1961 Impala Bubble Top 409 2 Door Hardtop on 2040-cars

Lynnwood, Washington, United States

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Number of Cylinders: 8

Model: Impala

Mileage: 133,233

Warranty: Unspecified

Sub Model: Bubbletop

Exterior Color: Red

Interior Color: Red

Chevrolet Impala for Sale

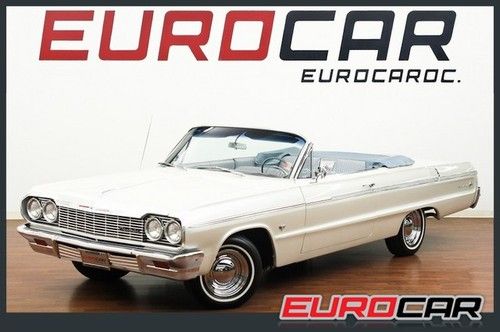

Restored original ss convertible pearl white automatic 327ci v8 show car

Restored original ss convertible pearl white automatic 327ci v8 show car 1964 impala with ss bucket seats and console interior

1964 impala with ss bucket seats and console interior 1958 chevrolet impala sport coupe no rust rio red 348 ps pb restored

1958 chevrolet impala sport coupe no rust rio red 348 ps pb restored 1967 chevrolet impala ss 2 door absolutely gorgeous ss hardtop w/matching # 327(US $23,995.00)

1967 chevrolet impala ss 2 door absolutely gorgeous ss hardtop w/matching # 327(US $23,995.00) Lt fleet 3.6l sunroof cd adjustable steering wheel engine immobilizer a/t abs(US $15,995.00)

Lt fleet 3.6l sunroof cd adjustable steering wheel engine immobilizer a/t abs(US $15,995.00) 1958 chevy impala convertible

1958 chevy impala convertible

Auto Services in Washington

Wayne`s Service Center ★★★★★

Wagley Creek Automotive ★★★★★

Tri-Cities Battery & Tire Pros ★★★★★

Trailer Town ★★★★★

Systems Unlimited ★★★★★

Steve`s Moss Bay Repair & Towing ★★★★★

Auto blog

GM Recalls 218,000 Chevy Aveo Models Over Fire-Prone Lighting

Wed, May 21 2014The recall train keeps on rolling for General Motors. Hot on the heels of its recent 2.4 million-vehicle recall of various models, it's now calling in 218,000 Chevrolet Aveo units from the 2004-2008 model years because they could catch fire. The problem concerns the daytime running light module in the instrument panel. It could overheat, melt and cause a fire. According to GM spokesperson Alan Adler, "We are aware of some fires," and the company "is still investigating." Adler wouldn't comment about how many fires were reported or when the automaker was first aware of this issue because of the ongoing analysis. However, he said the issue has not caused any injuries or fatalities. GM also doesn't have a fix for the problem with the DRL module yet. The company says in its recall statement to the National Highway Traffic Safety Administration that the remedy "is still under development." Adler wasn't sure when it would be ready, but he said Aveo owners would receive notification in the mail "relatively soon." They will receive a second letter later to schedule the repair. In a separate letter about the Aveo's problem to NHTSA (viewable here as a PDF), GM said its Executive Field Action Decision Committee decided to conduct the recall on May 16. Scroll down for the recall report. RECALL Subject : Daytime Running Light Module Overheating Report Receipt Date: MAY 19, 2014 NHTSA Campaign Number: 14V261000 Component(s): Potential Number of Units Affected: 218,000 Manufacturer: General Motors LLC SUMMARY: General Motors is recalling certain model year 2004-2008 Chevrolet Aveo vehicles equipped with daytime running lights (DRL). In the affected vehicles, there may be heat generated within the DRL module located in the center console in the instrument panel, which could melt the DRL module. CONSEQUENCE: If the DRL module melts due to the heat generation, it could cause a vehicle fire. REMEDY: The remedy for this recall campaign is still under development. The manufacturer has not yet provided a notification schedule. Owners may contact General Motors customer service at 1-800-222-1020 (Chevrolet). General Motors recall number for this campaign is 14236. NOTES: Owners may also contact the National Highway Traffic Safety Administration Vehicle Safety Hotline at 1-888-327-4236 (TTY 1-800-424-9153), or go to www.safercar.gov.

Former Fisker CEO has some advice for Tesla Motors

Wed, Oct 22 2014Former Fisker Automotive CEO and ex-Chevrolet Volt vehicle-line director Tony Posawatz has some words of caution for Tesla Motors. The long-time automaker executive questions the California automaker's long-term viability – and gives some praise – in a talk with Benzinga, which you can listen to below. While the all-wheel-drive D that Tesla unveiled earlier this month in Southern California wowed a packed crowd, Posawatz (starting at around minute 4:45 in the interview) says Tesla would've been better off taking the resources it expended toward that Model S upgrade and directed them towards speeding up the development of a more affordable plug-in. Perhaps a number of investors agreed, since the company's stock fell the day after the D was announced. Posawatz says Tesla has been over-reliant on the sale of ZEV credits. Posawatz also says that Tesla has been over-reliant on the sale of zero-emissions vehicle credits in California for its earnings and questions whether the automaker will ever work at a large enough scale to sufficiently drive down costs and make consistent profits. Tesla CEO Elon Musk would take issue with this characterization. Posawatz first made his mark in the plug-in vehicle world when he was the vehicle-line director at General Motors for the Volt extended-range plug-in from 2006 to 2012. Later that year, he joined extended-range plug-in maker Fisker Automotive as its CEO, though quit that job during the summer of 2013 as the company was descending into insolvency. He joined the Electrification Coalition this past March. News Source: Benzinga Green Chevrolet Fisker Tesla Electric PHEV Tony Posawatz

Goodbye Chevy Bolt, hello baby Ram and electric Chrysler 300 replacement? | Autoblog Podcast # 779

Fri, May 5 2023In this episode of the Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Editor Jeremy Korzeniewski. They kick things off this week with some news. The Chevy Bolt and Bolt EUV will be discontinued. The McLaren 750S gets revealed and a four-door new flagship McLaren are rumored. Did Chrysler show dealers an electric 300 replacement, did we spy a new compact Ram, and are we closer to a production version of the Genesis X Convertible? Also, Greg recently visited Michigan Central Station, which Ford is revitalizing. In this week's fleet, your hosts discuss driving the Genesis Electrified GV70, Chevy Tahoe RST Performance Edition and the Polaris RZR XP. Finally, they take to Reddit for this week's "Spend My Money" segment. Send us your questions for the Mailbag and Spend My Money at: Podcast@Autoblog.com. Autoblog Podcast # 779 Get The Podcast Apple Podcasts – Subscribe to the Autoblog Podcast in iTunes Spotify – Subscribe to the Autoblog Podcast on Spotify RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown News Chevy Bolt EV and EUV, two of the most affordable EVs, ending production McLaren 750S revealed, adding power and lightness to the old 720S McLaren reportedly confirms four-door model and next flagship supercar Chrysler reportedly showed its dealers an electric 300 replacement Ram small pickup truck spy photos show scaled-down 1500 looks Are we closer to a production version of the Genesis X Convertible? Bill Ford's dream takes shape: Historic Detroit building turns tech incubator Cars we're driving 2023 Genesis Electrified GV70 2023 Chevy Tahoe RST Performance Edition 2024 Polaris RZR XP Spend My Money: Swap a 2023 Kia Stinger GT2 AWD for a 2022 Audi SQ5 Prestige? Feedback Email – Podcast@Autoblog.com Review the show on Apple Podcasts Autoblog is now live on your smart speakers and voice assistants with the audio Autoblog Daily Digest. Say “Hey Google, play the news from Autoblog” or "Alexa, open Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related video: Podcasts Chevrolet Chrysler Ford Genesis McLaren RAM Truck Convertible Coupe Crossover SUV Electric Future Vehicles Luxury Performance Supercars Sedan