Chevrolet: Corvette Base Coupe 2-door on 2040-cars

Minerva, Ohio, United States

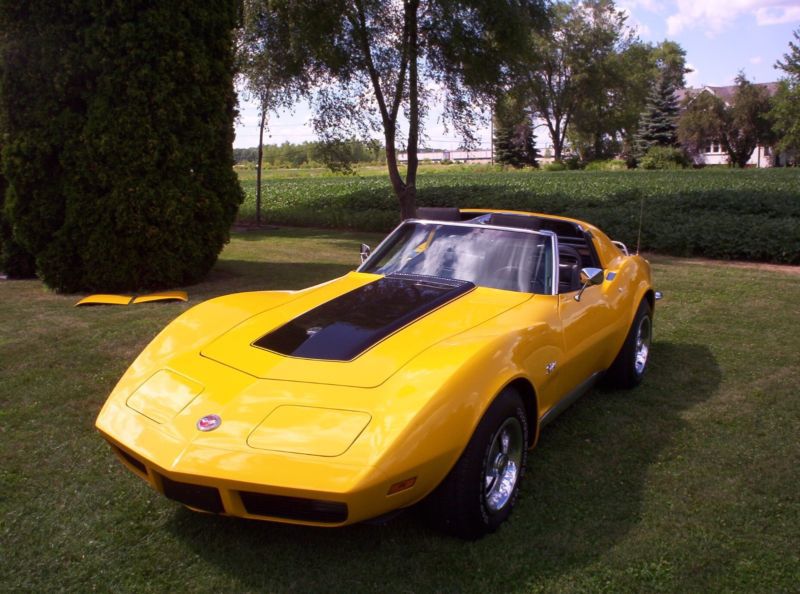

1998 Chevy Corvette.Comes with both tops- glass and painted.Car is in really good condition.Runs garagedSummer is right around the corner dont let this beauty slip away.

I will do my best to answer all questions as soon as possible. E-mail for contact : bartkv8mara@inmano.com

Chevrolet Corvette for Sale

1978 chevrolet corvette(US $13,650.00)

1978 chevrolet corvette(US $13,650.00) 1991 chevrolet corvette(US $2,900.00)

1991 chevrolet corvette(US $2,900.00) 1973 chevrolet corvette(US $16,185.00)

1973 chevrolet corvette(US $16,185.00) 1967 chevrolet corvette sting ray(US $15,600.00)

1967 chevrolet corvette sting ray(US $15,600.00) Chevrolet: corvette 2 door coupe t-tops(US $8,400.00)

Chevrolet: corvette 2 door coupe t-tops(US $8,400.00) Chevrolet: corvette z06 coupe 2-door(US $19,000.00)

Chevrolet: corvette z06 coupe 2-door(US $19,000.00)

Auto Services in Ohio

World Import Automotive Inc ★★★★★

Westerville Auto Group ★★★★★

W & W Auto Tech ★★★★★

Vendetta Towing Inc. ★★★★★

Van`s Tire ★★★★★

Tri County Tire Inc ★★★★★

Auto blog

Autoblog fan favorite car ads from Super Bowl XLIX

Mon, Feb 2 2015Super Bowl XLIX is in the books, and the New England Patriots emerged victorious. Of course, if you're like us, the big game wasn't so much about the battle between the east coast and west, so much as a fight between the world's automotive advertisers. We collected and collated all of last night's new ads and put them together for you to vote on. And yes, we're limiting this year's contest to last night's new features. That's why you aren't seeing Dodge's epic Wisdom among our collection of commercials, and it's a similar story with Chevrolet's Truck Guy Focus Group series, which highlights the new Colorado. You can still vote for your favorites. We won't be closing the voting on our Super Bowl page, so while the winners and losers are correct as of this writing, it's entirely possible that there could be some changes in the rankings as time goes on. So, without any further ado, here are the winning ads based on your voting. Nissan: With Dad Fiat: Ready For Action Jeep: Beautiful Lands BMW: Newfangled Idea Mercedes-Benz: Fable NASCAR: America Start Your Engines As for those ads that failed to impact you, loyal readers, Toyota was the absolute, undisputed loser. The Japanese brand ran four ads in total – two for Toyota and two for Lexus – and all of them have negative tallies as of this writing. Lexus' Make Some Noise and Lets Play and Toyota's One Bold Choice and My Bold Dad both had very weak showings among the commercials that aired, although they weren't alone. Neither Mazda nor Kia scored particularly well, despite featuring celebrity magic act Penn and Teller and former James Bond, Pierce Brosnan, respectively. Chevrolet was the winner of the losers, as of our writing, recording the fewest downvotes for its audience-punking The Big Game ad. If you want to take a second look at the losing ads, you can head back to our Super Bowl page for the complete collection. But for now, head into Comments and let us know what you think of the results.

