2009 Chevrolet Silverado 1500 Crew Cab 4x4 Chevy Pickup Trucks 4wd Nav Leather on 2040-cars

Madison, North Carolina, United States

Chevrolet Silverado 1500 for Sale

2002 chevrolet silverado 1500 extended cab 4dr pickup n mississippi no reserve

2002 chevrolet silverado 1500 extended cab 4dr pickup n mississippi no reserve 2011 chevrolet silverado 1500 extra cab automatic 4x2 chevy work truck 2wd autos

2011 chevrolet silverado 1500 extra cab automatic 4x2 chevy work truck 2wd autos 2013 chevrolet silverado ext cab lt 4x4 7k no reserve salvage repairable project

2013 chevrolet silverado ext cab lt 4x4 7k no reserve salvage repairable project Chevrolet 1500 silverado extended cab pickup truck gas 4.8l v8 a/c 4dr vortec gm

Chevrolet 1500 silverado extended cab pickup truck gas 4.8l v8 a/c 4dr vortec gm 2001 chevy silverado ss replica(US $6,400.00)

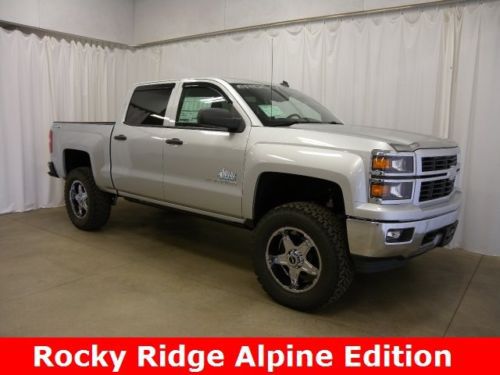

2001 chevy silverado ss replica(US $6,400.00) Rocky ridge alpine full coil over suspension lift 35 inch bfg's power steps new!(US $53,971.00)

Rocky ridge alpine full coil over suspension lift 35 inch bfg's power steps new!(US $53,971.00)

Auto Services in North Carolina

Window Genie ★★★★★

West Lee St Tire And Automotive Service Center Inc ★★★★★

Upstate Auto and Truck Repair ★★★★★

United Transmissions Inc ★★★★★

Total Collision Repair Inc ★★★★★

Supreme Lube & Svc Ctr ★★★★★

Auto blog

Safety group pans GM’s new Marketplace in-dash shopping

Wed, Dec 6 2017When it comes to our cars, is the Internet of Things a godsend? Or a hidden menace that will create more problems than it will solve? On the same day General Motors announced it will equip newer-model cars with its in-dash Marketplace e-commerce app, a prominent safety group was shooting it down. National Safety Council President Deborah Hersman tells Bloomberg the technology will only contribute to distracted driving and hurt efforts to stem the tide of rising auto fatalities, which grew 5.6 percent to more than 37,000 in the U.S. in 2016. The National Highway Traffic Safety Administration says distracted driving was responsible for 3,477 fatalities and 391,000 injuries in 2015, the most recent year for which it has data. "There's nothing about this that's safe," Hersman told Bloomberg. "If this is why they want WiFi in the car, we're going to see fatality numbers go up even higher than they are now." Marketplace, developed with IBM, will allow drivers — or more often, one hopes, their passengers — to order coffee or food, find gas stations and reserve hotel rooms from their dashboard screens. The technology is set to be uploaded automatically to nearly 1.9 million GM vehicles model-year 2017 and later that are equipped with WiFi hotspots and compatible systems. By the end of 2018, about 4 million Chevrolet, Buick, GMC and Cadillac vehicles will be equipped with Marketplace. The app will debut with a limited number of participating retailers, including TGI Fridays, Shell, Exxon Mobil and Starbucks, with more likely to join later. Online retail giant Amazon is also partnering with automakers such as Ford to bring e-commerce capabilities inside the car through its Alexa personal assistant. While convenience is nice, one other thing is becoming clear as the IoT wedges its way into our cars: It's taking aim at some decidedly first-world problems.Related Video: Image Credit: GM Buick Cadillac Chevrolet GM GMC Technology Infotainment in-car entertainment marketplace e-commerce

