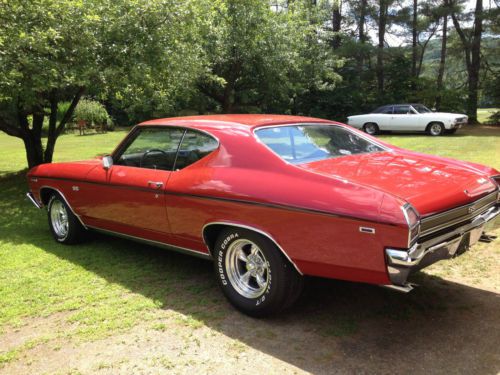

1967 Chevelle Malibu on 2040-cars

Los Banos, California, United States

|

up for sale, almost finished but putting up now, price will go up as i continue to dump more money and time in. 67 chevelle, 327 bored 60 over, forged crank, keith black pistons 11.25 to one compression ,high volume oil pump, iske solid lift cam 574 grind(big cam),202 fuelie heads ported/polished roller rockers, edelbrock roller chain, and manifold, MSD 6A ignition , holley 750 double pump, alum polished radiator, chrome vacuum reservoir for brake booster, needed with huge cam. long tube headers. large lot for transport, will help load for delivery low reserve!!! |

Chevrolet Malibu for Sale

Chevrolet malibu 4dr sdn sedan automatic gasoline 3.1l sfi v6 3100 galaxy silver

Chevrolet malibu 4dr sdn sedan automatic gasoline 3.1l sfi v6 3100 galaxy silver 2007 chevrolet malibu lt sedan 4-door 3.5l v6 black great condition(US $7,500.00)

2007 chevrolet malibu lt sedan 4-door 3.5l v6 black great condition(US $7,500.00) 1969 chevrolet chevelle malibu hardtop 2-door 5.7l(US $35,000.00)

1969 chevrolet chevelle malibu hardtop 2-door 5.7l(US $35,000.00) 1979 chevy malibu...street strip roller,imca,drag race, hot rod,sbc

1979 chevy malibu...street strip roller,imca,drag race, hot rod,sbc 2009 black chevrolet malibu ls 2.4l - great condition - no accidents(US $5,000.00)

2009 black chevrolet malibu ls 2.4l - great condition - no accidents(US $5,000.00) 2006 white chevrolet malibu ls sedan 4-door v-6

2006 white chevrolet malibu ls sedan 4-door v-6

Auto Services in California

Xtreme Auto Sound ★★★★★

Woodard`s Automotive ★★★★★

Window Tinting A Plus ★★★★★

Wickoff Racing ★★★★★

West Coast Auto Sales ★★★★★

Wescott`s Auto Wrecking & Truck Parts ★★★★★

Auto blog

Pony cars, trucks and Italian SUVs | Autoblog Podcast #552

Fri, Aug 31 2018On this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Editor Alex Kierstein and Associate Editor Reese Counts. We discuss the updated 2019 Chevy Camaro Turbo 1LE variant, the new 2019 GMC Sierra Denali, and the Ferrari-powered Maserati Levante GTS. We also debate whether Volkswagen should build the Atlas-based Tanoak pickup truck and what a delay means for the next-gen Ford Mustang. Finally, we answer a reader question about the state of Lexus.Autoblog Podcast #552 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown 2019 Chevy Camaro Turbo 1LE 2019 GMC Sierra 2019 Maserati Levante GTS Should Volkswagen build the Tanoak? Next-gen Ford Mustang delayed The past, present and future of Lexus Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video: Podcasts Chevrolet Ford GM GMC Lexus Maserati RAM Truck Coupe SUV Luxury Performance

Bring back the Bronco! Trademarks we hope are actually (someday) future car names

Tue, Mar 17 2015Trademark filings are the tea leaves of the auto industry. Read them carefully – and interpret them correctly – and you might be previewing an automaker's future product plans. Yes, they're routinely filed to maintain the rights to an iconic name. And sometimes they're only for toys and clothing. But not always. Sometimes, the truth is right in front of us. The trademark is required because a company actually wants to use the name on a new car. With that in mind, here's a list of intriguing trademark filings we want to see go from paperwork to production reality. Trademark: Bronco Company: Ford Previous Use: The Bronco was a long-running SUV that lived from 1966-1996. It's one of America's original SUVs and was responsible for the increased popularity of the segment. Still, it's best known as O.J. Simpson's would-be getaway car. We think: The Bronco was an icon. Everyone seems to want a Wrangler-fighter – Ford used to have a good one. Enough time has passed that the O.J. police chase isn't the immediate image conjured by the Bronco anymore. Even if we're doing a wish list in no particular order, the Bronco still finds its way to the top. For now (unfortunately), it's just federal paperwork. Rumors on this one can get especially heated. The official word from a Ford spokesman is: "Companies renew trademark filings to maintain ownership and control of the mark, even if it is not currently used. Ford values the iconic Bronco name and history." Trademarks: Aviator, AV8R Company: Ford Previous Use: The Aviator was one of the shortest-run Lincolns ever, lasting for the 2003-2005 model years. It never found the sales success of the Ford Explorer, with which it shared a platform. We Think: The Aviator name no longer fits with Lincoln's naming nomenclature. Too bad, it's better than any other name Lincoln currently uses, save for its former big brother, the Navigator. Perhaps we're barking up the wrong tree, though. Ford has made several customized, aviation themed-Mustangs in the past, including one called the Mustang AV8R in 2008, which had cues from the US Air Force's F-22 Raptor fighter jet. It sold for $500,000 at auction, and the glass roof – which is reminiscent of a fighter jet cockpit – helped Ford popularize the feature. Trademark: EcoBeast Company: Ford Previous Use: None by major carmakers.

This is how GM is hiding new Chevy Volt in public

Wed, Oct 1 2014General Motors is letting the public know that, well, it's not about to let the public know anything else about the next-generation Chevrolet Volt. But the automaker is willing to talk about its camouflaging process for upcoming versions of the extended-range plug-in. So it's a half-hearted secret, at best. GM actually has a "camouflage engineer" charged with creating ways to disguise the styling of new vehicles. In the Volt's case, the company is applying black and white swirly color patterns on top of the materials, such as plastics, vinyl and foam, that are used liberally across the body. It's all part of a teaser campaign that started last month with pictures of part the 2016 Volt. Earlier this month, GM said it was keeping track of Volt drivers' habits as it works on the next-gen model. The company noted that more than four out of five trips are being made in all-electric driving mode, and that 60 percent of Volt owners use a plain-old 100-volt outlet to recharge their cars. The car is slated to make its global debut at Detroit's North American International Auto Show next January, and the early word is that performance and all-electric range will be improved (we should hope so). The car will also be sleeker. By how much, we can't tell yet, because of those darn swirly patterns. GM's got more non-details in its press release below. Engineers charged with hiding styling while vehicle testing proceeds in public DETROIT – The styling of the next-generation Chevrolet Volt is one of the automotive world's best-kept secrets. Keeping customers and media eager to see the successor to the groundbreaking original at bay until the new Volt debuts at the North American International Auto Show in Detroit in January is tricky business. First, it is engineers, not designers, who are charged with creating camouflage that balances styling secrecy with the need to validate the Volt and its systems in public. "If it were up to me it would be a shoebox driving down the road," said Lionel Perkins, GM camouflage engineer. "The design team wants us to cover more of the vehicle and the engineering team needs to have enough of the vehicle's weight and aero exposed so that the tests in the development process are consistent with the product that will come to market." The engineers responsible for the "cool" designs covering the car might deserve style points but their efforts are intended strictly to hide the metal beneath.