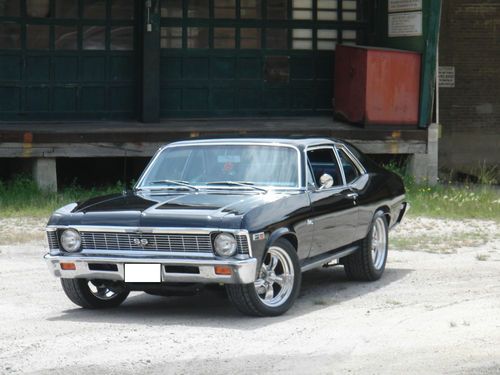

1967 Chevrolet Ss Nova Super Nice Solid Car! Protecto Plate on 2040-cars

Fort Worth, Texas, United States

Engine:V8

Body Type:Hardtop

Vehicle Title:Clear

For Sale By:Private Seller

Interior Color: Red

Model: Nova

Number of Cylinders: 8

Trim: Super Sport

Drive Type: Automatic

Mileage: 39,000

Sub Model: Super Sport

Warranty: Vehicle does NOT have an existing warranty

Exterior Color: White

No fancy ad here just a really nice,sanitary,super solid SS Nova that is ready to go! Rust free Texas car

On Jun-12-13 at 08:47:29 PDT, seller added the following information:

Correction....the rear end is a 12 bolt not a 10 bolt....

Chevrolet Nova for Sale

Auto Services in Texas

Yale Auto ★★★★★

World Car Mazda Service ★★★★★

Wilson`s Automotive ★★★★★

Whitakers Auto Body & Paint ★★★★★

Wetzel`s Automotive ★★★★★

Wetmore Master Lube Exp Inc ★★★★★

Auto blog

Recharge Wrap-up: Chevy Volt's new, improved powertrain; Inabikari wants to build Tesla Model X fighter

Thu, Nov 6 2014We knew the 2016 Chevrolet Volt's new powertrain would provide more range, but we didn't know how much. According to GM's Executive Director Larry Nitz, it is about 12 percent more, overall. "I can't think of a powertrain we've re-engineered more extensively within a five-year period than this one," he said. The battery, electric drive system and gasoline generator have all been reworked to allow for an overall driving range of up to 425 miles, with electric range speculated to reach 42 miles or more. The new Volt will also benefit from 20 percent quicker low-end acceleration, weight reductions and improvements in NVH. Read more at Hybrid Cars and at the SAE website. Hyundai's FCEV research and development boss, Dr. Sae-Hoon Kim, is optimistic about the future of hydrogen mobility in Japan. With the Tucson Fuel Cell already in production ahead of Toyota's FCV, Hyundai has a foothold in the hydrogen car scene. Kim believes that since the Fukushima disaster, Japan's attitudes toward energy make it friendly to a growing hydrogen economy. He also says that hydrogen won't be limited to Hyundai, with Kia getting all the battery EVs. "Both types are for both companies," Kim says. "For the moment, volumes are small and it is not wise to have Hyundai and Kia competing." Read more at Just Auto. The Latvian/German startup Inabikari is using crowdfunding to build an electric crossover for Europe. The Rev.01 EV hopes to compete with Tesla's upcoming Model X with a range of over 400 miles and a five-second 0-60 time. The group currently is trying to raise initial funds through an Indiegogo campaign, with hopes of more investment in the future and sales beginning in 2017. See the video below, and read more at Hybrid Cars and at the Inabikari website. Fuel economy and emissions regulations could lead to some interesting design changes to automobiles. The World Light Duty Test Procedure, set to replace the New European Driving Cycle in 2017, will push automakers to find new ways to reduce drag on their vehicles. For better aerodynamics, we could see traditional side-view mirrors replaced by cameras that display what they see on screens inside the vehicle. Another likely change will be the introduction of smaller, narrower wheels. Improving the average drag coefficient from 0.32 to 0.20 could reduce CO2 emissions by as much as 20 percent. Read more at Automotive News Europe.

