2008 Chrysler Sebring Ltd Convertible Navigation 56k Mi Texas Direct Auto on 2040-cars

Stafford, Texas, United States

For Sale By:Dealer

Engine:3.5L 3497CC 215Cu. In. V6 GAS SOHC Naturally Aspirated

Body Type:Convertible

Transmission:Automatic

Fuel Type:GAS

Year: 2008

Make: Chrysler

Options: Convertible

Model: Sebring

Power Options: Power Windows, Power Locks

Trim: Limited Convertible 2-Door

Number Of Doors: 2

Drive Type: FWD

CALL NOW: 281-410-6115

Mileage: 56,488

Inspection: Vehicle has been inspected

Sub Model: WE FINANCE!!

Seller Rating: 5 STAR *****

Exterior Color: Black

Interior Color: Tan

Number of Cylinders: 6

Warranty: Vehicle has an existing warranty

Chrysler 200 Series for Sale

2005 chrysler town & country, touring, leather, navigation, sunroof, dvd,

2005 chrysler town & country, touring, leather, navigation, sunroof, dvd, 04 chrysler town & country lx one owner no reserve

04 chrysler town & country lx one owner no reserve 3.5l v6 limited leather heated seats dual zone ac premium sound 6 cd mp3 chrome

3.5l v6 limited leather heated seats dual zone ac premium sound 6 cd mp3 chrome 2006 chrysler 300 c

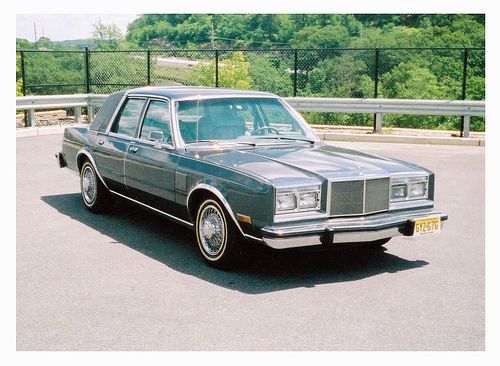

2006 chrysler 300 c 1987 chrysler 5th avenue - 45,000 orig miles

1987 chrysler 5th avenue - 45,000 orig miles 2008 chrysler sebring ltd convertible nav htd seats 60k texas direct auto(US $12,980.00)

2008 chrysler sebring ltd convertible nav htd seats 60k texas direct auto(US $12,980.00)

Auto Services in Texas

Zepco ★★★★★

Z Max Auto ★★★★★

Young`s Trailer Sales ★★★★★

Woodys Auto Repair ★★★★★

Window Magic ★★★★★

Wichita Alignment & Brake ★★★★★

Auto blog

FCA and Cummins named in diesel emissions class-action lawsuit

Mon, Nov 14 2016Chrysler is now the first United States-based carmaker to be sued for allegedly skewing emissions results. In a move that sounds eerily similar to the troubles of European manufacturers, Chrysler is claimed to have hid diesel engine characteristics causing emissions as much as 14 times higher than permitted by regulations. According to Bloomberg, the lawsuit alleges that Chrysler, together with its diesel engine partner Cummins, has concealed the nitrogen oxide output of certain Ram vehicles produced between 2007 and 2012. The NOx pollutants were meant to be broken down in a process called regeneration in the truck's NAC system, or NOx Absorption Catalyst, which predated the 2013-introduced SCR, or Selective Catalytic Reduction system. By design, the NAC captures and stores NOx emissions, converting them to nitrogen and oxygen through a catalytic process. The lawsuit claims the Cummins engine's system has a limited capacity to store the emissions, and as a result the pollutants escape, increasing emissions, worsening fuel consumption and wearing down the catalytic converter. The later, cleaner SCR system uses a urea-water injection, and it gradually replaced the NAC on Cummins 6.7-liter engines, as it was first implemented in 2011 and made standard in 2013. As Bloomberg notes, the model years of Ram trucks involved in the lawsuit predate the earliest Volkswagen "Dieselgate" models by two years. The lawsuit, filed on behalf of 500,000 truck owners, accuses Chrysler and Cummins of fraud, false advertising and racketeering. As an underlying motive, the filing mentions a 2001 change in EPA emissions standards. Announced to become effective in 2010, the EPA requirements drove Chrysler and Cummins to try and reach those already by 2007. However, the NAC system is said to have fallen short of these goals, and the filing claims that Chrysler and Cummins chose to "rig" the engines instead. The affected vehicles predate the 2014 merger of Chrysler and Fiat. FCA US has released a statement regarding the lawsuit, saying it will contest the lawsuit "vigorously". News Source: BloombergImage Credit: Getty Editorial Government/Legal Green Chrysler Dodge RAM Emissions Diesel Vehicles FCA cummins diesel

