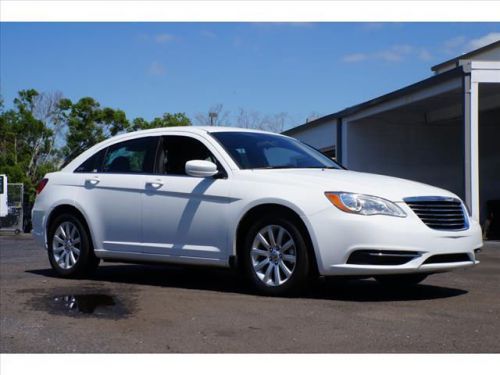

2013 Chrysler 200 Touring on 2040-cars

30777 US Hwy 19 N, Palm Harbor, Florida, United States

Engine:2.4L I4 16V MPFI DOHC

Transmission:Automatic

VIN (Vehicle Identification Number): 1C3CCBBB4DN627411

Stock Num: P28883B

Make: Chrysler

Model: 200 Touring

Year: 2013

Exterior Color: Gray

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 6865

CLEAN AUTOCHECK!!! And FLORIDA OWNED. Welcome to Dick Norris Buick GMC! Best color! This 2013 200 is for Chrysler nuts looking everywhere for that perfect car. It will take you where you need to go every time...all you have to do is steer! Please ask for Internet Sales at 855-433-0848. "We're changing the way you buy cars, one deal at a time!" Dick Norris is a family owned and operated dealership. Come in and see the difference. Experience Dick Norris' value pricing on all pre-owned vehicles. Save time and aggravation with our best price upfront.

Chrysler 200 Series for Sale

2013 chrysler 200 touring(US $14,254.00)

2013 chrysler 200 touring(US $14,254.00) 2013 chrysler 200 touring(US $16,254.00)

2013 chrysler 200 touring(US $16,254.00) 2013 chrysler 200 touring(US $14,754.00)

2013 chrysler 200 touring(US $14,754.00) 2012 chrysler 200 touring(US $18,500.00)

2012 chrysler 200 touring(US $18,500.00) 2012 chrysler 200 lx(US $14,625.00)

2012 chrysler 200 lx(US $14,625.00) 2013 chrysler 200 limited(US $21,400.00)

2013 chrysler 200 limited(US $21,400.00)

Auto Services in Florida

Yogi`s Tire Shop Inc ★★★★★

Window Graphics ★★★★★

West Palm Beach Kia ★★★★★

Wekiva Auto Body ★★★★★

Value Tire Royal Palm Beach ★★★★★

Valu Auto Care Center ★★★★★

Auto blog

Fiat Chrysler parts firm Magneti Marelli sold for $7.1B

Mon, Oct 22 2018TOKYO/MILAN — Japan's Calsonic Kansei, owned by U.S. private equity firm KKR, has agreed to buy Fiat Chrysler's Magneti Marelli for 6.2 billion euros ($7.1 billion) to form the seventh-largest independent car parts supplier. The first big deal by FCA's newly-appointed chief executive Mike Manley, who took over in July after the sudden death of long-time boss Sergio Marchionne, creates a company with revenue of 15.2 billion euros ($17.5 billion), the companies said. The newly formed Magneti Marelli CK Holdings is likely to cut costs through synergies and expand its customer base as components makers try to keep up with a shift by carmakers into autonomous driving, connected cars and electric vehicles. "This combination with Calsonic Kansei has emerged as an ideal opportunity to accelerate Magneti Marelli's future growth," Manley said on Monday of the FCA unit, which specializes in lighting, powertrain and high-tech electronics. FCA shares were up 5.2 percent at 0906 GMT as investors welcomed the hefty price tag, which will boost FCA's net cash position and raises expectations of a share buyback. "Getting this transaction completed at the price agreed is a significant early milestone and accomplishment," George Galliers, an analyst at Evercore ISI, said of Manley and his team's ability to match Marchionne's deal-making reputation. Marchionne had set in motion a process to spin off the unit and distribute its shares to FCA shareholders by early 2019, but said in June that FCA would still be "receptive" to an offer. Neither FCA nor its top shareholder, Fiat's founding Agnelli family, will have a stake in the combined business, but FCA said it would enter into a multi-year agreement to secure supplies to its plants and also to maintain operations and staff in Italy. Part of a global expansion KKR bought Calsonic from Nissan and other shareholders in 2016, saying it would help the parts maker, which relies on the Japanese carmaker for most of its sales, to expand globally. Calsonic has been in talks with FCA for months and made an initial 5.8 billion euro bid, sources have said. FCA does not break out earnings for Magneti Marelli, which sits within its components unit alongside robotics specialist Comau and castings firm Teksid. The unit employs around 43,000 people and operates in 19 countries. A takeover of Magneti Marelli had remained elusive as potential bidders were offering too little or were only interested in some parts of the business.

The Aficianauto sets his lens on Black Beauty

Fri, 24 Jan 2014In the short time we've known about the works of The Aficionauto, we've become fans of the video series highlighting some of the most famous and iconic movie/television cars ever. While past episodes featured cars from 1980s movies and tv shows, the latest video shows off the 1965 Chrysler Imperial affectionately known as Black Beauty We saw the Imperial for the first time at the 2009 Comic-Con; the car actually used in the 2011 action comedy The Green Hornet.

Of the 30 cars made for the movie, host Chris Rutkowski says that Sony only preserved two, and if you're a collector of movie cars, this one is currently being sold for $165,000. Scroll down to watch as Rutkowski takes Black Beauty for a spin through Beverly Hills, CA with its assortment of exposed weapons including the hood-mounted machine guns, numerous missiles and flame thrower.

Next Chrysler minivan spied inside and out

Wed, Feb 18 2015Chrysler isn't supposed to unveil the next-generation Town & Country until the 2016 Detroit Auto Show, but FCA is hard at work getting the minivan ready for launch. Our spies recently caught prototypes on the road and took copious photos of the interior and exterior, giving us an early idea what to expect from the future family-hauler. These shots make it pretty clear that FCA's engineers aren't done working on the next T&C yet, and all of the camouflage on the outside makes any styling changes very difficult to spot. However, the company is testing the future version with a current one, and the new design appears to have harder angles. One intriguing picture clearly shows the Dodge logo on the back of the minivan. The Dodge Grand Caravan is supposed to be killed off for 2016, though. We've also heard the next-generation minivan will get a plug-in hybrid variant, which was reportedly confirmed last week. The interior is slightly less concealed than the outside, but development is still ongoing in there, too. It's easy to spot the familiar infotainment screen from other FCA products, and there's just a peek at the T&C's instrument cluster, including the design for the tachometer. A rotary dial gearshift also appears to be in the center console, similar to the Chrysler 200. Even at this early stage, it appears that FCA is trying to take the next T&C a little more upmarket compared to the current iteration. The move fits well with earlier rumors of the price increasing for the future model. Related Video: