2012 Chrysler 200 Series Limited on 2040-cars

Salt Lake City, Utah, United States

Engine:4 Cylinder Engine

Fuel Type:Gasoline

Body Type:4dr Car

Transmission:Automatic

For Sale By:Dealer

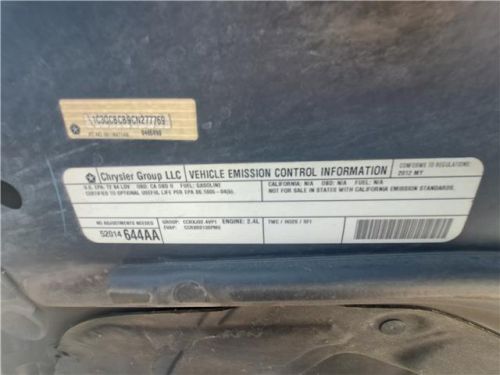

VIN (Vehicle Identification Number): 1C3CCBCB9CN277769

Mileage: 0

Make: Chrysler

Trim: Limited

Drive Type: FWD

Horsepower Value: 173

Horsepower RPM: 6000

Net Torque Value: 166

Net Torque RPM: 4400

Style ID: 335674

Features: 2.4L DOHC SMPI 16-VALVE I4 DUAL VVT ENGINE

Power Options: Pwr rack & pinion steering

Exterior Color: Black

Interior Color: --

Warranty: Unspecified

Model: 200 Series

Chrysler 200 Series for Sale

2012 chrysler 200 series 4dr sdn limited(US $10,491.00)

2012 chrysler 200 series 4dr sdn limited(US $10,491.00) 2012 chrysler 200 series s(US $7,950.00)

2012 chrysler 200 series s(US $7,950.00) 2016 chrysler 200 series limited(US $15,499.00)

2016 chrysler 200 series limited(US $15,499.00) 2014 chrysler 200 series touring convertible(US $8,990.00)

2014 chrysler 200 series touring convertible(US $8,990.00) 2014 chrysler 200 super s group(US $8,995.00)

2014 chrysler 200 super s group(US $8,995.00) 2014 chrysler 200 series lx(US $9,400.00)

2014 chrysler 200 series lx(US $9,400.00)

Auto Services in Utah

Winterton Automotive Towing ★★★★★

Vargas Auto Service ★★★★★

Tip Top Transmission ★★★★★

Speedy Auto ★★★★★

Schneider Auto Karosserie Body & Paint ★★★★★

Save On Cars ★★★★★

Auto blog

2015 Dodge Charger SRT Hellcat revealed [UPDATE]

Wed, 13 Aug 2014Almost immediately after we drove the 2015 Dodge Challenger SRT Hellcat, we began wondering: what's next? Pumping 707 horsepower into the Challenger seemed so crazy - and so intoxicating - we just assumed that Dodge would try that trick again.

Rumors swirled about a Charger Hellcat. Frankly it makes even more sense than the Challenger version. The Charger is a bigger car, and Dodge has never been shy about dropping monster engines under its hood. Hell (cat), we've seen Charger mules running around town that appeared to be the super sedan.

And finally, it's here. The 2015 Dodge Charger SRT Hellcat was revealed today at a preview event near Detroit, and it will be a centerpiece of the Chrysler display this weekend at the Woodward Dream Cruise.

The Walter P. Chrysler Museum is shutting down permanently this December

Thu, Nov 10 2016It is with disappointment that we report the Walter P. Chrysler Museum in Auburn Hills, MI, will be closed down permanently at the end of this year. The museum, which closed in 2012 after not being able to cover costs, was recently reopened to the public on alternating weekends starting in June, but Chrysler made the decision to shutter it altogether after its final day of operation on December 18, 2016. The reason for this is primarily because FCA needs more office space, and the company decided to convert the museum for that purpose. The the cars will be moved to storage after the closure, and they'll be shown at various events. However, they'll only be able to be seen together for two more weekends. Those weekends include those of November 19 and 20, and December 17 and 18. The museum will be open from 10 am to 4 pm on those days. If you can, we highly recommend visiting the museum. Adults get in for $10, seniors and retired FCA employees for $8, kids between 6 and 17 for $6, and kids under 5 for free. It also has some fantastic cars including concepts from the 1950s to the 2000s, oddball performance vehicles such as the Omni GLH-S, and of course plenty of fascinating history. And if it makes any difference to you, there's even a purple Plymouth Prowler you can sit in. Just make sure you don't wait too long to make up your mind about visiting. Related Video:

Stellantis earnings rise along with EV sales

Wed, Feb 22 2023AMSTERDAM — Automaker Stellantis on Wednesday reported its earnings grew in 2022 from a year earlier and said its push into electric vehicles led to a jump in sales even as it faces growing competition from an industrywide shift to more climate-friendly offerings. Stellantis, formed in 2021 from the merger of Fiat Chrysler and FranceÂ’s PSA Peugeot, said net revenue of 179.6 billion euros ($191 billion) was up 18% from 2021, citing strong pricing and its mix of vehicles. It reported net profit of 16.8 billion euros, up 26% from 2021. Stellantis plans to convert all of its European sales and half of its U.S. sales to battery-electric vehicles by 2030. It said the strategy led to a 41% increase in battery EV sales in 2022, to 288,000 vehicles, compared with the year earlier. The company has “demonstrated the effectiveness of our electrification strategy in Europe,” CEO Carlos Tavares said in a statement. “We now have the technology, the products, the raw materials and the full battery ecosystem to lead that same transformative journey in North America, starting with our first fully electric Ram vehicles from 2023 and Jeep from 2024.” The automaker is competing in an increasingly crowded field for a share of the electric vehicle market. Companies are scrambling to roll out environmentally friendly models as they look to hit goals of cutting climate-changing emissions, driven by government pressure. The transformation has gotten a boost from a U.S. law that is rolling out big subsidies for clean technology like EVs but has European governments calling out the harm that they say the funding poses to homegrown industry across the Atlantic. Stellantis' Jeep brand will start selling two fully electric SUVs in North America and another one in Europe over the next two years. It says its Ram brand will roll out an electric pickup truck this year, joining a rush of EV competitors looking to claim a piece of the full-size truck market. The company plans to bring 25 battery-electric models to the U.S. by 2030. As part of that push, it has said it would build two EV battery factories in North America. A $2.5 billion joint venture with Samsung will bring one of those facilities to Indiana, which is expected to employ up to 1,400 workers. The other factory will be in Windsor, Ontario, a collaboration with South KoreaÂ’s LG Energy Solution that aims to create about 2,500 jobs. The EV push comes amid a slowdown in U.S.