12 new cars that will never go out of style

Tue, Nov 23 2021Some cars never go out of style. Itís rare, but it happens. They get old. They get depreciated. But they never stop looking cool.¬† Some might call them modern or instant classics. Within a few years they¬íre no longer the latest and greatest, no longer the flavor of the month, but they remain special. Eternally special. Timeless.¬† These cars aren¬ít necessarily going to be worth a fortune someday. However, some may not depreciate as rapidly or as far as other models. But that¬ís not what we¬íre talking about here. These are the cars that enthusiasts will always find desirable from the curbside. They¬íre the cars you end up shopping on eBay late at night 10 years later because you can¬ít get them out of your head. They¬íre the cars that will forever excite you when you spot a clean one in traffic or in a parking lot.¬† There are plenty of recent examples over the past couple of decades that could count as instant design classics. But then we got to thinking, what 2021 models will be forever cool to stare at? Which new cars and trucks on sale today will we be shopping on eBay late at night in the 2030s? We kept supercars and other ultra-expensive cars off the list to keep things within the realm of attainability, and ended up with 12 total cars. Lexus LC We¬íre not applying a numerical ranking to any of the cars on this list, but if we were, the Lexus LC would be No. 1. There isn¬ít another car design out there that can stir our emotions the way an LC can when it¬ís just standing still. This car is a concept design come true in the most beautiful of ways, and it¬ís a shoo-in winner for Concours events decades into the future. All of this heaping praise, and we haven¬ít even gotten to the LC 500¬ís intoxicating 5.0-liter V8. It doesn¬ít win drag races. It won¬ít be the fastest around the track against any similarly-priced competition. But none of that matters. It¬ís quite possibly the best car you can buy new, and that says it all when it comes to the LC. Chevrolet Corvette It might not be the stunner that the Lexus LC is, but the new C8 Corvette is and will always be a special vehicle. It¬ís the first mid-engine Corvette, which instantly cements it into an automotive hall of fame section of sorts. All of the performance stats and specs are there to back up its supercar-like looks, and it remains the best performance bargain on sale today.

Since 2010, Chevy Volt has outsold Nissan Leaf by just two units

Tue, Mar 3 2015The first two plug-in vehicles from major automakers in the US were the Chevy Volt and the Nissan Leaf. Ever since they went on sale to much fanfare in late 2010, we've been tracking the monthly sales with great interest (and, of course, other green vehicle sales as well). After a big initial lead by the Volt Ė the Volt outsold the Leaf 23,461 to 9,819 in 2012 ¬Ė the Leaf has been chugging along and outsold the Volt every month since November 2013. We knew that the cumulative totals would soon tip in favor of the Leaf, but for at least one more month, the Volt is going to be able to say its the most popular plug-in vehicle in the US. Overall, for all officially reported sales of the Leaf and the Volt, things are almost exactly tied. Since the vehicles went on sale in the end of 2010 until the end of February 2015, the Volt has sold 74,592 units and the Leaf has sold ... drumroll please ... 74,590 units. For February, Leaf sales totaled 1,198 units, a 17-percent drop from the 1,425 Leafs sold last February. Brendan Jones, Nissan's director of Electric Vehicle Sales and Infrastructure, said in a statement that, "Tough winter weather in several key markets held EV sales back in February. As we head into spring, we look forward to seeing more dealership traffic so shoppers can experience firsthand the benefits of the all-electric Nissan Leaf." Of course, it was cold in the US last February, too, but we're sure that the nasty weather did indeed play a role last month. Things were even worse for the Chevy Volt, which dropped to just 693 copies sold, down 47 percent from the 1,210 sold last year. That's just barely enough for Chevy to keep talking about its plug-in sales leadership, but we expect the message to change once the March numbers come out next month. Related Video:

1966 chevy ii ss nova

1966 chevy ii ss nova Absolutley stunning 1967 chevrolet nova ss coupe p.s,p.b,cold a/c bucket's wow

Absolutley stunning 1967 chevrolet nova ss coupe p.s,p.b,cold a/c bucket's wow 1972 chevrolet nova coupe

1972 chevrolet nova coupe 1963 chevrolet nova 327 v8 chevy ii nova sport coupe

1963 chevrolet nova 327 v8 chevy ii nova sport coupe 1969 chevy nova

1969 chevy nova 1971 nova ss tribute lt-1350, six speed

1971 nova ss tribute lt-1350, six speed