2002 Chrysler Concorde Lxi Sedan Maroon Sunroof Leather V6 Clear Title Part Car on 2040-cars

Morgantown, West Virginia, United States

|

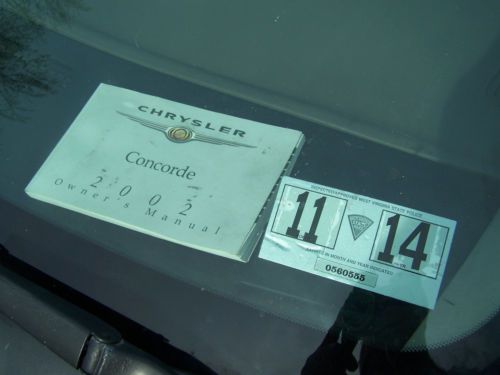

NO RESERVE SO THIS CAR GOES TO THE HIGHEST BIDDER! This is a car that starts right up, but has transmission problem. Great 6 cylinder engine that runs well. Excellent buy for someone that needs engine and other parts. Car requires that it be trailered or towed as it is considered undriveable. We had a transmission shop diagnose this car and the codes are as shown in the photo. Mileage is around 126261. The Concorde is famous for its large trunk capacity. Features a large sunroof. Four door with leather seats(drivers side shows typical wear), CD and cassette Dolby sound system. Missing hood cowl and has some body damage as shown in photos. Comes with 2 keys and 2 fobs (power locks inoperable but present) and Anti-theft equipped. Power driver seat equipped but inoperable.

|

Chrysler 200 Series for Sale

1989 chrysler tc by maserati garaged one owner california car 69k miles

1989 chrysler tc by maserati garaged one owner california car 69k miles V6 auto,pb,cloth interior, heated mirrors,good tires 79,850 miles,(US $9,000.00)

V6 auto,pb,cloth interior, heated mirrors,good tires 79,850 miles,(US $9,000.00) 2007 chrysler sebring touring sedan 4-door 2.4l(US $5,950.00)

2007 chrysler sebring touring sedan 4-door 2.4l(US $5,950.00) 2013 chrysler 200 series(US $12,222.00)

2013 chrysler 200 series(US $12,222.00) Investment grade 300c convertible 392 dual quad hemi v8(US $179,900.00)

Investment grade 300c convertible 392 dual quad hemi v8(US $179,900.00) 1966 chrysler 300 tnt package, dodge, plymouth(US $17,000.00)

1966 chrysler 300 tnt package, dodge, plymouth(US $17,000.00)

Auto Services in West Virginia

Todd Auto Body Inc ★★★★★

Ramey 9999 Or Less ★★★★★

Pro Tech Autocare ★★★★★

ohio motor group ★★★★★

Mercury Endurance Cycles ★★★★★

Far From Factory ★★★★★

Auto blog

Chrysler taking big risk snubbing NHTSA

Wed, 05 Jun 2013Maker Insists Feds Overstate Risk Of Fires With Grand Cherokee, Liberty Models

It's not often that recall stories make it above the fold, in that old newspaper parlance, but when one shows up as the lead story on the network evening news programs, you know it's something big.

And so it is with Chrysler snubbing its nose at a request by the National Highway Traffic Safety Administration to recall 2.7 million Jeeps the feds insist are at risk of potentially catastrophic fuel tank fires in a rear-end collision.

Former Treasury boss unaware auto task force fired GM's Wagoner

Wed, 14 May 2014We dig a good political tell-all every once in a while (how else will we get our political fix while waiting for House of Cards' third season?). Today, we get just that from former Treasury Secretary Timothy Geithner's new book, "Stress Test," which details, among other parts of the 2009 financial catastrophe, the structured bankruptcy that allowed Chrysler and General Motors to emerge as competitive players in the auto industry.

In the book, which is nicely recapped by The Detroit News, Geithner discusses the firing of GM CEO Rick Wagoner while explaining how much trust he had in the auto industry task force that executed the move without his knowledge.

Auto Czar Steve Rattner "didn't even consult me before he fired General Motors CEO Rick Wagoner; if anything, that move increased my confidence in Team Auto," Geithner wrote.

Ferrari officially files SEC paperwork to register future IPO

Thu, Jul 23 2015Late last year FCA announced plans to spin off Ferrari into a separate company, and after a long wait that process has finally become official. The Prancing Horse has now filed the necessary prospectus and other documents with the Securities and Exchange Commission to hold an initial public offering on The New York Stock Exchange. The paperwork doesn't mention a specific date for the Italian sportscar maker's IPO, but it's expected sometime in October. At this point, the documents also don't include some other vital data about the IPO. Ferrari lists neither the number of shares being offered nor their price. The company also doesn't have a stock symbol yet. UBS, BofA Merrill Lynch and Santander are acting as joint book runners for the deal. As part of the IPO, FCA initially intends to sell 10 percent of Ferrari's shares on the stock market. Another 10 percent of the company still belongs to Piero Ferrari. FCA is holding onto the remaining 80 percent in the short term for financial reasons but intends to distribute them to shareholders in early 2016. After the spin-off, about 24 percent of Ferrari would be owned by Exor, 10 percent by Piero Ferrari, and 66 percent by public shareholders, according to the SEC documents. FCA boss Sergio Marchionne believes that Ferrari could be worth over $11 billion. Although, his estimate might be slightly high. According to Reuters, Wall Street is actually putting the value somewhere between $5.5 billion and $11 billion. If you're thinking about investing in the company or just want to read the nitty-gritty about the brand's financial health, the entire SEC filing can be read here. Ferrari Files for Initial Public Offering LONDON, July 23, 2015 /PRNewswire/ -- Fiat Chrysler Automobiles N.V. ("FCA") announced today that its subsidiary, New Business Netherlands N.V. (to be renamed Ferrari N.V.), has filed a registration statement on Form F-1 with the U.S. Securities and Exchange Commission ("SEC") for a proposed initial public offering of common shares currently held by FCA. The number of common shares to be offered and the price range for the proposed offering have not yet been determined, although the proposed offering is not expected to exceed 10% of the outstanding common shares. In connection with the initial public offering, Ferrari intends to apply to list its common shares on the New York Stock Exchange.