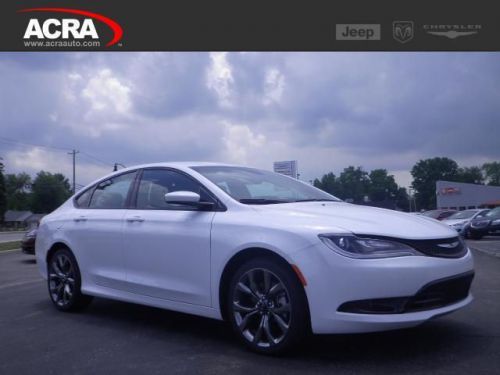

2014 Chrysler 200 Limited on 2040-cars

1200 IN-44, Shelbyville, Indiana, United States

Engine:3.6L V6 24V MPFI DOHC

Transmission:Automatic

VIN (Vehicle Identification Number): 1C3CCBCG7EN135645

Stock Num: N1442

Make: Chrysler

Model: 200 Limited

Year: 2014

Exterior Color: True Blue

Interior Color: Black

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 10

This 2014 Chrysler 200 has features that include durable and comfy leather seats, a Sunroof, and the quickest route to any destination with your Navigation System. It also has an Auxiliary Audio Input, Heated Seats to help you defrost a little faster, and a Premium Sound System to enhance your music. It also has Keyless Entry, Child Locks, and an Anti-Theft System. It also has an Auxiliary Power Outlet, an MP3 Player / Dock, and Automatic Climate Control. This vehicle also includes: Remote Engine Start - Satellite Radio - Side Curtain Air Bag - Steering Wheel Audio - Steering Wheel Cruise Control - Traction Control - Heated Mirror(s) - Tire Pressure Monitoring System - Bucket Seats - Cruise Control - Front Wheel Drive - Garage Door Opener - Power Seat - Power Windows - Rear Head Air Bag - Disc Brakes - Air Conditioning - Power Locks - Power Mirrors - CD Single-Disc Player - Auto Dimming R/V Mirror - Compass - Leather Wrapped Steering Wheel - Center Console - Flexible Fuel Capability - Fog Lights - Rear Window Defrost - Remote Trunk Release - Tilt Wheel - Vanity Mirrors - Bench Seat - Trip Computer - Center Arm Rest >>> 4 LOCATIONS - PLEASE CALL 866-463-9137 FOR VEHICLE AVAILABILITY <<<

Chrysler 200 Series for Sale

2015 chrysler 200 s(US $26,140.00)

2015 chrysler 200 s(US $26,140.00) 2011 chrysler 200 limited(US $16,995.00)

2011 chrysler 200 limited(US $16,995.00) 2013 chrysler 200 touring(US $18,495.00)

2013 chrysler 200 touring(US $18,495.00) 2015 chrysler 200 s(US $26,484.00)

2015 chrysler 200 s(US $26,484.00) 2014 chrysler 200 limited(US $23,653.00)

2014 chrysler 200 limited(US $23,653.00) 2011 chrysler 200 s(US $18,495.00)

2011 chrysler 200 s(US $18,495.00)

Auto Services in Indiana

Webbs Auto Center ★★★★★

Webb Ford ★★★★★

Tire Grading Co ★★★★★

Sun Tech Auto Glass ★★★★★

S & S Automotive ★★★★★

Prestige Auto Sales Inc ★★★★★

Auto blog

Marchionne offers belated apology for 'wop engine' comment

Wed, 22 May 2013Automotive News reports Fiat-Chrysler CEO Sergio Marchionne has issued a written apology for his comments regarding his decision to stick with an Italian engine for the upcoming Alfa Romeo 4C. As you may recall, back in January, Marchionne was quoted as saying, "I cannot come up with a schlock product, I just won't. I won't put an American engine into that car. With all due respect to my American friends, it has to be a wop engine." The CEO penned an apology to the Italian American ONE VOICE Coalition for using the racial epithet, saying that he made the comment in jest. Marchionne also said he realizes his remarks were unacceptable.

ONE VOICE, an organization aimed at fighting discrimination and stereotyping of Italian Americans, thanked Marchionne, Chrysler and Fiat for the apology. Marchionne is an Italian-born Canadian citizen, and he's gotten in trouble for other comments in the past. In 2011, he called high interest rates Chrysler was paying to the Canadian government "shyster rates." He apologized a day later.

Fiat ups Chrysler stake by 3.3%, inches closer to full control

Mon, 08 Jul 2013Fiat is one step closer to completing a merger with Chrysler after exercising an option to acquire an additional 3.3 percent of the Auburn Hills-based automaker today. Automotive News reports that Fiat now controls 68.49-percent of Chrysler, which is up almost 10 percent since we last heard news of this deal back in February when Fiat talking to various banks to raise more capital in order to complete the acquisition.

The article says that Fiat is still able to increase its stake in Chrysler up to 75 percent over the next 12 months, but it sounds like CEO Sergio Marchinonne would rather purchase the remaining shares from VEBA - the retiree benefits trust - sooner rather than later. Unfortunately, the two sides still seem far from an agreement on a fair price for the rest of Chrysler, as Fiat has them valued at $4.2 billion compared to the $10.3 billion estimate from the unions that currently own the remaining stake in Chrysler.

Stellantis won't race to split electric vehicles from fossil fuel cars

Fri, May 6 2022MILAN - Stellantis is not considering splitting its electric vehicle (EV) business from its legacy combustion engine operation, its finance chief said on Thursday, as the carmaker presented above-expectation revenue data for the first quarter. Chief Financial Officer Richard Palmer told analysts he did not see huge benefits in the kind of separations pursued by rivals such as France's Renault and U.S. Ford. "We need to manage the company and the assets we have through this transition," he said. "There are benefits to having the cash flow being generated by the internal combustion business for the investments we need to make." Palmer said the group, formed by a merger last year of Fiat Chrysler and Peugeot maker PSA, was not averse to considering adjusting its structure "but we aren't anticipating any big changes." Palmer's comments came after the world's fourth largest carmaker said its net revenue rose 12% to 41.5 billion euros ($44.1 billion) in the January-March period, as strong pricing and the type of vehicles sold helped offset the impact of the semiconductor shortage on volumes. That topped analyst expectations of 36.9 billion euros, according to a Reuters poll. Milan-listed shares were up 0.5% by 1415 GMT, in line with Italy's blue-chip index. The impact of the chip crunch was evident in the decline in shipment figures which fell 12% in the quarter to 1.374 million vehicles. It was a similar story for Germany's BMW which posted higher revenues on Thursday and a decline in car sales. Riding the Recovery Stellantis, whose brands also include Citroen, Jeep and Maserati, confirmed its 2022 forecasts for a double-digit adjusted operating income margin, after 11.8% last year, and a positive cash-flow despite supply and inflationary headwinds. Morgan Stanley analysts said after the results that Stellantis had better management than many peers and benefited from its significant exposure to a stronger U.S. economy and a European recovery from the COVID-19 pandemic. They also said it was less affected by a slowing Chinese economy. Palmer said it was important for the group to maintain double-digit margins and keep delivering positive cash flows. "A 12% increase in revenue with a 12% decrease in volumes indicates a very strong performance on price and mix, which augurs well for our margin performance," he said. He said semiconductor supply problems were expected to ease this year with continued improvements in 2023.