2012 Chevrolet Cruze Lt on 2040-cars

1320 State Road 46 East, Batesville, Indiana, United States

Engine:1.4L I4 16V MPFI DOHC Turbo

Transmission:6-Speed Automatic

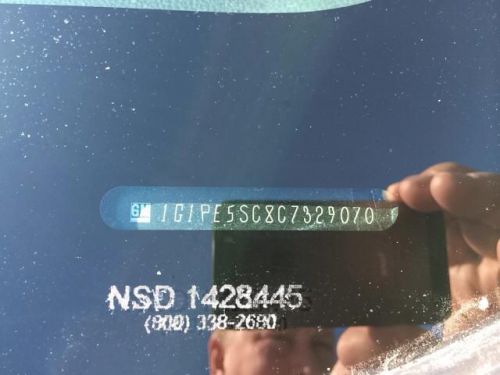

VIN (Vehicle Identification Number): 1G1PE5SC8C7329070

Stock Num: 17557

Make: Chevrolet

Model: Cruze LT

Year: 2012

Exterior Color: Maroon

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 21388

LIKE NEW WITHOUT THE PRICE OF A NEW ONE. REMAINDER OF FACTORY WARRANTY and SUPER CLEAN. Join us at Batesville Chrysler Dodge Jeep Ram! Your lucky day! Are you interested in a simply great car? Then take a look at this stunning 2012 Chevrolet Cruze. The quality of materials and execution of the design exceed anything else in this price range. Motor Trend calls Cruze the most significant global offering from GM to date. Call Mike for more info 866-422-8948. SPEND LESS. DRIVE MORE.

Chevrolet Cruze for Sale

2013 chevrolet cruze 2lt(US $16,906.00)

2013 chevrolet cruze 2lt(US $16,906.00) 2011 chevrolet cruze eco

2011 chevrolet cruze eco 2012 chevrolet cruze 2lt(US $15,495.00)

2012 chevrolet cruze 2lt(US $15,495.00) 2013 chevrolet cruze ls

2013 chevrolet cruze ls 2013 chevrolet cruze 2lt(US $16,995.00)

2013 chevrolet cruze 2lt(US $16,995.00) 2012 chevrolet cruze lt(US $15,995.00)

2012 chevrolet cruze lt(US $15,995.00)

Auto Services in Indiana

Widco Transmissions ★★★★★

Townsend Transmission ★★★★★

Tom`s Midwest Muffler & Brake ★★★★★

Superior Auto ★★★★★

Such`s Auto Care ★★★★★

Shepherdsville Discount Auto Supply ★★★★★

Auto blog

Weekly Recap: Chevy and Alfa plot comeback strategies

Sat, Jun 27 2015Chevrolet and Alfa Romeo were two of the 20th Century's most iconic automotive brands. Chevy embodied America's post-war power and confidence. Alfa was the definition of the stylish Italian sports car. They reached halcyon heights in the 1950s and '60s, before declining precipitously amid new competition, changing consumer tastes, and uneven corporate management. Both say 2015 is the start of something better, and this week Chevy and Alfa laid out ambitious plans and showcased new cars that they hope will make them more relevant this year, and in the coming years. Each brand sits at its own crossroads, and their paths forward are as different as the Chevy Cruze and the Alfa Romeo Giulia. Chevy is still a sales beast, as evidenced by its volume of 4.8 million vehicles sold around the world last year. Chevy executives are fond of saying one of their cars is sold every seven seconds, which illustrates the strength and reach of a car brand that is the fourth largest in the world. "Make no mistake about it, we are a brand for the people," said General Motors North America president Alan Batey. But he wants consumers to want to buy a Chevy for its design and technology, not simply because it's affordable. That starts with all Chevys now featuring a distinctive a family look, with sporty cues from the Corvette or strong lines that riff on the Silverado pickup. "We want people to fall in lust with our cars," said Mike Pevovar, executive design director for Chevy passenger cars. "That initial emotional attraction has to be right on the exterior, and that's where form comes into play." Chevy is also loading up its cars, like the freshly unveiled 2016 Chevy Cruze, with technology to appeal to a younger crowd that prizes connectivity. The Cruze will offer Apple CarPlay and Android Auto with its MyLink infotainment system, and OnStar with 4G LTE and wifi. Seeking out younger buyers is also sound business practice: Millennials now outnumber Baby Boomers as the largest single age group in the United States. Younger buyers also can improve a brand's image, which is another area where Chevy would like to improve. Chevy ranks 82nd on Interbrand's Best Global Brand's list, behind 11 other automakers. Apple is No. 1. "We need our own variation of the Genius Bar," Batey said. 2016 Alfa Romeo Giulia View 3 Photos Meanwhile, Alfa is in different shape.

The best Super Bowl car commercials from the last 5 years

Wed, Jan 28 2015If you've been dipping into the Autoblog feed over the past days and weeks, you wouldn't even have to be a sports fan to know the Super Bowl is coming up. Automakers have been teasing their spots for the big game, dropping them days early, fully-formed onto the Internet and otherwise trying to amp up the multi-million-dollar outlays that they've made for air time on the biggest advertising day of the year. And, we're into it. The lead up to the Super Bowl is almost akin to a mini auto show around these parts; with automakers being amongst the most prolific advertisers on these special Sundays. The crop of ads from 2015 looks as strong as ever, but we thought we'd take a quick look back at some of our favorite spots from the last five years. Take a look at our picks – created from a very informal polling of Autoblog editors and presented in no particular order – and then tell us about your recent faves, in Comments. Chrysler, Imported From Detroit Chrysler, Eminem and a lingering pan shot of "The Fist" – it doesn't get much more Motown than 2011's Imported From Detroit. With the weight of our staffers hailing from in and around The D, it's no wonder that our memories still favor this epic Super Bowl commercial (even though the car it was shilling was crap). Imported really set the tone for later Chrysler ads, too, repeated the formula: celebrity endorsement + dramatic copy + dash of jingoism = pulled car-guy heartstrings. Mercedes-Benz, Soul teaser with Kate Upton One of our favorite Super Bowl commercials (and yours, based on the insane number of views you logged) didn't even technically air during the game. Mercedes-Benz teased its eventual spot Soul with 90-seconds worth of Kate Upton threatening to do her best Joy Harmon impression. (Teaser indeed.) It doesn't win points for cleverness, use of music, acting, or any compelling carness, but it proved that Mercedes' advertisers knew how to make a splash in the Internet Age. And, hey, it's still classier than every GoDaddy commercial. Kia, A Dream Car. For Real Life Like the Mercedes video above, the initial draw here is a pretty lady; in this case the always stunning Adriana Lima. But this Kia commercial really delivers the extra effort we expect while scarfing crabby snacks and homemades, too. First of all, Motley Crue. Second, a cowboy on a bucking rhino. Enjoy yet again.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.