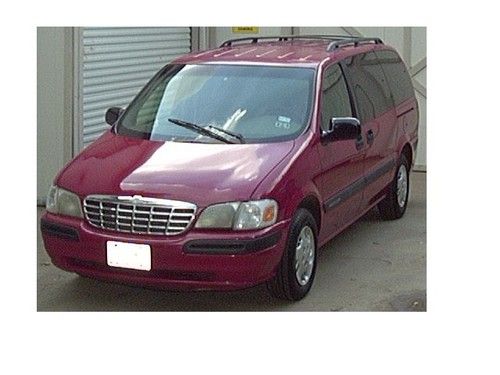

2000 Chevrolet Venture Automatic 6 Cylinder No Reserve on 2040-cars

Orange, California, United States

Body Type:Minivan, Van

Vehicle Title:Clear

Engine:3.4L 6 Cylinder

Fuel Type:Gasoline

For Sale By:Private Seller

Make: Chevrolet

Model: Venture

Trim: LS Extended

Options: Cassette Player

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Drive Type: FWD

Power Options: Power Locks, Power Windows

Mileage: 141,332

Exterior Color: White

Interior Color: Gray

Warranty: Vehicle does NOT have an existing warranty

Number of Cylinders: 6

Chevrolet Venture for Sale

1999 chevrolet venture ls mini passenger van awd 4x4 no reserve

1999 chevrolet venture ls mini passenger van awd 4x4 no reserve 2003 chevrolet venture warner bros. mini passenger van 4-door 3.4l***no reserve

2003 chevrolet venture warner bros. mini passenger van 4-door 3.4l***no reserve 2003 chevrolet venture warner bros. extended van-minivan(US $4,400.00)

2003 chevrolet venture warner bros. extended van-minivan(US $4,400.00) 2004 chevy venture white 130.000 mile wifes van buying new car run great look gr

2004 chevy venture white 130.000 mile wifes van buying new car run great look gr 2003 chevrolet venture mini passenger van extended 4-door 3.4l(US $3,800.00)

2003 chevrolet venture mini passenger van extended 4-door 3.4l(US $3,800.00)

Auto Services in California

ZD Autobody ★★★★★

Z Benz Company Inc ★★★★★

Www.Bumperking.Net ★★★★★

Working Class Auto ★★★★★

Whittier Collision Center #2 ★★★★★

West Tow & Roadside Servce ★★★★★

Auto blog

Pushing Back: GM expanding Chevrolet into Korea, Daewoo out

Thu, 29 Apr 2010Chevrolet Camaro goes to South Korea - Click above for high-res image

General Motors decided several years ago to begin heavily promoting Chevrolet as its global mainstream brand even in markets where its existing brands like Opel and Daewoo were a dominant force. Today, at the Busan Motor Show in South Korea, GM Daewoo president Mike Arcamone announced that the Camaro would lead the way in GM's efforts to market Chevrolet in South Korea.

For now at least Chevrolet and Daewoo-branded vehicles will coexist in the Korean market. However, while we were in China last week GM officials told us that the Daewoo brand, which has been somewhat tainted by past quality issues, would eventually be phased out in favor of Chevrolet. When the new Aveo launches next year it will likely be badged as a Chevrolet even though GM Daewoo is in charge of engineering the car.

GM raises 2023 guidance on strong sales, higher profits

Tue, Apr 25 2023General Motors beat first-quarter profit estimates and raised its full-year earnings and cash-flow guidance after vehicle demand at the start of the year surpassed expectations. Its shares rose in premarket trading. GM made $2.21 a share in adjusted profit in the first quarter, compared to a consensus forecast of $1.72 a share. Revenue rose 11% to $39.99 billion, it said Tuesday, which was more than the $39.24 billion analysts expected. The stronger results stem from rising sales in the US, even in the face of higher interest rates and inflation. GM executives said demand was strong enough to revise 2023 guidance upward, boosting profit estimates for the year by $500 million to between $11 billion and $13 billion. “We did it with strong production and inventory discipline and consistent pricing,” GM Chief Financial Officer Paul Jacobson said on a call with journalists. “All in all, weÂ’re feeling confident about 2023.” The Detroit automaker raised per-share full-year guidance to between $6.35 and $7.35, up from $6 to $7 a share, and said free cash flow would also increase by $500 million to a range of $5.5 billion to $7.5 billion. GMÂ’s shares pared a gain of as much as 4.4% before the start of regular trading Tuesday, rising 3.5% to $35.50 as of 6:55 a.m. in New York. The stock was up 1.9% for the year as of the close on Monday. North American Strength The automakerÂ’s sales were particularly strong in North America, where first-quarter earnings rose before interest and taxes rose to $3.6 billion. Vehicle sales rose 18% to 707,000 in the region. Jacobson said the company originally expected to sell 15 million vehicles in the US this year, slightly less than the 15.5 million annualized rate automakers foresaw in the first quarter. North American demand was enough to offset a weak performance in China, GMÂ’s second-largest market. The automaker continues to struggle in the country, where its vehicle sales fell 25% to 462,000 vehicles in the quarter. Profits from its joint ventures in the market slumped 65% to $83 million. The market has struggled overall in the wake of Covid-19 restrictions and foreign automakers have had to overcome a growing preference for Chinese brands by competing on price, squeezing profit margins. The situation in China probably wonÂ’t significantly improve until the second half of the year, according to Jacobson. GM remains on target to sell 150,000 electric vehicles this year, the CFO said.

Submit your questions for Autoblog Podcast #316 LIVE!

Mon, 14 Jan 2013We record Autoblog Podcast #316 tonight, and you can drop us your questions and comments regarding the rest of the week's news via our Q&A module below. Subscribe to the Autoblog Podcast in iTunes if you haven't already done so, and if you want to take it all in live, tune in to our UStream (audio only) channel at 10:00 PM Eastern tonight.

Discussion Topics for Autoblog Podcast Episode #316

2013 Detroit Auto Show