chrysler 200 limited(US $28,880.00) 2014 chrysler 200 limited(US $28,880.00)

2014 chrysler 200 limited(US $28,880.00) 2015 chrysler 200 limited(US $25,145.00)

2015 chrysler 200 limited(US $25,145.00) 2015 chrysler 200 s(US $27,780.00)

2015 chrysler 200 s(US $27,780.00)

Auto Services in Missouri

Wrightway Garage ★★★★★

Southwest Auto Parts ★★★★★

Smart Buy Tire ★★★★★

Sedalia Power Sports ★★★★★

Raymond Smith Body Shop ★★★★★

Payless Car Care Center ★★★★★

Auto blog

Mopar opening Custom Shop at Cobo

Thu, 09 Jan 2014While other automakers have been streamlining their brand portfolio, the Chrysler Group has shown no such signs. It's got the Dodge, Chrysler and Jeep brands, plus Fiat, and it recently broke out its SRT and Ram nameplates into their own brands. And you can bet each will have its own presence at the Detroit Auto Show this year. But don't forget Mopar. The company's performance parts division is getting its own display at Cobo this year, and it'll be the largest in the brand's history.

The Mopar Custom Shop is poised to take up 5,500 square-feet of Cobo floor space, further expanding on last year's Mopar Garage. If the image above offers any indication, the show stand will include a Dodge Challenger, SRT Viper, Fiat 500L, Jeep Wrangler, Jeep Cherokee, Ram 3500 and what looks like (but isn't identified in the press release below as) a Chrysler 200 (which may be replaced by a 2014 model), all augmented with Mopar parts and accessories.

Visitors will also be able to use pre-programmed iPads to configure Chrysler Group vehicles with a wide range of accessories - a portfolio that grows by 1,500 new parts every year and tops over 100 add-ons for every new vehicle Chrysler launches.

Fiat Chrysler, Peugeot owner PSA reportedly in merger talks

Tue, Oct 29 2019Fiat Chrysler and Peugeot owner PSA are in talks to combine in a deal that could create a $50 billion automaker, the Wall Street Journal reported on Tuesday, citing sources. The deal could be in the form of an all-stock deal, the report said. Fiat Chrysler shares rose sharply after the report and were up more than 7% in late afternoon trading. Fiat Chrysler and Peugeot had no comment. Investors have speculated for several years that Fiat Chrysler was hunting for a merger partner, encouraged by the rhetoric of the company's late chief executive, Sergio Marchionne. In 2015, Marchionne outlined the case for consolidation of the auto industry, and tried unsuccessfully to interest General Motors in a deal. Peugeot and Fiat Chrysler had discussed a combination earlier this year, before Fiat Chrysler proposed a $35 billion merger with French automaker Renault SA. Fiat Chrysler Chairman John Elkann broke off talks with Renault in June after French government officials intervened, and pushed for Renault to first resolve tensions with its Japanese alliance partner, Nissan. Following the collapse of the Renault merger plan, Fiat Chrysler CEO Mike Manley left the door open for talks with would-be partners, but said the Italian-American automaker could go it alone despite mounting costs to develop electric vehicles and comply with tougher emissions rules in Europe, the United States and China. Peugeot CEO Carlos Tavares dismissed the idea of a combination with Fiat Chrysler during a discussion with reporters at the Frankfurt auto show last month. "We don't need it," Tavares said when asked whether he was still interested in a deal with Fiat Chrysler. Fiat Chrysler has a commercial vehicle partnership with Peugeot.

Zombie cars roundup: Dodge has sold 3 new Vipers this year

Thu, Jan 6 2022Car models come and go, but as revealed by monthly sales data, once a car is discontinued, it doesn't just disappear instantly. And in the case of some models, vanishing into obscurity can be a slow, tedious process. That's the case with the 12 cars we have here. All of them have been discontinued, but car companies keep racking up "new" sales with them. There are actually more discontinued cars that are still registering new sales than what we decided to include here. We kept this list to the oldest or otherwise most interesting vehicles still being sold as new, including a supercar. We'll run the list in alphabetical order, starting with *drumroll* ... BMW 6 Series: 55 total sales BMW quietly removed the 6 Series from the U.S. market during the 2019 model year. It had been available in three configurations, a hardtop coupe, a convertible and a sleek four-door coupe-like shape. BMW i8: 18 total sales We've always had a soft spot for the BMW i8, despite the fact that it never quite fit into a particular category. It was sporty, but nowhere near as fast as similarly-priced competitors. It looked very high-tech and boasted a unique carbon fiber chassis design and a plug-in hybrid powertrain, but wasn't really designed for maximum efficiency or maximum performance. Still, the in-betweener was very cool to look at and drive, and 18 buyers took one home over the course of 2021. Chevy Impala: 750 total sales The Impala represented classic American tastes at a time when American tastes were shifting away from soft-riding sedans with big interior room and trunk space and into higher-riding crossovers. A total of 750 sales were inked last year. Chrysler 200: 15 total sales The Chrysler 200 was actually a pretty nice sedan, with good looks and decent driving dynamics let down by a lack of roominess, particularly in the back seat. Of course, as we said regarding the Chevy Impala, the number of Americans in the market for sedans is rapidly winding down, and other automakers are following Chrysler's footsteps in canceling their slow-selling four-doors. Even if Chrysler never really found its footing in the ultra-competitive midsize sedan segment, apparently dealerships have a few leftover 2017 200s floating around. And for some reason, 15 buyers decided to sign the dotted line to take one of these aging sedans home last year.