1982 Corvette on 2040-cars

Gallup, New Mexico, United States

Body Type:Coupe

Vehicle Title:Clear

Engine:350

Fuel Type:Gasoline

For Sale By:owner

Number of Cylinders: 8

Make: Chevrolet

Model: Corvette

Trim: STD

Power Options: Air Conditioning

Drive Type: Automatic Trans

Mileage: 62,858

Exterior Color: Black

Number of Doors: 2

Chevrolet Corvette for Sale

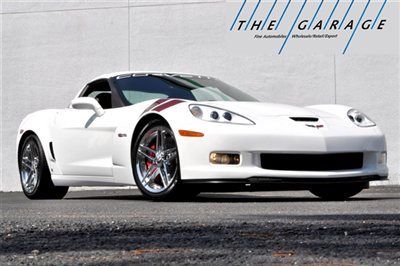

2007 chevrolet corvette 1 of 399 ron fellows alms gt1 champ edit only 12 miles!!(US $69,900.00)

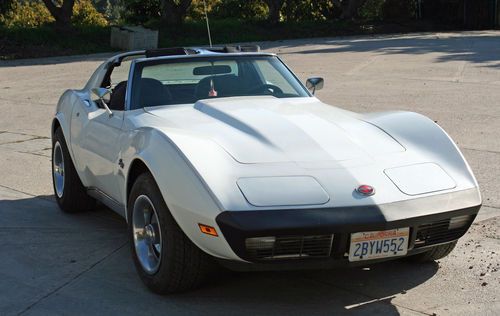

2007 chevrolet corvette 1 of 399 ron fellows alms gt1 champ edit only 12 miles!!(US $69,900.00) 1974 chevrolet corvette no reserve auction california registered

1974 chevrolet corvette no reserve auction california registered 2009 chevrolet corvette z06 coupe 2-door 7.0l

2009 chevrolet corvette z06 coupe 2-door 7.0l Coupe 1sc c5 ls1 350 hp leather power seats hud heads up automatic 12 cd bose(US $19,788.00)

Coupe 1sc c5 ls1 350 hp leather power seats hud heads up automatic 12 cd bose(US $19,788.00) 1996 corvette grand sport #378

1996 corvette grand sport #378 86 corvette c4(US $2,500.00)

86 corvette c4(US $2,500.00)

Auto Services in New Mexico

XpectMore AutoMotive ★★★★★

Viva Mitsubishi ★★★★★

Southwest Gear ★★★★★

S & V Automotive ★★★★★

Northside Auto Repair, Inc. ★★★★★

New Mexico Auto Wholesalers ★★★★★

Auto blog

Peter Max staring down $1M lawsuit over Corvette collection sale

Wed, Dec 17 2014Pop artist Peter Max recently sold off his collection of 36 vintage Chevrolet Corvettes – one each from 1953 to 1989 – for an undisclosed amount. The new owners have already announced plans to restore some of them and auction the models off sometime soon. Up until then, the sports cars had been languishing in various garages around New York City for decades and were caked in dust and grime. However, Max's end of the transaction has just become more complicated, because two men are suing the artist claiming he employed them to complete the deal first. The men allege that Max hired them to broker the sale of the 36 Corvettes in exchange for a 10-percent commission, according to the New York Post. They claim to have emails and text messages proving the existence of the deal, and are taking Max to court for $1 million over the squabble. The collection of Corvettes was amassed in 1989 as part of a prize package from the television network VH1, and Max bought the cars from the winner intending on using them for an art project. He never got around to it, though, and parked the sports cars around New York, until he finally sold them over the summer.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

Chevy exec confirms SS production model reveal at Daytona on Feb 16

Wed, 06 Feb 2013The 2014 Chevrolet SS will make its racing debut for the 2013 Daytona 500, but the production version of the car will get its official unveiling on February 16 in Daytona, a week before The Great American Race. According to a report by Automotive News, the reveal has been confirmed by Jim Campbell, Chevy's US vice president of performance and motorsports. With the departure of the Dodge Charger, the new Chevrolet racecar will be the only competitor to feature a V8, rear-wheel-drive layout in both street and NASCAR form.

NASCAR fans will be able to see the new fullsize performance-oriented sedan on display in the festivities leading up to the Daytona 500, but the car won't go on sale until later in the year. The Australian-built Chevy SS will be a low-volume performance model, and it will be priced above the 2014 Impala, which starts at $27,535.