2003 Chevrolet Monte Carlo Ss One Owner 80+photos See Description Wow Must See!! on 2040-cars

Plymouth Meeting, Pennsylvania, United States

Chevrolet Monte Carlo for Sale

1971 monte carlo project car

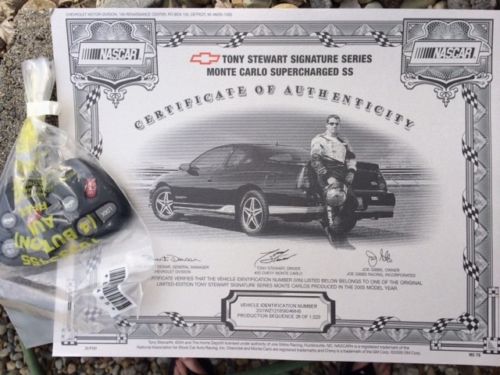

1971 monte carlo project car 2005 limited edition tony stewart signature series supercharged monte carlo ss(US $27,500.00)

2005 limited edition tony stewart signature series supercharged monte carlo ss(US $27,500.00) 2007 chevy monte carlo ss- - 5.3l v8(US $10,300.00)

2007 chevy monte carlo ss- - 5.3l v8(US $10,300.00) Monte carlo ss(US $12,500.00)

Monte carlo ss(US $12,500.00) No reserve * ltd edition * #8 dale jr * ss supercharged * loaded * xxx clean !!!

No reserve * ltd edition * #8 dale jr * ss supercharged * loaded * xxx clean !!! 1979 monte carlo(US $4,500.00)

1979 monte carlo(US $4,500.00)

Auto Services in Pennsylvania

Wood`s Locksmithing ★★★★★

Wiscount & Sons Auto Parts ★★★★★

West Deptford Auto Repair ★★★★★

Waterdam Auto Service Inc. ★★★★★

Wagner`s Auto Service ★★★★★

Used Auto Parts of Southampton ★★★★★

Auto blog

GM says its electric pickup truck is 'in development'

Thu, Jun 6 2019GM President Mark Reuss just reiterated the company's support for an electric pickup project. He also claimed that GM is going to be selling its future electric cars at "very average transaction prices" during the same conference with Wall Street analysts. Previously, Mary Barra informed the world of GM's electric pickup truck aspirations, but didn't tell us anything else. Reuss says the truck is already in development, though, according to a Wards Auto report. "We will have a complete electric lineup, including a pickup truck that's in development," Reuss said. This comment marks the second time GM has gone on the record about its intentions to bring an electric pickup to market. Additionally, Reuss said GM's third-generation global EV platform will be used to help develop the electric pickup. This platform was recently announced to underpin at least 20 new EVs from GM in the future — the platform itself is slated to be unveiled in 2021. Of course, this platform will be flexible and modular to allow various body styles to be used with it, a truck being one of those. Reuss still hasn't said what GM brand the pickup will be sold under, or what class of truck it will be. GM thinks this new platform is also going to be what helps it drive down the cost of building EVs. "We'll reach parity a lot sooner than people think," Reuss said comparing EVs to traditional gas-powered engines. "We're driving down the cost of batteries and the whole EV in general." As for electric pickups, Ford is also deep in development of its own electric F-150. However, neither of these truck projects have official timelines on them, so we can't say when they'll hit the market. For now, the cross-town rivals are both in development with their respective electric pickups. Even further across town is Rivian (in which Ford just invested half a billion dollars), a company that says its electric R1T pickup is right around the corner, with the official due date being end of 2020 for the time being. Green Chevrolet GMC Green Culture Green Driving Truck Electric Future Vehicles

GM to squeeze out more production capacity for midsize trucks

Tue, May 26 2015General Motors was predicting a strong showing for the Chevrolet Colorado and GMC Canyon before they debuted, and demand among dealers for the midsize trucks even exceeded company's expectations. The positive situation has left GM with a problem, though: finding ways to increase capacity for the pickups at the Wentzville Assembly plant in Missiouri. With a third shift already running, GM has continued to look for ways to build just a few more of the trucks at the plant. The company has plans to hire as many as 1,000 more workers for the Saturday and Sunday shifts to construct an additional 2,000 pickups a month, according to unnamed insiders at the factory speaking to Automotive News. The little adjustments even extend to getting rid of an unpaid break to add 18 minute of assembly time over the course of a day, which equals about 3,500 more vehicles a year. All of this effort comes because the trucks are in such high demand. According to GM's figures, the company has delivered a combined 35,720 units of the Colorado and Canyon from January through April 2015, and the Chevy was the fastest-selling truck in the US for the previous three months. In May, it spent an average of just 12 days in showrooms before being snapped up. And even better for the company, 43 percent of these buyers came from other brands. According to Automotive News, the most popular trade-ins have included the Ford F-150, Toyota Tacoma, and Dodge Dakota. Related Video:

GM Recalling 370,000 Trucks For Fire Risk

Mon, Jan 13 2014DETROIT (AP) - General Motors is recalling 370,000 Chevrolet Silverado and GMC Sierra pickups from the 2014 model year to fix software that could cause the exhaust components to overheat and start a fire. The recall includes 303,000 trucks in the U.S. and 67,000 in Canada and Mexico. All of the trucks involved have 4.3-liter or 5.3-liter engines. GM said eight fires have been reported, but no injuries. One garage was damaged, the company said. All of the incidents occurred in cold weather. The company is asking customers not to leave their trucks idling unattended. GM dealers will reprogram the software for free. The company will inform owners starting Jan. 16. The major recall announcement, which came on Saturday, marred the Silverado's winning of the 2014 North American Truck of the Year Award at the Detroit Auto Show on Monday. Related Gallery Our Favorite Cars For Winter View 11 Photos Recalls Chevrolet sierra