Chevy's 6.6-liter Duramax is pretty much all new

Thu, Sep 29 2016To say there's a heated battle in heavy-duty pickups is an understatement, with Chevrolet, Ford, and Ram constantly trading blows of increased torque, horsepower, and towing capacity. The latest salvo is the revised, more powerful turbo diesel 6.6-liter Duramax V8 in the 2017 Chevy Silverado. It has 910 pound-feet of torque, an increase of 145, putting it nearly level with the Ford Super Duty. Here's a closer look at where those gains come from. How exactly did Chevrolet add all that torque plus 48 horsepower? The automaker essentially took a fine-tooth comb to the entire engine. Chevy says it changed 90 percent of the V8, and the cumulative effect of those small changes adds up to big increases. As you might guess, the turbocharger is updated. The larger unit features electric actuation of the variable nozzle turbine (VNT), and what Chevy calls a double axle cartridge mechanism that separates the VNT moving parts from the housing. That helps with heat performance as well, with a claim that the exhaust side of the turbo can run continuously up to 1,436 degrees Fahrenheit. Helping that cause are six exhaust gaskets made of Inconel - an nickel alloy that contains chromium and iron – and upgraded stainless steel for the exhaust manifold. Despite having the same cast iron cylinder block, albeit with some minor enhancements, the engine has new cylinder heads, pistons, piston pins, connecting rods, and crankshaft, which have all been upgraded to handle 20 percent higher cylinder pressures. Alongside the increase in pressure, Chevrolet also increased the cylinder head's structure with a honeycomb design. The pattern features high-strength aluminum with dual layer water jackets that not only improve strength, but also optimize water flow for better cooling. For 2017, the cylinder head also benefits from integrated plenum that aids the engine in getting more air under heavy loads. The cylinder head isn't the only component to get a minor update, as the pistons have a larger diameter pin for improved oil flow. The same detailed improvements has been bestowed to the humble connecting rods (second in our hearts only to the inanimate carbon rod). The new design has the bolts oriented roughly 45-degrees to the rod instead of parallel. The angle split design, as it's called allows for easier passage through the cylinder.

Common Dodge Ram 1500 vs. Chevrolet Silverado breakdowns

Wed, May 4 2016These two trucks are famous for their ability to get the job done. Still, even the toughest vehicle can have mechanical problems at some time. What if we match the Dodge Ram 1500 and Chevrolet Silverado head to head? Let's find out more about common repairs for each model. Also, learn some tricks to pay for car repairs. Clunky Steering Both Dodge and the Chevy owners sometimes notice bumping and clunking when steering. This might be more noticeable when driving over bumps. The cause is usually different in each truck though. In the Dodge Ram, clunky steering is more likely due to a defective lower ball joint. Replacement costs around $300 - $400, parts and labor. Clunky Chevy Silverado steering is probably a steering rack failure. This problem appears more often in trucks with over 90,000 miles. Silverado steering rack repair will run you up to $1,000 or more. Starting Woes For the Chevy Silverado with over 130,000 miles, you might notice trouble starting. This problem may appear occasionally at first, but it typically gets worse. Excluding a weak battery, the culprit is usually the starter. Replacement will cost you around $330 - $500. Of the total cost, $90 is for labor only. Now the Dodge Ram might make a ticking sound when starting, especially on models with over 94,500 miles. The noise often disappears after the engine warms up. These symptoms may indicate a broken exhaust manifold. Repair costs range from $800 - $900. Burning Oil & Gas Gauge On The Blink Sometimes, the Dodge Ram burns oil much faster than normal. In models with over 125,000 miles, this often points towards a leaky intake manifold gasket. A knocking sound may also appear with acceleration along with possible engine misfire. The cost to repair is around $200 - $300. The Chevy Silverado has its own surprises, especially when you've filled the gas tank but the gauge still reads low. Or the needle fluctuates widely from low to full while driving. In trucks with over 120,000 miles, it's likely due to a faulty fuel sensor. You might need a full fuel pump replacement, which can cost you up to $820, parts and labor. Water Inside And Poor Heat The Ram 1500 rear window has been known to leak. You might notice the back seat and floor wet after a rainstorm. This is more common in trucks with over 65,000 miles. Resealing the Ram 1500 rear window costs around $150 - $250.