2011 Chevrolet Malibu Lt Hail Damage Salvage Rebuildable No Reserve Auciton on 2040-cars

Shippensburg, Pennsylvania, United States

Chevrolet Malibu for Sale

2012 chevrolet malibu 2lt 30k ~ moon roof, remote start, heated seats & more ~(US $13,500.00)

2012 chevrolet malibu 2lt 30k ~ moon roof, remote start, heated seats & more ~(US $13,500.00) 1999 chevrolet malibu ls sedan 4-door 3.1l

1999 chevrolet malibu ls sedan 4-door 3.1l 2010 chevy malibu lt cd audio cruise control only 75k texas direct auto(US $12,780.00)

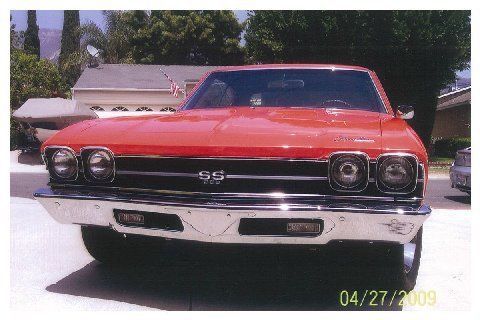

2010 chevy malibu lt cd audio cruise control only 75k texas direct auto(US $12,780.00) 1969 chevrolet chevelle malibu hardtop(US $69,500.00)

1969 chevrolet chevelle malibu hardtop(US $69,500.00) 1969 chevelle ss 396ci/375hp m-22 original-owner-docs matching # off-frame-resto

1969 chevelle ss 396ci/375hp m-22 original-owner-docs matching # off-frame-resto 4dr sdn ltz sedan automatic gasoline 3.6l v6 cyl black granite metallic(US $7,944.00)

4dr sdn ltz sedan automatic gasoline 3.6l v6 cyl black granite metallic(US $7,944.00)

Auto Services in Pennsylvania

West Penn Collision ★★★★★

Wallace Towing & Repair ★★★★★

Truck Accessories by TruckAmmo ★★★★★

Town Service Center ★★★★★

Tom`s Automotive Repair ★★★★★

Stottsville Automotive ★★★★★

Auto blog

Rolls-Royce Cullinan, Mercedes-AMG E 53 and BMW 2 Series | Autoblog Podcast #734

Fri, Jun 17 2022In this episode of the Autoblog Podcast, Editor-in-Chief Greg Migliore and Senior Editor, Consumer, Jeremy Korzeniewski kick things off with a discussion of the Rolls-Royce Cullinan and the future of the brand. The Mercedes-AMG E-Class is next up, followed by the BMW 2 Series Coupe. Next, Senior West Coast Editor James Riswick reports from the ground at the first drive of the latest Honda HR-V. Our hosts revisit the week's news, including automakers requesting a lift of the EV federal tax credit cap, Chevy giving us a peek at its electric Blazer, and Ford recalling millions of vehicles, including about half of all the Mustang Mach-E EVs it has sold. Finally, our guys dig through the mailbag to help a reader decide whether to purchase a Ford Focus ST or another hot hatch. Send us your questions for the Mailbag and Spend My Money at: Podcast@Autoblog.com. Autoblog Podcast #734 Get The Podcast Apple Podcasts – Subscribe to the Autoblog Podcast in iTunes Spotify – Subscribe to the Autoblog Podcast on Spotify RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Cars we're driving Rolls-Royce Cullinan Mercedes-AMG E 53 BMW 2 Series Coupe Dispatch from the 2023 Honda HR-V first drive event GM, Ford, Toyota, Stellantis CEOs want EV tax credit cap lifted 2024 Chevy Blazer EV partly revealed, details coming in July Ford recalls Mustang Mach-E, includes stop-sale order Ford recalls 3 million other vehicles Spend my money Feedback Email – Podcast@Autoblog.com Review the show on Apple Podcasts Autoblog is now live on your smart speakers and voice assistants with the audio Autoblog Daily Digest. Say “Hey Google, play the news from Autoblog” or "Alexa, open Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related video:

Watch this time-lapse build of the Chevy SS for NASCAR

Fri, 08 Feb 2013There's only about a week left until we get our first look at the production version of the 2014 Chevrolet SS sedan, but Chevrolet NASCAR teams have been looking at the race version of the car all winter. Autoweek has posted a really neat time-lapse video showing just a portion of what it takes to build one of NASCAR's new Gen6 stock cars.

Though the video is quite brief, it does show almost the entire build process starting with just the car's nose, and it gives us a good look at how integral the template is to the final product. As a bonus, Hendrick Motorsports also provided some videos showing two of its teams performing pit stop tests over the winter. The second video shows some of the more detailed aspects of the racecar's rear end, including the stock-looking trunk cutout and a newly mandated rear bumper extension that will be used on super speedways like Daytona and Talladega.

To see what Team Chevy has been up to all off-season, check out all three videos posted after the jump.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.