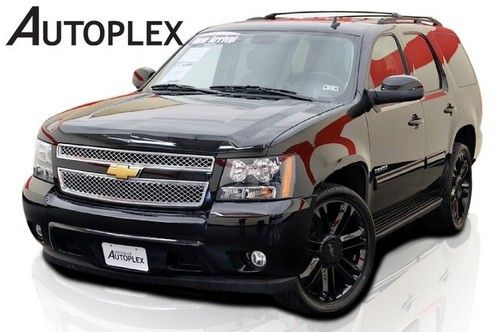

Lt 5.3l Power Door Locks Power Windows Power Driver's Seat Alloy Wheels Clock on 2040-cars

Statesville, North Carolina, United States

Body Type:Other

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Make: Chevrolet

Model: Tahoe

Warranty: Unspecified

Mileage: 125,818

Sub Model: LT

Power Options: Air Conditioning

Exterior Color: Black

Interior Color: Other

Number of Cylinders: 8

Chevrolet Tahoe for Sale

07 chevy tahoe ls very clean loaded florida suv leather 5.3l v8 lt gmc yukon slt(US $18,499.00)

07 chevy tahoe ls very clean loaded florida suv leather 5.3l v8 lt gmc yukon slt(US $18,499.00) Triple black! 24in wheels! sunroof! rear dvd! heated seats! third row!(US $42,991.00)

Triple black! 24in wheels! sunroof! rear dvd! heated seats! third row!(US $42,991.00) Ls 4 dr suv automatic gasoline 5.3l v8 sfi amber bronze metallic

Ls 4 dr suv automatic gasoline 5.3l v8 sfi amber bronze metallic 4x4 navigation dvd sunroof heated leather seats chrome wheels

4x4 navigation dvd sunroof heated leather seats chrome wheels 2005 tahoe lt 4wd autoride v8 kenwood gps leather rood 3rd row we finance

2005 tahoe lt 4wd autoride v8 kenwood gps leather rood 3rd row we finance 03 chevy tahoe z71 4x4 5.3 vortec v8 black gray leather sunroof black 20" wheels(US $9,500.00)

03 chevy tahoe z71 4x4 5.3 vortec v8 black gray leather sunroof black 20" wheels(US $9,500.00)

Auto Services in North Carolina

Winr Auto Repair ★★★★★

Universal Motors ★★★★★

Universal Automotive 4 x 4 & Drive Shaft Shop, Inc. ★★★★★

Turner Towing & Recovery ★★★★★

Triad Sun Control Inc ★★★★★

Tom`s Automotive ★★★★★

Auto blog

Leaked GM document shows GMC Sierra I6 diesel is more powerful than F-150's

Thu, Oct 4 2018GM told us earlier this year that the 2019 GMC Sierra would be getting a 3.0-liter I6 diesel option, but it never mentioned power or fuel economy figures. Hold the phone though, because a leaked GM Canada document just showed up online that lists out the details we've been waiting for. Originally published by TFL Truck, the 3.0-liter oil-burner supposedly makes 282 horsepower and 450 pound-feet of torque. For those who are counting, that's more than the Ford F-150's 250 horsepower and 440 pound-feet from its 3.0-liter diesel. It soundly bests the 240 horsepower and 420 pound-feet of torque from Ram's 3.0-liter diesel as well. Fuel economy is another story, though. The promotional material states that it will get 28 mpg on the highway, which is 2 mpg short of the F-150's 30 mpg — mind you, it's only capable of that magical 30 mpg figure in rear-wheel drive form. There's another caveat here, too; these are numbers for Canada, so they're not exactly finalized EPA figures. However, we wouldn't expect drastic differences between the two when the American numbers come out. The leaked documents also state the diesel Sierra will be capable of towing 7,800 pounds. That number seems remarkably low when compared to the F-150, which can tow up to 11,400 pounds with its diesel. Extra power and torque would have us assume that GM could get even better numbers than Ford, so we're going to hold our final judgment for official word. A 10-speed automatic will do the shifting on the diesel, just like on the 6.2-liter V8. Since the Chevy Silverado is also expected to get this engine, we can assume the figures would be almost, if not identical, to those we see here. We recently drove the 2019 Sierra and Silverado without the diesel engines, so go check those reviews out if you'd like to know more of our thoughts on the redesigned GM trucks. Related video:

Nissan Leaf sales get January jump as Chevy Volt trends downward

Mon, Feb 3 2014The cold January sales dip hit both the Nissan Leaf and the Chevy Volt last month, but when compared 2014 to 2013's first-month-of-the-year sales totals, one of the two early plug-in vehicles obviously came out on top. The top Leaf market also shifted away from Atlanta for the first time in months. Last year, the Leaf sold just 650 units in January, but it managed to move 1,252 last month, a 92.6-percent increase over 2013 but a big drop from the 2,529 sold in December 2013. Paige Presley over at Nissan told AutoblogGreen that the Leaf has now broken sales records for 11 months straight and that, "we see unique seasonality with some December pull-ahead demand based on federal and state tax incentives." The number one Leaf market also shifted away from Atlanta for the first time in months, moving back to San Francisco. That change could be short-lived. "We had some inventory constraint issues early in the month in Atlanta with end-of-year demand depleting stock," Presley said. "By the time we resolved that, the weather hampered sales." There was not as much good news on the Chevrolet front. Last month, the Volt sold 918 units, down from 1,140 in January 2013 and 2,392 in December 2013. It also marks the first time the Volt has sold in the three-digit range since January 2012, when it sold 603 copies. That string of solid months means that the plug-in hybrid has a roughly 12,000-unit lead over the EV since the two cars brought plug-in vehicles back to the mass market all the way back in December 2010. We will have our full report of January's green car sales up soon.

Nissan Leaf has 2nd-best sales month ever, Chevy Volt does a 2013 repeat [UPDATE]

Tue, Apr 1 2014UPDATE: The official press release says that "Volt [sales were] up 7 percent," but Randy Fox let AutoblogGreen know that this is simply due to a change in the fleet/retail mix between March 2013 and 2014. The actual number sold was exactly the same in the two months. A month ago, Nissan's director of EV sales and marketing, Toby Perry, said he expected to see the Leaf's sales momentum continue into March. It wasn't a big leap, since January and February were slow sales months in 2013 (around 640 each) before a big climb to 2,200 in March. In 2014, the first two months of the year were better (around 1,300 each) but Nissan can still be happy that the Leaf just had the best March ever and its second-highest sales month ever, with 2,507 sold. That's a 12.1 percent increase from 2013 and Perry said in a statement to AutoblogGreen that one reason is all of the buyers who are becoming evangelists for the vehicle. "We've also seen an increase in showroom traffic as we enhanced our marketing presence in March," he said. Nissan pointed to cities like Washington, DC, Raleigh-Durham, NC and urban areas in Texas as strong Leaf markets last month. On the Chevy Volt front, January and February were also slow months in 2014, down roughly half from the 2,000-ish the plug-in hybrid was selling at the end of 2013. For 2014, sales were up slightly from the first two months of the year and Chevy spokesman Randy Fox told AutoblogGreen that the March number was "pretty flat, year-over-year." Even with that warning, we were surprised to see the total come in at 1,478. Why's that? Because the total for March 2013 was ... 1,478. So, yeah, that's pretty steady even if there were 26 selling days in March period this year compared to 27 last year. As always, our more complete report of last month's green car sales will be coming soon. News Source: General Motors, Nissan Green Chevrolet GM Nissan Electric Hybrid PHEV ev sales