1965 Chevrolet El Camino Base 4.6l on 2040-cars

Concord, California, United States

Body Type:U/K

Engine:4.6L 4638CC 283Cu. In. V8 GAS OHV Naturally Aspirated

Vehicle Title:Clear

Fuel Type:GAS

For Sale By:owner

Interior Color: Black

Make: Chevrolet

Number of Cylinders: 8

Model: El Camino

Trim: Base

Warranty: Vehicle does NOT have an existing warranty

Drive Type: U/K

Mileage: 339,835

Exterior Color: Gray

Chevrolet El Camino for Sale

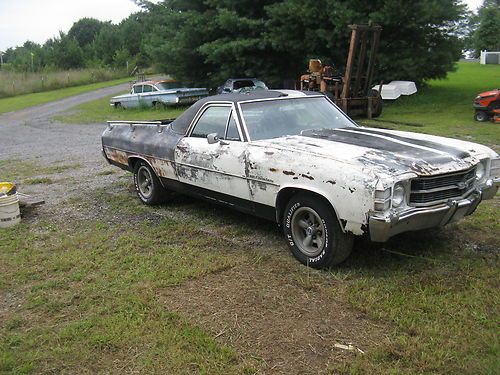

1972 camino runs good needs body and paint, 305 engine recent blk interior, fun

1972 camino runs good needs body and paint, 305 engine recent blk interior, fun 1972 chevrolet elcamino

1972 chevrolet elcamino Hurst olds theme 79 el camino 400 hp 350 auto hotrod restomod nicest ever fast(US $10,500.00)

Hurst olds theme 79 el camino 400 hp 350 auto hotrod restomod nicest ever fast(US $10,500.00) Super clean 1969 1970 1971 1972 1973 chevy elko elco el camino ss super restored(US $16,400.00)

Super clean 1969 1970 1971 1972 1973 chevy elko elco el camino ss super restored(US $16,400.00) 1971 chevrolet el camino ss 454(US $34,900.00)

1971 chevrolet el camino ss 454(US $34,900.00) 1971 ss 454

1971 ss 454

Auto Services in California

Yuki Import Service ★★★★★

Your Car Specialists ★★★★★

Xpress Auto Service ★★★★★

Xpress Auto Leasing & Sales ★★★★★

Wynns Motors ★★★★★

Wright & Knight Service Center ★★★★★

Auto blog

GM announces net 220 job increase as Trump visits Michigan

Wed, Mar 15 2017GM announced today that about 900 jobs would be added (or, importantly, retained) ahead of President Trump's arrival in Michigan, where he is expected to discuss his plan to roll back fuel economy standards. The timing of the announcement is almost certainly not coincidental, as appending it to a Trump visit gives it a higher profile and dovetails with the President's jobs agenda. It's less likely the decision itself was made for those reasons, but the free PR boost is a nice bonus. As for those 900 jobs themselves, they aren't all new jobs. The only net gain is approximately 220 jobs at the Romulus Powertrain Plant, which produces the 10-speed automatic transmission that's proliferating through the company's lineup. The 180 jobs at Flint Assembly and 500 jobs at Lansing Delta Township are retained jobs – that is to say, spots the company found for workers who would otherwise have been laid off. By the way, the Flint jobs will help with production of heavy-duty pickups, and the Lansing jobs are to produce the Chevrolet Traverse and Buick Enclave. Finding jobs for manufacturing workers in the auto sector, whether new or retained, is admirable. No matter how GM couches it, the company has created or retained a total of 7,000 jobs this year, and its total reinvestment in US production is around $1 billion. But these decisions are business ones, not political ones – timing the announcements to make them seem inspired by economic policy, or the political situation, is simply smart PR. Related Video: Image Credit: Bill Pugliano/Getty Images Celebrities Government/Legal Buick Cadillac Chevrolet GMC

2014 Chevrolet Malibu gets more torque, more room and inspiration from the Impala

Fri, 31 May 2013The 2014 Chevrolet Malibu, having stared at the Impala across the showroom floor for a year, gets nips and tucks all over inspired by its larger brother. The 2.5-liter four-cylinder in the base car will get a stop-start system and 23 city miles per gallon, 35 highway, each number representing a one-mpg improvement over the 2013 car. Output is 196 horsepower and 186 pound-feet of torque.

Opt for the 2.0-liter turbo and, while power holds steady at 259 hp, torque goes up by 14 percent to a striking 295 lb-ft (a figure Chevy calls best in the class). The final details include newly programmed transmission shift points and faster shifts, for better engaging and enjoying the added power.

Looks-wise, the grille's been reshaped to be more in line with the new Chevrolet look, a narrower upper grille hovering over a larger lower grille.

No, Cadillac is not killing its flagship CT6 sedan

Sat, Jul 22 2017Mark Twain never actually said that reports of his death had been greatly exaggerated. But if the Cadillac CT6 could talk, those are the exact words it would use. Speaking to Jalopnik, Cadillac chief Johan de Nysschen confirmed, emphatically, "There is absolutely no plan, at all, to cancel the CT6." In fact, says de Nysschen, the CT6 will soon be the beneficiary of significant investment. "The [CT6] forms a very important part of our product strategy going forward for the brand. The car also has a very major contribution to make to the shaping of brand perceptions, and the transformational process that Cadillac is undergoing." For instance, expect the CT6 to spearhead General Motors' most advanced forays into self-driving automobile technology. Interestingly, though, the Cadillac ATS and CTS sedans probably won't live past their current generations as the automaker 're-balances its sedan portfolio.' Replacement models are "in development" right now, says de Nysschen, which will "much more clearly separate the market position, both in terms of target customer demographics, in terms of market segments and in terms of price points between these three sedan lineups." So, that's confirmation that the Cadillac CT6 is going to stick around for a while. But what of other models cited by Reuters to potentially be killed, like the Buick LaCrosse and Chevy Impala and Volt? Read our take on that here, but suffice it to say that we don't think they're in danger, either. Related Video: News Source: JalopnikImage Credit: VCG via Getty Plants/Manufacturing Buick Cadillac Chevrolet Electric Hybrid Luxury Sedan confirmed cadillac ct6