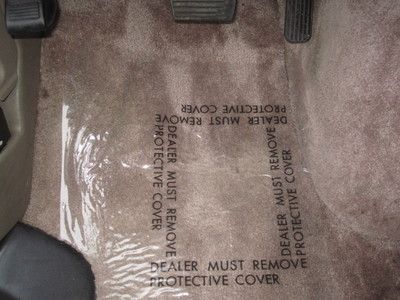

1999 Chevy Express Conversion Fully Loaded Leather Clean Runsgr8 Well Maintainte on 2040-cars

Philadelphia, Pennsylvania, United States

Body Type:Minivan, Van

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Make: Chevrolet

Model: Express

Warranty: Unspecified

Mileage: 87,827

Sub Model: 1500 135" WB

Power Options: Air Conditioning

Exterior Color: Tan

Interior Color: Tan

Number of Cylinders: 6

Chevrolet Express for Sale

1500 rwd 135 4.3l

1500 rwd 135 4.3l 2002 gmc savana 2500 9 passenger van..5.7 v8 gas motor,auto.trans ice cold air

2002 gmc savana 2500 9 passenger van..5.7 v8 gas motor,auto.trans ice cold air 2002 chevrolet express cargo g1500 1-owner 96k hard-wood floor cargo area!!(US $8,900.00)

2002 chevrolet express cargo g1500 1-owner 96k hard-wood floor cargo area!!(US $8,900.00) 2003 chevrolet express custom explorer limited wheelchair lift handicap van

2003 chevrolet express custom explorer limited wheelchair lift handicap van Cargo new 4.3l alternator 145 amps glass fixed rear doors summit white abs a/c

Cargo new 4.3l alternator 145 amps glass fixed rear doors summit white abs a/c 2009 chevrolet express cargo work service 3/4 ton $ clean nice van cold a/c(US $11,500.00)

2009 chevrolet express cargo work service 3/4 ton $ clean nice van cold a/c(US $11,500.00)

Auto Services in Pennsylvania

Young`s Auto Body Inc ★★★★★

Young`s Auto Body Inc ★★★★★

Wilcox Garage ★★★★★

Tint-Pro 3M ★★★★★

Sutliff Chevrolet ★★★★★

Steve`s Auto Repair ★★★★★

Auto blog

GM trucks get hybrid versions, but you'll probably never see one

Thu, Feb 25 2016A few years ago, General Motors sold hybrid versions of its Chevy Silverado and GMC Sierra pickups. They weren't very good, using GM's old two-mode hybrid system that resulted in only negligible fuel economy gains. But GM's trying again, launching eAssist models of the 2016 Silverado and Sierra that are said to offer 2-mpg improvements in city, highway, and combined fuel economy ratings. Problem is, you probably won't be able to get one. Only 700 eAssist trucks will be made for the 2016 model year – 500 Silverados and 200 Sierras. When you consider that GM moved 824,683 examples of its light-duty pickups in 2015, this small run represents 0.08-percent of all Silverado/Sierra production, and GM says it "will monitor the market closely ... and adjust as appropriate moving forward." But that's not the only limitation. The eAssist trucks will only be sold through California dealers. For the Silverado, eAssist can only be optioned on the 1500 Crew Cab 1LT 2WD model, and for the Sierra, the fuel-saving technology is solely available on the 1500 SLT Crew Cab 2WD model with the SLT Premium Plus package. Granted, in terms of the Sierra, that means you get niceties like LED headlights and taillights, Apple CarPlay and Android Auto, Bose premium audio, heated seats and steering wheel, lane keep assist, and more. In the trucks, eAssist combines a small electric motor and 0.45-kWh battery pack with the pickups' 5.3-liter V8. GM estimates total output of 355 horsepower and 383 pound-feet of torque – no more horsepower than the non-eAssist trucks, but three more pound-feet of torque. GM says the eAssist trucks can tow up to 9,400 pounds, and the battery only adds 100 pounds to the trucks' weight. The electric motor provides 13 hp and 44 lb-ft of torque for a boost of acceleration off the line, or during passing. It also allows the engine to run in four-cylinder mode for longer periods of time. eAssist uses regenerative braking to help power onboard electrical systems, and adds start/stop to the powertrain. Finally, the so-equipped trucks have a six-percent improvement in aerodynamics, thanks to a soft tonneau cover and active grille shutters in the front fascia. Great news is, the eAssist option is relatively inexpensive, only costing $500. But good luck getting your hands on one.

2016 Chevy Volt powertrain video teasers

Fri, Oct 31 2014If there's one thing we've learned about plug-in vehicle fans, you have a thing for seeing your cars get made. The series of videos showing BMW i3 production was strangely popular, as were the shots from inside the VW e-Golf plant. Well, with General Motors pulling the veil off of the 2016 Chevy Volt this week, it's time to take a peek at the production process for that vehicle as well. You're welcome. Up first we've got a clip from CNN Money showing a little bit about how the new Volt's new battery pack and other powertrain components are made. Those of you who are trying to read the lithium tea leaves and see if the new shape reveals that the 2016 Volt will have five seats might want to check it out. Then we've got two clips from GM itself, one showing an animation about the updated Voltec powertrain and another with some B Roll of the old Volt. Since GM doesn't want us to see the new car quite yet, we'll have to enjoy this for now. Watch below. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Chevy up to old EVs-equal-range-anxiety tricks in new Volt Olympics ad

Fri, Feb 14 2014General Motors is at it again with a new Chevrolet Volt TV commercial. Viewers of the Winter Olymics (at least in some markets) recently saw a TV ad in between the skating and the skiing that made no mention of the environmental benefits or freedom from the power of Big Oil that electric vehicles provide. No, this one was based on pure survival instinct. In the video, a father is driving down a highway, perhaps through the Mojave Desert. His young son is sitting in the Volt's backseat and asks what happens when the EV's battery runs out. "We'll have to cross that burning desert with snakes and cactus until we make it back to civilization," the dad tells his son as they pass the skeleton of a fallen bull. The fine print makes it clear that the actual maximum range is 342 miles. But there is hope. The father tells his son, with a beaming smile on his face, that the gas generator has kicked in and they're going to make it through the desert. As they wend their way to the horizon, a voice over says that Volt drivers who charge up regularly are making it 900 miles between fill ups. The fine print makes it clear that the actual official maximum range before you need to either plug in or fill up is 342 miles. This theme that emphasized range anxiety has been utilized by GM since the extended range Volt was launched in late 2010, despite the fact that Chevrolet now offers an all-electric vehicle in the Spark EV. Volt fans are praising the commercial, called The New Freedom, on the GM-Volt forum and you can see for yourself below. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. News Source: Cheverolet via CleanTechnica, YouTube Green Chevrolet GM Fuel Efficiency Green Culture Electric range anxiety extended range