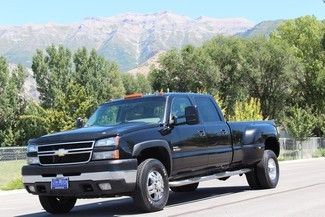

2007 Chev Silverado 3500hd Crew Cab 3lt 6.6 Duramax Turbo Diesel, 4x4, Dually on 2040-cars

Orem, Utah, United States

Body Type:Pickup Truck

Engine:ENGINE, DURAMAX 6.6L TURBO DIESEL V8

Vehicle Title:Clear

Fuel Type:Diesel

For Sale By:Dealer

Make: Chevrolet

Model: Silverado 3500

Cab Type (For Trucks Only): Crew Cab

Mileage: 266,876

Sub Model: DRW LT3

Exterior Color: Black

Number of Doors: 4

Interior Color: Gray

Drivetrain: 4 Wheel Drive

Number of Cylinders: 8

Chevrolet Silverado 3500 for Sale

2011 chevy silverado 3500 ltz 4x4 diesel dually nav dvd texas direct auto(US $47,980.00)

2011 chevy silverado 3500 ltz 4x4 diesel dually nav dvd texas direct auto(US $47,980.00) 1998 chevy 3500hd flat bed dump truck.(US $6,500.00)

1998 chevy 3500hd flat bed dump truck.(US $6,500.00) Reg cab 6.0l cd stake body work ready cloth seats abs adjustable steering wheel

Reg cab 6.0l cd stake body work ready cloth seats abs adjustable steering wheel 07 silverado 3500 dually flatbed 6.6l duramax diesel allison automatic(US $18,950.00)

07 silverado 3500 dually flatbed 6.6l duramax diesel allison automatic(US $18,950.00) 2005 chevrolet 3500hd crewcab 6.6 duramax with skirted flatbed

2005 chevrolet 3500hd crewcab 6.6 duramax with skirted flatbed 2011 chevy silverado 3500 lt 4x4 dually long bed 2k mi texas direct auto(US $36,780.00)

2011 chevy silverado 3500 lt 4x4 dually long bed 2k mi texas direct auto(US $36,780.00)

Auto Services in Utah

Washburn Motors ★★★★★

Utah Imports ★★★★★

Tuff Country Suspension ★★★★★

Tint Specialists Inc. ★★★★★

Superior Locksmith ★★★★★

Slick Willley`s II ★★★★★

Auto blog

NHTSA, IIHS, and 20 automakers to make auto braking standard by 2022

Thu, Mar 17 2016The National Highway Traffic Safety Administration, the Insurance Institute for Highway Safety and virtually every automaker in the US domestic market have announced a pact to make automatic emergency braking standard by 2022. Here's the full rundown of companies involved: BMW, Fiat Chrysler Automobiles, Ford, General Motors, Honda, Hyundai, Jaguar Land Rover, Kia, Mazda, Mercedes-Benz, Mitsubishi, Nissan, Subaru, Tesla, Toyota, Volkswagen, and Volvo (not to mention the brands that fall under each automaker's respective umbrella). Like we reported yesterday, AEB will be as ubiquitous in the future as traction and stability control are today. But the thing to note here is that this is not a governmental mandate. It's truly an agreement between automakers and the government, a fact that NHTSA claims will lead to widespread adoption three years sooner than a formal rule. That fact in itself should prevent up to 28,000 crashes and 12,000 injuries. The agreement will come into effect in two waves. For the majority of vehicles on the road – those with gross vehicle weights below 8,500 pounds – AEB will need to be standard equipment by September 1, 2022. Vehicles between 8,501 and 10,000 pounds will have an extra three years to offer AEB. "It's an exciting time for vehicle safety. By proactively making emergency braking systems standard equipment on their vehicles, these 20 automakers will help prevent thousands of crashes and save lives," said Secretary of Transportation Anthony Foxx said in an official statement. "It's a win for safety and a win for consumers." Read on for the official press release from NHTSA. Related Video: U.S. DOT and IIHS announce historic commitment of 20 automakers to make automatic emergency braking standard on new vehicles McLEAN, Va. – The U.S. Department of Transportation's National Highway Traffic Safety Administration and the Insurance Institute for Highway Safety announced today a historic commitment by 20 automakers representing more than 99 percent of the U.S. auto market to make automatic emergency braking a standard feature on virtually all new cars no later than NHTSA's 2022 reporting year, which begins Sept 1, 2022. Automakers making the commitment are Audi, BMW, FCA US LLC, Ford, General Motors, Honda, Hyundai, Jaguar Land Rover, Kia, Maserati, Mazda, Mercedes-Benz, Mitsubishi Motors, Nissan, Porsche, Subaru, Tesla Motors Inc., Toyota, Volkswagen and Volvo Car USA.

