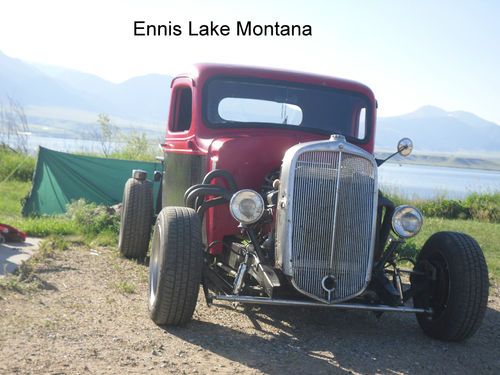

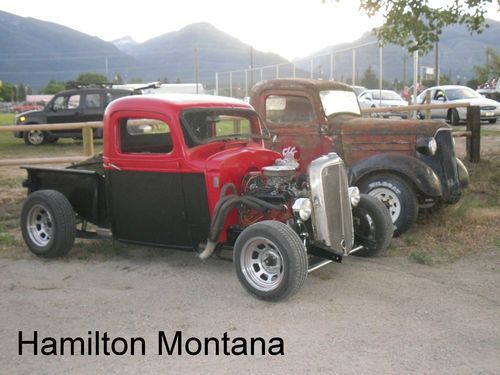

1937 Chevy Rat Rod Pickup Rat Rod Truck Hot on 2040-cars

Billings, Montana, United States

Vehicle Title:Clear

Make: Chevrolet

Drive Type: 2 wheel drive

Model: Other Pickups

Mileage: 44,000

Trim: RAT ROD

Chevrolet Other Pickups for Sale

1981 chevy van converted to truck (nicely done)(US $3,000.00)

1981 chevy van converted to truck (nicely done)(US $3,000.00) 1949 chevy 3/4 ton 5 window truck!! must see!!

1949 chevy 3/4 ton 5 window truck!! must see!! Cab & chassis box bed dixie classic leather running boards cd tool box hitch tow(US $23,000.00)

Cab & chassis box bed dixie classic leather running boards cd tool box hitch tow(US $23,000.00) Best of the best, show truck, street rod

Best of the best, show truck, street rod 1941 street rod, complete build, unbelievable, show or driver! none like it!(US $52,250.00)

1941 street rod, complete build, unbelievable, show or driver! none like it!(US $52,250.00) 1952 chevrolet pickup 3100 air ride chopped top 235 inline 6 cylinder 3 speed

1952 chevrolet pickup 3100 air ride chopped top 235 inline 6 cylinder 3 speed

Auto Services in Montana

Tire-Rama ★★★★★

Ted`s Towing, LLC ★★★★★

S & D Automotive Repair ★★★★★

Novus Glass ★★★★★

Lincoln Auto Tech ★★★★★

High Plains Motors, Inc. ★★★★★

Auto blog

CA Chevy dealer allegedly adds $50K 'market value adjustment' to 2015 Z06

Fri, Jan 9 2015It seems to happen with every eagerly anticipated new car – dealerships, recognizing that crushing demand far outstrips the initial limited supply of a new model, inflate the price via a so-called "market value adjustment." We've seen it in the past with a number of new models, and now it's happening again with one of the Detroit 3's hottest vehicles. A dealership in Roseville, CA, outside of Sacramento, has allegedly attached a staggering $49,995 market value adjustment to a 2015 Corvette Z06. We say allegedly because, despite the evidence uncovered by BoostAddict, John L. Sullivan Chevy's online inventory listing doesn't display the price premium of the Z06 in question, a (normally) $93,965 model with the top-end 3LZ trim. It's unclear if either of the dealer's other Z06s, both 3LZs, one of which is in transit, will receive similar price adjustments. Now, legally, Sullivan Chevy isn't doing anything wrong here. Dealerships are under no obligation to observe a manufacturer's suggested retail price, a point General Motors' spokesperson Ryndee Carney pointed out to Autoblog via email. "For the Corvette Z06, Chevrolet has established a Manufacturer's Suggested Retail Price we feel is right for the market. Actual transaction prices, however, are the province of the dealer," Carney said, adding that a dealer zone manager will be discussing the price hike with the dealership. While we also reached out to the dealership over both the market value adjustment and the price of the Z06 as it appears on the company's website, we've yet to hear back as of this writing. Should they reply to our inquiries, we'll be sure to update you. Until then, we'd like to hear what you think about this case. Is Sullivan Chevy simply pricing the cars as high as it thinks the market can bear, or is this a cash grab for an hotly anticipated product? Have your say in Comments.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

GM program sees dealers taking on way more loaner cars

Wed, Dec 17 2014Given the volume of vehicles we're talking about, this is a significant development for GM's bottom line. Bring your car into the dealership for service, and you may need a loaner car in exchange. And with so many recalls being carried out, that means a lot of loaners – especially at General Motors dealerships. That could be one of the reasons why GM is massively expanding its loaner fleet program. While many Chevrolet and Buick-GMC dealerships have an on-site rental car location operated by a third party like Enterprise (which may or may not provide a GM vehicle), others manage their own loaner fleets. But while the range of dealerships operating such fleets was once small, reports Automotive News, the number has been growing rapidly: from the locations responsible for only 20 percent of those brands' sales two years ago to about 90 percent today. The impetus for that growth comes down to a massive expansion of GM's Courtesy Transportation Program. The initiative encourages dealers to ramp up their loaner fleet to a maximum size determined by GM, with a mix determined by the dealer itself, so that a showroom in Texas can be bolstered with a fleet of pickup trucks and a dealer in California can employ more Volt and Camaro Convertible loaners. The dealership gets a $500 credit for each vehicle its puts in its fleet, and can use those vehicles as loaners for service customers, as multi-day test drivers or to rent out separately. The vehicles remain in the dealer's fleet for 90 days or 7,500 miles, then they can be sold as used, but with new-car incentives. The dealer gets a fleet of loaners, customers get to use the loaners, try out a new car overnight or buy a barely used car with attractive incentives, and GM gets to clock more sales. But therein lies the kicker: the automaker counts the dispatch of the loaner new vehicle to the dealership as a new-car sale, which could end up distorting its sales figures. Counting loaner vehicles as sold vehicles is something of an industry-standard practice, but given the volume of vehicles we're talking about, this is a significant development for GM's bottom line. One dealership - Paddock Chevrolet in Kenmore, NY, for example - had no loaner fleet two years ago, but now runs a fleet of 50 vehicles. Multiply that by the 4,000 or so dealers GM has across America and you're talking about the potential for hundreds of thousands of these sorts of sales.