1972 Chevrolet Monte Carlo 402 on 2040-cars

Rochester, New York, United States

|

1972 Chevrolet Monte Carlo

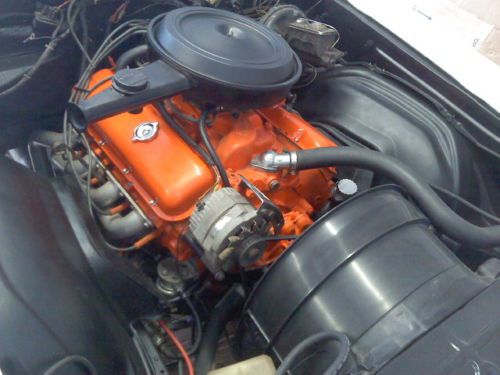

Up for auction is a very nice '72 Monte Carlo with its original drivetrain. The odometer reads 22,000 and some change. I believe it has 122,000 do to its age and the fact that it is 42 years old. The car has one newer repaint with very solid original panels throughout. The bottom of the doors and door jams are perfect. All body lines are as good as when it came out of the factory. There aren't any dings, dent, or scratches anywhere on the paint. The floor boards are solid and have never been patched as the same for the frame. All the stainless on the car is in great condition. The bumpers have been replaced with new ones do to some staining and discoloration to the originals. The vinal top was replaced do to fading and shrinking in some areas. The interior is all original except for a new carpet and rear package tray. The front bench seat has one small rip on the pipe seam on the driver's side and a small tear on the shoulder part of the passenger side. The dash has one crack in its usual area toward the center speaker. All the guages are in funtional order except for the famous clock. Yes, the factory tachometer works. Sporting its original drive train, this car has the 402 cubic inch, big block V-8, with Turbo 400 automatic transmission, and a 12 bolt non-posi rear end. A previous owner has replaced the factory exhaust manifolds with a set of ceramic coated headers with complete exhaust to the rear tailpipes. Along with that, some of the A/C components have been removed, but are somewhat available if the new owner wants them with the car. (Not sure what posseses people to remove original equipment and never put it back in its place). The engine has been refreshed with new cam & lifters, seals, berrings, and gaskets. It runs excellent, does not smoke, or leak. Same for the transmission. It has been fully rebuilt with a mild shift kit. Shifts smoothly and promptly. Car has the original Rally Wheels with BF Goodrich radial T/A white letter tires. This is a turn key car that you can drive anywhere and for any length of time with no worries. It has a nice smooth ride on the road and is very responsive in every way. Not to forget to mention a real head turner on the road. The car will be sold to the winning bidder in as is/where is condition do the fact that it is 42 years old and does not come with a warranty because it is privately owned. A paypal deposit of $500 will be due within 24 hours from the end of the auction, with the balence do within 7 days from the end of the auction. Buyer will be fully responsible to pick up the vehicle, or arrainge for the vehicle to be picked up. I do suggest that if you wish to inspect or send someone to inspect the car before you bid, you may do so. I have described the car to the best of my knowledge and you won't be disappointed. The car looks great in the photos but satisfaction is rendered when you see it in person. I ask that you please respect my 100% feedback. If you do not have the funds or have to get permission to buy this type of vehicle, then please do not bid on my auction. Thank you for understanding and happy bidding!

|

Chevrolet Monte Carlo for Sale

1971 chevrolet monte carlo 46k miles, 3 owner , triple black , restored, nm

1971 chevrolet monte carlo 46k miles, 3 owner , triple black , restored, nm 1987 chevy monte carlo ss. 2 owner car. only 68 k miles adult driven t tops(US $12,995.00)

1987 chevy monte carlo ss. 2 owner car. only 68 k miles adult driven t tops(US $12,995.00) 1973 monte carlo landau(US $4,995.00)

1973 monte carlo landau(US $4,995.00) 2001 chevrolet monte carlo ls 2 door 3.4 liter 6 cylinder with air conditioning

2001 chevrolet monte carlo ls 2 door 3.4 liter 6 cylinder with air conditioning Montecarlo ss aero coupe(US $9,500.00)

Montecarlo ss aero coupe(US $9,500.00) 1972 chevrolet monte carlo 2 door 350 automatic with floor shifter 59000 miles