GM Design shows what could have been and what might be

Thu, May 27 2021We periodically like to check in with GM Design's Instagram account to see what they're cooking up. Even better is when we catch a glimpse of an alternate history of what legendary designers from The General's past were thinking, though those ideas may not have made it into production. This week, for example, the account posted some illustrations from George Camp, whose career at GM spanned nearly four decades, from 1963 to 2001. One of the renderings is of what appears to be a 1971-72 Pontiac GTO Judge, but with two headlights instead of the production unit's quad beams. The rear departs from the canonical version most dramatically, with a massive integrated wing. Other bits that didn't make the production cut include large side vents, a gill-like side marker and rectangular intakes below the headlights that wouldn't be out of place on a modern design today. Amazingly, from what we can make out of the date, it appears that the drawing was done sometime in 1965, which makes it quite prescient.      View this post on Instagram            A post shared by GM Design (@generalmotorsdesign) There's also a very aerodynamic interpretation of a Corvette ZR-1. To our eyes it splits the difference between the 1986 Corvette Indy concept and a fourth-generation F-body Pontiac Firebird, so perhaps parts of Camp's work on this sketch did make it into physical form. There's also a radical sports car concept from May 1970 that resembles the Mazda RX-500 concept from the same year, a Syd Mead-looking Cadillac coupe, and an Oldsmobile with a cool take on the company's trademark waterfall grille and elements of the Colonnade Cutlass at the rear. Other recent posts include a FJ Cruiser-like off-road EV, a sleek coupe with the Chevy corporate grille, and a rendering of a Silverado-esque pickup that looks far better than the current production version.      View this post on Instagram            A post shared by GM Design (@generalmotorsdesign) It's pretty easy to lose hours in the account, but it's always fascinating to see GM's visions of what could have been and what might be. Related Video:

Porsche wins the 2015 24 Hours of Le Mans

Sun, Jun 14 2015The question going into this year's 24 Hours of Le Mans was whether or not the Porsche 919 Hybrid would be able to combine its qualifying pace with race reliability. After battling neck-and-neck with Audi's R18 for most of the race, the answer is a resounding yes. Not only did Porsche drivers climb the first two spots on the podium, they did so without any major mishaps on track. This win is the first overall trophy for Porsche since 1998. Audi previously won the last five races, and 13 of the last 15. Corvette also returned to the winner's circle, with the No. 64 C7.R taking winning the GTE Pro division. The victory is the first class win for Corvette since 2011. KCMG won the LMP2 class in ninth overall. With 45 minutes to go the No. 98 Aston Martin crashed out of first place in GTE Amateur, giving the class win to SMP Racing's Ferrari and second place to the Patrick Dempsey Racing Porsche 911 RSR. For the full list of official results, click here. The GTE Pro class proved to be just as exciting as the P1 class, with a four-way battle for first after four hours into the race. For most of the race, the battle at the top went back and forth between the two German manufacturers. An tire puncture in the No. 7 Audi gave up the lead to Porsche, and moments later a crash forced the No. 8 into the garage. But a three-minute replacement of the front and rear bodywork kept the Audi in contention. As the race wore into the night, Porsche maintained a slightly faster pace than Audi. Nick Tandy took the lead on Lap 253 early Sunday morning, and car No. 19 never gave up the top position. The win is the first for all three drivers of the No. 19 – Nico Hulkenberg, Earl Bamber, and Nick Tandy. A lap behind in second was the No. 17 Porsche. The Audis fought reliability problems late in the race but still finished third with the No. 7 R18. The GTE Pro class proved to be just as exciting as the P1 class, with a four-way battle for first after four hours into the race. As the Aston Martin cars dropped away, the lone Corvette Racing entry took over, followed by a charging AF Corse team Ferrari 458 Italia. The Corvette and Ferrari continued to trade places in the final hours until gearbox trouble forced the No. 51 Ferrari out of contention. It was eventually passed by the other AF Corse car, No. 71. Nissan experienced all the pain of a first-year effort with its front-wheel-drive GT-R LM Nismo.