2020 Chevy Trax and Buick Encore spied testing

Tue, Aug 14 2018We just recently saw a little crossover SUV from General Motors being tested, and we weren't positive what brand it belonged to. We narrowed it down to Chevy or GMC, but we're feeling more confident that it's a GMC now, since both the next generation Chevy Trax and Buick Encore subcompact crossover SUVs have been spied testing together. Of the two, the Chevy has the more radically different sheet metal. It ditches the somewhat frumpy, lumpy shape of the current Trax for a body inspired by the bigger Chevy Blazer. The roofline has sharp corners, and the hood is wide and flat. The front fascia, though obscured, shows the most connection to the bigger crossover. It has the same split headlight configuration, and it looks as though the grille takes up a sizable section of the fascia. View 7 Photos The Buick Encore on the other hand looks evolutionary in design. The body still has plenty of curves, and the distinctive, sharply rising window sill are all hallmarks of the current Encore design. The headlights and grille are similar, too, though the grille appears to be slightly updated to fit in with the Enclave and Regal. It's understandable that Buick might want to play it safe with the new Encore, since the model is Buick's best seller, selling about 23,000 units in the last quarter, nearly twice that of the next best performer, the Enclave. Since this is the first time we've seen these little crossovers, we expect it will still be a year or two before we get to see them fully revealed. They will probably continue to use small-displacement turbocharged four-cylinder engines with either front- or all-wheel drive. Related Video:

Chevy Bolt 200-mile EV going into production near Detroit

Thu, Feb 12 2015Where there's smoke, there's fire, apparently. The rumors of the Chevy Bolt going into production have been proven correct, with an announcement this morning at the Chicago Auto Show that the 200-mile, all-electric Bolt will be built at the Orion Assembly facility near Detroit. GM didn't say exactly when the Bolt will be built, but GM North America president Alan Batey said in a statement that, "We are moving quickly because of its potential to completely shake up the status quo for electric vehicles." He's not kidding. GM is talking about a $30,000 price tag for an EV that can do twice as many electric miles as any non-Tesla mass-production EV today. Previous hints have the Bolt starting production next year for a market debut in 2017, and with all of the accuracy we've seen from these secret releases up to now, we're going to say this is probably accurate until we hear otherwise. We still have questions about the price tag, but for now we'll try to track down more information here in Chicago. Chevrolet Commits to Bolt EV Production Game-changing, long-range EV to be built at Orion Assembly facility in Michigan CHICAGO – Chevrolet this morning confirmed production of its next-generation pure electric vehicle, based on the Bolt EV concept. It will be built at General Motors' Orion Assembly facility near Detroit. GM North America President Alan Batey made the announcement ahead of the Chicago Auto Show. The Bolt EV concept was introduced last month at the North American International Auto Show in Detroit. "The message from consumers about the Bolt EV concept was clear and unequivocal: Build it," said Batey. "We are moving quickly because of its potential to completely shake up the status quo for electric vehicles." Leveraging the industry-leading battery technology found in the Chevrolet Volt and Spark EV, the Bolt EV concept was developed as a game-changing, long-range pure electric for all 50 states, designed to offer more than a GM-estimated 200 miles of range at a target price of around $30,000. The progressively styled concept vehicle features selectable driving modes for preferred driving styles, such as daily commuting, and it was designed to support DC fast charging. "We're proud that Chevrolet has decided to produce the Bolt EV here in Michigan at the Orion Assembly facility," Gov. Rick Snyder said. "Michigan unquestionably remains the global automotive leader.