|

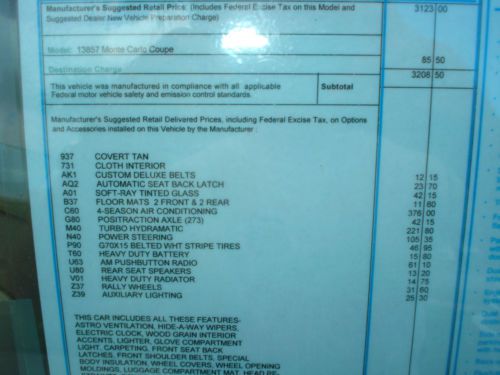

1972 MONTE CARLO 2 DOOR COUPE HARDTOP IN MINT CONDITION

|

Chevrolet Monte Carlo for Sale

2002 chevrolet ss monte carlo pace car

2002 chevrolet ss monte carlo pace car 1971 71 monte carlo 350 buckets & console 402 bb automatic daily driver(US $5,950.00)

1971 71 monte carlo 350 buckets & console 402 bb automatic daily driver(US $5,950.00) 71~1971~chevrolet~monte~carlo

71~1971~chevrolet~monte~carlo 1971 chevrolet monte carlo ss 454! one of 1919-original engine(US $21,750.00)

1971 chevrolet monte carlo ss 454! one of 1919-original engine(US $21,750.00) 1983 chevrolet monte carlo rebuilt 350 v8 5.7 turbo hydro 350 trans posi rear(US $4,200.00)

1983 chevrolet monte carlo rebuilt 350 v8 5.7 turbo hydro 350 trans posi rear(US $4,200.00) 2007 chevrolet monte carlo ss coupe 2-door 5.3l(US $9,999.00)

2007 chevrolet monte carlo ss coupe 2-door 5.3l(US $9,999.00)

Auto blog

Weekly Recap: Volvo buys Polestar, makes performance a priority

Sat, Jul 18 2015Volvo is taking its performance business in-house, and the Swedish carmaker announced Tuesday that it bought tuning company Polestar, which has long been known for producing sporty Volvos. The move allows Volvo to ramp up its performance business, and it plans to increase Polestar-branded vehicle sales to 1,000 to 1,500 annually, up from the 750 total projected for this year. The companies have been working together on motorsports projects since 1996. Financial terms of the sale were not released, and Polestar workers will move over to Volvo. Former Polestar owner Christian Dahl will keep control of the Polestar racing team and operate it under a new name. In addition to sales volume, Volvo has ambitious plans for other parts of Polestar, including its aftermarket business. Volvo also said it will use its twin-engine hybrid technology for Polestar models in the future, though specifics and timing were not revealed. Meanwhile, Volvo announced it will offer a run of 265 total Polestars in the United States for the 2016 model year, with S60 and V60s available. "Driving a Volvo Polestar is a special experience. We have decided to bring this experience to more Volvo drivers, placing the full resources of Volvo behind the development of Polestar as the model name for our high performance cars," Volvo CEO Hakan Samuelsson said in a statement. OTHER NEWS & NOTES 2016 Chevy Silverado, GMC Sierra, get nose jobs Automakers tend to refer to light updates as 'facelifts,' and that's exactly what Chevy gave the 2016 Silverado and GMC Sierra. Chevy slightly changed the front end of the truck. Using the one photo released of the new Z71 model as a guide, we can see that the headlights went from a stacked vertical design to single bulbs, and they are set on top of LED running lights. The grille has more body-colored elements instead of shiny metal, and the hood has a new line running down the middle (look really closely). The design theme will be similar across the portfolio, though materials and details will vary, a spokesman said. Some models, like the High Country and LTZ will have more chrome, and the LEDs are only for the upper trims. Chevy also said it will use the eight-speed automatic transmission on more versions of the Silverado, and it updated the MyLink feature to support Android Auto and Apple CarPlay.

GM to make most cars LTE hotspots for 2015

Mon, 25 Feb 2013General Motors isn't the first automaker to deliver in-car Internet access, but a proposed plan announced today could make the technology more widespread than any of its competitors have offered. By the 2015 model year, most Chevrolet, Buick, Cadillac and GMC products in the US and Canada will offer 4G LTE mobile broadband access. Initially, GM will just be pairing with AT&T to deliver this service, but additional carriers will be revealed in the future.

Current in-car Wi-Fi hot spots are limited to 3G, but GM says that 4G LTE is 10 times faster than 3G service and will allow for full Internet access, including streaming video for entertainment as well as services like real-time traffic updates and navigation driving directions. There is also no need for a paired smartphone with this new system, which should make it easier to use, and GM and AT&T will also be working together to develop new apps for customers.

Buyers can expect to start seeing 4G LTE in their cars starting next year, and GM is already planning to expand the service to other global markets as well. All of the information from GM's announcement is posted in a press release below.

Why the Corvette's Performance Data Recorder can be illegal in some states

Fri, 26 Sep 2014The Performance Data Recorder with Valet Mode available on the 2015 Chevrolet Corvette Stingray seems like a fantastic tool for many owners. Whether they are taking 720p video while lapping the track in their new 'Vette, or just want to protect their purchase from inconsiderate joyriders, the system offers a lot of functionality in one package. However, one of the PDR's features might get buyers in trouble with the law, and it has nothing to do with recording some illicit high-speed driving on a favorite back road. The problem hinges on the various state laws concerning a person's right to privacy.

According to a letter posted by Jalopnik, Chevy dealers are asking 2015 Corvette owners not to use the Valet Mode portion of the PDR because it records audio in the cabin, in addition to performance specs. That's a problem because privacy laws vary from state to state with some requiring just one side's consent to tape sound and others requiring all parties to agree. According Jalopnik, 15 states mandate everyone's permission beforehand, but it's not clear whether these numbers are up to date. (Actually, the report varies, saying 13 states in some places and 15 in a list.)

According to the letter, Chevy is already working on a software update for the near future to rectify the issue. It's possible that simply adding a warning to drivers and the ability to turn off the audio recording function in Valet Mode might solve the problem. Obviously, this doesn't preclude Corvette drivers from using the performance aspect of the PDR, and owners are free tape lap after lap at the track.