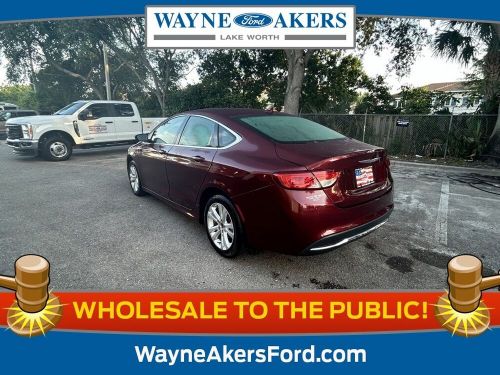

2011 Chrysler 200 Series Touring on 2040-cars

Engine:Pentastar 3.6L Flex Fuel V6 283hp 260ft. lbs.

Fuel Type:Gasoline

Body Type:Sedan

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 1C3BC1FGXBN512501

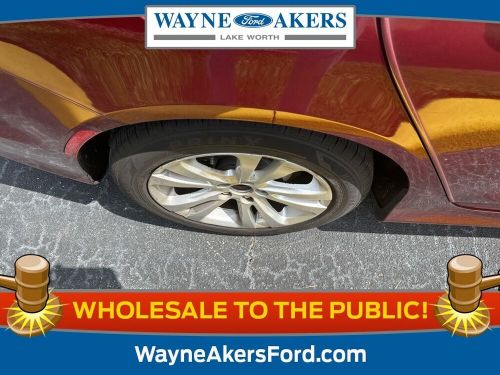

Mileage: 52739

Make: Chrysler

Trim: Touring

Drive Type: --

Features: --

Power Options: --

Exterior Color: Silver

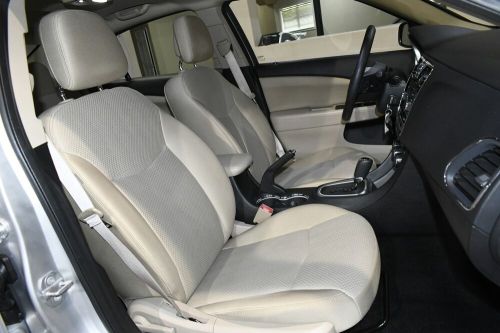

Interior Color: Light Frost Beige Cloth

Warranty: Unspecified

Model: 200 Series

Chrysler 200 Series for Sale

2017 chrysler 200 series limited(US $11,995.00)

2017 chrysler 200 series limited(US $11,995.00) 2015 chrysler 200 series 4dr sedan limited fwd(US $2,100.00)

2015 chrysler 200 series 4dr sedan limited fwd(US $2,100.00) 2017 chrysler 200 lx power seat sirius xm radio bluetooth backup cam(US $12,991.00)

2017 chrysler 200 lx power seat sirius xm radio bluetooth backup cam(US $12,991.00) 2017 chrysler 200 series limited(US $11,995.00)

2017 chrysler 200 series limited(US $11,995.00) 2015 chrysler 200 series c(US $9,950.00)

2015 chrysler 200 series c(US $9,950.00) 2014 chrysler 200 super s group(US $8,795.00)

2014 chrysler 200 super s group(US $8,795.00)

Auto blog

Consumer Reports says these are the worst new cars of 2014

Thu, 27 Feb 2014Consumer Reports has announced its annual list of worst vehicles, a cringe-inducing contrast to its list of top vehicles. Ignominiously leading the way in 2014 is Chrysler, which has a staggering seven models listed.

Jeep nearly sweeps the small SUV segment by itself, with its Compass, Patriot and 2.4-liter version of the new Cherokee, while the only midsize sedans listed by CR were the Chrysler 200 and Dodge Avenger. The new Dodge Dart and the Dodge Journey round out CR's condemnation of Chrysler.

Ford is taking heat as well, with the Taurus, Edge and their counterparts from Lincoln all listed as the worst vehicles in their respective segments. Toyota doesn't fare much better, with its Lexus IS, Scion iQ and tC also making the list.

Trump is pleased with FCA's investment in Michigan and Ohio, but it wasn't done for him

Mon, Jan 9 2017Fiat Chrysler announced yesterday that it would be spending $1 billion on vehicle production in both Michigan and Ohio. The company estimates that its investment will yield about 2,000 jobs between both states. In addition to attracting our attention, it caught the gaze of President-elect Donald Trump, who tweeted praise to both FCA and the Ford Motor Company. He praised the latter for the company's move to cancel a new factory in Mexico. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Trump's writing also seems to imply he deserves a certain amount of credit for these shifts to American production. However, as Sergio Marchionne, CEO of FCA, explained to the press in a conference today, Trump and his impending administration had nothing to do with the decision. He said the decision to invest in the plants in Michigan and Ohio were in place well before Trump was going to be the President of the United States. In addition, he said that FCA has not been in contact with Trump or any of his colleagues regarding the decision. Marchionne also stated that neither he nor the company was making any preemptive plans for manufacturing locations the light of the upcoming Trump presidency. Rather, he said that the company will change to address regulations that are actually passed, and the only way the company could change plans ahead of new laws or taxes would be with more information and clarity. We assume that a "big border tax" isn't specific enough. Still, the fact that automakers are going out of their way to make and clarify announcements about manufacturing illustrates the massive attention Trump brings with every Tweet. Related Video: Government/Legal Plants/Manufacturing Detroit Auto Show Chrysler Fiat Sergio Marchionne FCA 2017 Detroit Auto Show

Woodward Dream Cruise Photo Gallery | Classics and American muscle

Sun, Aug 21 2022The 2022 running of the Woodward Dream Cruise just went down, and we were there from morning to evening drinking in the sweet sights and pre-emissions exhaust fumes. Yes, it’s a little smelly on Woodward Ave. this time of year. Just like always, the Dream Cruise invites all comers to cruise their machines on Woodward from Ferndale, MI to Pontiac, MI. Everybody is invited, but the original intent of the Dream Cruise was to highlight classic American muscle cars. YouÂ’ll see plenty of those in our mega gallery above, but weÂ’ve sprinkled it with a bunch of other vehicle types, such as modern muscle and other intriguing American vehicles. Similar to years past, though, sometimes the classics arenÂ’t the most entertaining thing to look at on Woodward. ThatÂ’s why weÂ’ll have other mega galleries coming soon, highlighting the weird cars and (great) dogs of the Cruise, all the imports and exotics you can imagine and a special one for all the trucks of Woodward — perhaps even more so than in years past, the truck population on Dream Cruise day was quite high. Click through above to see all the classics you wouldÂ’ve seen had you been roadside on the day of the cruise. And if you missed this yearÂ’s event, make sure you check out what happens next year. You wonÂ’t be alone, as itÂ’s estimated that over 1 million people attend the Dream Cruise to either watch from the side of the road or to sit in the most glorious traffic jam in the world. Related video Featured Gallery 2022 Woodward Dream Cruise classics and American muscle View 160 Photos Design/Style Buick Cadillac Chevrolet Chrysler Dodge Ford GM GMC Hummer Jeep Pontiac RAM Classics Woodward Dream Cruise