1972 chevrolet monte carlo 2 door 350 automatic with floor shifter 59000 miles

Auto Services in New York

West Herr Chrysler Jeep ★★★★★

Top Edge Inc ★★★★★

The Garage ★★★★★

Star Transmission Company Incorporated ★★★★★

South Street Collision ★★★★★

Safelite AutoGlass - Syracuse ★★★★★

Auto blog

Here's the production Chevy Bolt

Tue, Dec 1 2015"It looks like a Volt had an evening of regrets with an i3." That's AutoblogGreen editor-in-chief Sebastian Blanco talking about the car you see here, the 2017 Chevy Bolt. Our trusty spy photographers caught the new Bolt EV fully uncovered at a photo shoot, ahead of its official debut at the Consumer Electronics Show in January. To say the styling looks familiar would be an understatement. There's a lot of Volt elements here, and the nod to the BMW i3 is definitely valid. It's not unattractive, it's just sort of, well, there. Never mind, the Bolt will have a lot going for it when it launches, should earlier rumors come to fruition. The hatchback is expected to have a 200-mile electric range, and should cost right around $30,000 after incentives. The Bolt will be built in Michigan, and will likely arrive at dealers in early 2017. Chevy knows this one's going to be huge, and the company is fully committed to launching and marketing the Bolt the right way. We'll have the full details in January at CES. For now, feast your eyes on His Boltness in the gallery above. Let us know what you think about it, in the Comments.

GM puts e-commerce shopping in car dashboards

Tue, Dec 5 2017DETROIT — General Motors on Tuesday said it will equip newer cars with in-dash e-commerce technology, betting it can profit as drivers order food, find fuel or reserve hotel rooms by tapping icons on the dashboard screen, instead of using smartphones while driving. GM's Marketplace technology, developed with IBM, will be uploaded automatically to about 1.9 million model-year 2017 and later vehicles starting immediately, with about 4 million vehicles across the Chevrolet, Buick, GMC and Cadillac brands equipped with the capability in the United States by the end of 2018, GM said. GM will get an undisclosed amount of revenue from merchants featured on its in-dash Marketplace, Santiago Chamorro, GM vice president for global connected customer experience, said during a briefing for reporters. Customers will not be charged for using the service or the data transmitted to and from the car while making transactions, he said. "This platform is financed by the merchants," Chamorro said. GM will get paid for placing a merchant's application on its screens, and "there's some level of revenue sharing" based on each transaction, he said. It is too soon to say how much revenue GM could realize from the Marketplace system, he said. The GM Marketplace will compete for customer clicks and revenue with hand-held smartphones, which offer a far richer array of applications than the GM system will at the outset. Amazon.com is partnering with other automakers, including Ford, to offer in-car e-commerce capability through Amazon's Alexa personal assistant system. For example, GM will launch Marketplace with just Shell and Exxon Mobil icons in the fuel category. The only restaurant available for in-car table reservations at launch is the chain TGI Fridays, GM said. In addition, there will be apps for parking, and ordering ahead at coffee shops and restaurants such as Starbucks, Dunkin' Donuts and Applebee's. "We will be adding more vendors," with some coming in the first quarter of 2018, Chamorro said. In addition, he said GM plans to expand integration into its vehicles of music, news and other information services. GM also hopes to use its in-car Marketplace connections to expand purchases of products and services, such as additional access to in-car wifi, from its own replacement parts business and dealer network. Customers can "expect to see more service promotions coming through the platform," Chamorro said. Reporting by Joe WhiteRelated Video:

How easy is it to rebuild a Chevy small block V8?

Sat, Mar 21 2015Chevrolet's famous small block V8 stands as one of the workhorse engines in American auto history, with its variants going into vehicles from hot rods to pickup trucks. But do you know that you can fully disassemble and completely restore one of these mills in just under four minutes? Well, as long as there's some assistance from time-lapse photography, that is. Hagerty created this short clip showing a dirt-covered small block turning from a frog into a prince. Thankfully, the time-lapse doesn't speed the process up too much, and it's still easy to see how all of the principal parts fit together. With all sorts of sensors and software helping to drive the modern automobile, viewing the internal combustion engine in its purely mechanical form is still fascinating. Related Video: