Very Nice Diesel Duramax Truck! 4x4 ! Air Ride System ! Serviced! No Reserve! 03 on 2040-cars

Philadelphia, Pennsylvania, United States

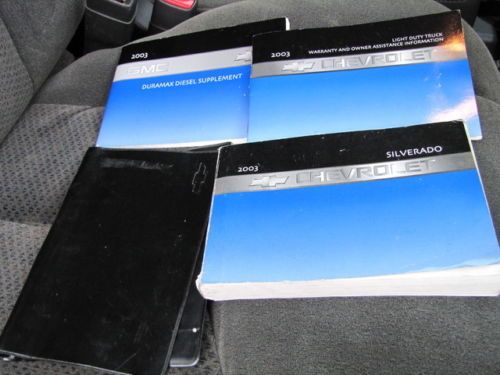

Chevrolet Silverado 2500 for Sale

6.6l diesel allison transmission ltz 4x4 leather bose climate seats grill guard

6.6l diesel allison transmission ltz 4x4 leather bose climate seats grill guard 2007 chevrolet silverado 2500 hd classic lt crew cab pickup 4wd 4-door 6.6l(US $17,500.00)

2007 chevrolet silverado 2500 hd classic lt crew cab pickup 4wd 4-door 6.6l(US $17,500.00) Turbo charged diesel 6.6l,4x4, dvd, 4dr, 2500 heavy duty, bedliner,privacy glass

Turbo charged diesel 6.6l,4x4, dvd, 4dr, 2500 heavy duty, bedliner,privacy glass 6.6l duramax diesel 4x4 banks air amp research running boards leather navigation

6.6l duramax diesel 4x4 banks air amp research running boards leather navigation White, 4 door, 4x4, lifted, great condition, low miles, 6 passenger

White, 4 door, 4x4, lifted, great condition, low miles, 6 passenger Florida truck! duramax turbo diesel allison trans bose cd leather 4x4 new tires!(US $23,900.00)

Florida truck! duramax turbo diesel allison trans bose cd leather 4x4 new tires!(US $23,900.00)

Auto Services in Pennsylvania

Zirkle`s Garage ★★★★★

Young`s Auto Transit ★★★★★

Wolbert Auto Body and Repair ★★★★★

Wilkie Lexus ★★★★★

Vo Automotive ★★★★★

Vince`s Auto Service ★★★★★

Auto blog

2014 Chevy Silverado priced from *$24,585, V8 gets better economy than Ford EcoBoost V6

Mon, 01 Apr 2013Chevrolet has thrown down the next hand in the pickup truck poker wars and revealed at least a couple of potential aces - depending on which numbers matter most to you. The 2014 2014 Silverado 1500 with its 5.3-liter EcoTec3 V8 gets 335 horsepower and 383 pound-feet of torque, is mated to a six-speed automatic, can tow 11,500 pounds with the optional Max Trailer Package and costs the same as the outgoing Silverado, $24,585 (*including $995 destination fee). Chevy says the Silverado also stands atop the fuel economy charts when comparing any competitor with a V8 engine - and some competitors with V6 engines. The two-wheel drive model returns 16 miles per gallon city, 23 mpg highway, 19 mpg combined in two-wheel drive guise and 16 mpg city, 22 mpg highway and 18 mpg combined as a four-wheel drive.

For context around those numbers, the most fuel efficient V8-powered 2013 Ford F-150 pickups lose about two mpg in every metric compared to the Silverado, the 3.5-liter V6 EcoBoost returning 16 city, 18 highway and 22 combined in two-wheel drive. However, that EcoBoost does have 365 hp and 420 lb-ft of torque. You can get a Ram 1500 with a 3.6-liter V6 that gets 25 mpg highway, but it has 305 hp and 269 lb-ft of torque. The 2013 Ram with the 5.7-liter Hemi V8 and its 395 hp and 407 lb-ft drops one mpg in every category to the Silverado. Its tow rating is 200 pounds beyond its nearest competitor, the F-150 with the Max Trailer Tow Package.

Elsewhere, the new Silverado gets a quieter cab with a redesigned interior, a new bed with improved load-management possibilities, disc brakes all around, tweaked steering and suspension, along with free standard scheduled maintenance for two years or 24,000 miles.

GM cutting Chevy Sonic, Buick Verano production by more than 20%

Sat, Jun 13 2015General Motors' Orion Assembly plant in Michigan is seeing even more production cuts this year to further reduce inventories of the Chevrolet Sonic and Buick Verano. These latest adjustments mean layoffs for about 100 workers in phases starting in July. "GM Orion Assembly will adjust plant production capacity to better align with market demand," the company said in a statement announcing the change. Through May, sales of the Sonic are down 28.5 percent to 29,082 vehicles, and the Verano is off 15.6 percent, with 15,279 sold this year. According to unnamed plant insiders speaking to Automotive News, the assembly rate is slowing at Orion Assembly from the current 33 cars an hour down to 26 an hour, a 21-percent reduction. GM is also reportedly going to keep the plant idle for three weeks during the normal summer shutdown, rather than the usual two. Earlier in the year, the factory was idled for two weeks due to excess supply of the Sonic and Verano. In March, it was closed again for several days for the same reason. The Orion Assembly plant is the future home to the line for the Chevy Bolt EV. GM Statement: GM Orion Assembly will adjust plant production capacity to better align with market demand. A phased layoff of approximately 100 employees will begin in July 2015 and conclude by year-end. Related Video: News Source: Automotive News - sub. req.Image Credit: Bill Pugliano / Getty Images Plants/Manufacturing Buick Chevrolet GM Hatchback Sedan buick verano orion assembly

New Takata problem results in recall of 414 GM vehicles

Mon, Oct 19 2015An airbag-inflator rupture discovered by Takata during testing has resulted in a new recall affecting 414 vehicles from General Motors, including 395 of them in the US. This latest campaign covers 2015 model-year examples of the Buick LaCrosse, Cadillac XTS, Chevrolet Camaro, Equinox, Malibu, and GMC Terrain. There are no reported breaks in any of these vehicles on the road, and the company estimates only one percent of them actually have the faulty parts. According to documents submitted to the National Highway Traffic Safety Administration (as a PDF), one side-airbag inflator failed a cold test at -40 Fahrenheit "releasing high pressure gas and propelling the separated components apart." The supplier told GM about the failure the next day. In these vehicles, the safety device might not only burst but the bag could inflate incorrectly, as well. GM and Takata say that a cause is not yet known, but they are "conducting an investigation." GM will begin notifying affected owners via overnight mail on Oct. 19. Dealers will replace the side airbag modules on all of the affected vehicles with new components outside of the suspect lot. All of the removed parts will also be collected for further study. Takata's faulty front airbag inflators have resulted in a serious scandal for the supplier. Initial figures indicated 34 million US vehicles are need of repair, though more recent figures have knocked that down to 23.4 million bad parts in 19.2 million automobiles. GM was already among the dozen automakers with models to fix, and some of its pickups were affected, along with the Saab 9-2X and Pontiac Vibe. GM Statement: General Motors is recalling 395 cars and crossovers in the U.S. because one of the front seat side air bags inflators may be defective. In the event of a deployment, the air bag's inflator may rupture and the air bag may not properly inflate. The rupture could cause metal fragments to strike the vehicle occupants, potentially resulting in serious injury or death. GM is unaware of any incidents involving vehicles with these components, which were part of a lot in which one inflator failed acceptance testing at the supplier. Dealers will replace the side air bag module or modules in affected vehicles. Including Canada, Mexico and exports, the total population of the recall is 414, GM estimates 1 percent of the recalled vehicles may have the defect.