Treasury says auto bailout tally drops to $20.3 billion

Tue, 12 Feb 2013In December, the US Treasury announced that it was going to sell all of its shares in General Motors within 12 to 15 months. The first tranche of the 500-million total shares was purchased by GM, which took 200 million of them at $27.50 per share. That price represents an eight-percent premium over the market price at the time. The remaining 300 million shares will be sold "through various means in an orderly fashion."

Of the $418 billion disbursed through the Troubled Asset Relief Program (TARP), a report in Automotive News indicates that "about 93 percent" has been paid back, and the latest figures put Treasury's loss from the program overall at $55.58 billion. That's a $4.1 billion improvement on the last figure, when the expected red ink added up to $59.68 billion. The auto industry's portion of that loss is estimated to be $20.3 billion, a 16-percent drop from the earlier estimate of $24.3 billion.

The Treasury now owns 19 percent of GM, but if all goes well, there will be no more cause for anyone to utter "Government Motors" by the end of Q1 next year. A loss of some kind is still expected, however. Although GM's stock price is close to $29 at the time of this writing, that's still $4 below its IPO price and well below the $72 share price necessary for the government to come out even on its GM investment. On second thought, maybe the ribbing will continue.

Why the Detroit Three should merge their engine operations

Tue, Dec 22 2015GM and FCA should consider a smaller merger that could still save them billions of dollars, and maybe lure Ford into the deal. Fiat-Chrysler CEO Sergio Marchionne would love to see his company merge with General Motors. But GM's board of directors essentially told him to go pound sand. So now what? The boardroom battle started when Mr. Marchionne published a study called Confessions of a Capital Junkie. In it, Sergio detailed the amount of capital the auto industry wastes every year with duplicate investments. And he documented how other industries provide superior returns. He's right, of course. Other industries earn much better returns on their invested capital. And there's a danger that one day the investors will turn their backs on the auto industry and look to other business sectors where they can make more money. But even with powerful arguments Marchionne couldn't convince GM to take over FCA. And while that fight may now be over, GM and FCA should consider a smaller merger that could still save them billions of dollars, and maybe lure Ford into the deal. No doubt this suggestion will send purists into convulsions, but so be it. The Detroit Three should seriously consider merging their powertrain operations, even though that's a sacrilege in an industry that still considers the engine the "heart" of the car. These automakers have built up considerable brand equity in some of their engines. But the vast majority of American car buyers could not tell you what kind of engine they have under the hood. More importantly, most car buyers really don't care what kind of engine or transmission they have as long as it's reliable, durable, and efficient. Combining that production would give the Detroit Three the kind of scale that no one else could match. There are exceptions, of course. Hardcore enthusiasts care deeply about the powertrains in their cars. So do most diesel, plug-in, and hybrid owners. But all of them account for maybe 15 percent of the car-buying public. So that means about 85 percent of car buyers don't care where their engine and transmission came from, just as they don't know or care who supplied the steel, who made the headlamps, or who delivered the seats on a just-in-time basis. It's immaterial to them. And that presents the automakers with an opportunity to achieve a staggering level of manufacturing scale. In the NAFTA market alone, GM, Ford, and FCA will build nearly nine million engines and nine million transmissions this year.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.038 s, 7884 u