1961 Corvette Convertible, 327, 3-speed Manual, Needs Paint, Runs & Drives Good on 2040-cars

Murfreesboro, Tennessee, United States

Body Type:Convertible

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Model: Corvette

Mileage: 3,698

Warranty: Vehicle does NOT have an existing warranty

Exterior Color: Green

Interior Color: Black

Number of Cylinders: 8

Chevrolet Corvette for Sale

3lt & z15 heritage package navigation bluetooth & bose heated memory leather(US $48,999.00)

3lt & z15 heritage package navigation bluetooth & bose heated memory leather(US $48,999.00) 1988 35th anniversary corvette

1988 35th anniversary corvette 1988 chevrolet corvette base hatchback 2-door 5.7l

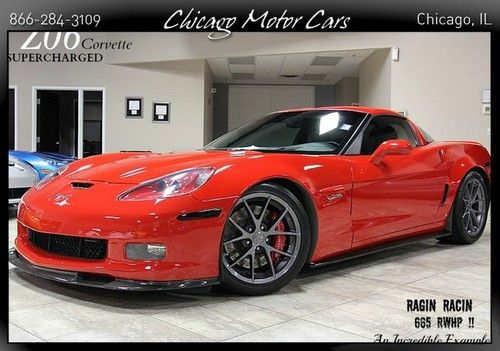

1988 chevrolet corvette base hatchback 2-door 5.7l 2009 chevrolet corvette z06 3lz supercharged over 700 horsepower! $40k upgrades(US $69,800.00)

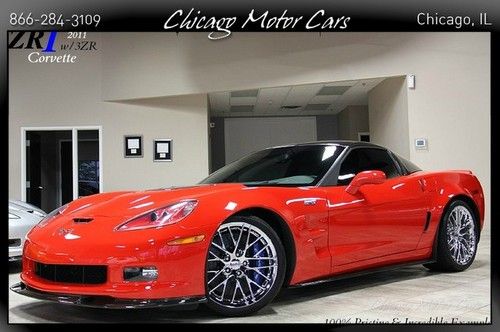

2009 chevrolet corvette z06 3lz supercharged over 700 horsepower! $40k upgrades(US $69,800.00) 2011 chevrolet corvette zr1 w/3zr only 1238 miles! navigation chromes loaded!$$(US $89,800.00)

2011 chevrolet corvette zr1 w/3zr only 1238 miles! navigation chromes loaded!$$(US $89,800.00) 1976 chevrolet corvette stingray l-48 , low miles

1976 chevrolet corvette stingray l-48 , low miles

Auto Services in Tennessee

Wheel Doctor ★★★★★

Super Express Lube ★★★★★

Service Plus Automotive ★★★★★

Reagan`s Muffler ★★★★★

Rays Auto Works ★★★★★

Pewitt Brothers Tune And Tire Service ★★★★★

Auto blog

We really want to use an eCrate to restomod an old GM car. Here's what we'd build

Fri, Oct 30 2020You hopefully saw the news today of GM's introduction of its Connect and Cruise eCrate motor and battery package, which effectively makes the Bolt's electric motor, battery pack and myriad other elements available to, ah, bolt into a different vehicle. It's the same concept as installing a gasoline-powered crate motor into a classic car, but with electricity and stuff. This, of course, got us thinking about what we'd stuff the eCrate into. Before we got too ahead of ourselves, however, we discovered that the eCrate battery pack is literally the Bolt EV pack in not only capacity but size and shape. In other words, you need to have enough space in the vehicle to place and/or stuff roughly 60% of a Chevy Bolt's length. It's not a big car, but that's still an awful lot of real estate. There's a reason GM chose to simply plop the pack into the bed and cargo area of old full-size SUVs. Well that, and having a rear suspension beefy enough to handle about 1,000 pounds of batteries. So after that buzz kill, we still wanted to peruse the GM back catalog for classics we'd love to see transformed into an electric restomod that might be able to swallow all that battery ... maybe ... possibly ... whatever, saws and blow torches exist for a reason. 1971 Buick Riviera Consumer Editor Jeremy Korzeniewski: If you’re going to build an electric conversion, why not do it with style? ThatÂ’s why IÂ’m choosing a 1971-1973 Buick Riviera. You know, the one with the big glass boat-tail rear end that ends in a pointy V. Being a rather large vehicle with a big sloping fastback shape, IÂ’m hoping thereÂ’s enough room in the trunk and back seat to pack in the requisite battery pack. That would likely require cutting away some of the metal bulkhead that supports the rear seatback, but not so much that a wee bit of structural bracing couldnÂ’t shore things up. The big 455-cubic-inch Buick V8 up front will obviously have to go. Remember, this was the 1970s, so despite all that displacement, the Riviera only had around 250 horsepower (depending on the year and the trim level). So the electric motorÂ’s 200 horsepower and 266 pound-feet of torque ought to work as an acceptable replacement.  1982 Chevrolet S10 Associate Editor Byron Hurd: OK, so the name "E-10" is already taken by a completely different truck, but let's not let labels get in the way of a fun idea.

2014 Chevy Silverado, GMC Sierra full configurators truck in

Sat, 15 Jun 2013You can now put prices to your wildest option-sheet dreams of the 2014 Chevrolet Silverado and GMC Sierra. A microsite for the full-size pickup truck twins has been up since January, and now the full-blown configurator is live and ready to take your virtual orders. The only two chassis configurations available at the moment are the Crew Cab with either a short or standard bed - Regular and Double Cab versions will come later. In Silverado flavors that will run you $32,710 for the short box, $33,010 for the standard box, while the Sierra adds a $1,500 premium to both of those prices, and destination and handling for both models adds another $995.

Since these are American pickups the list of modifications is lengthy, but we added $11,450 in just two steps by starting with the Silverado Crew Cab and standard bed, then checking four-wheel drive and the LTZ Z71 package. Our final truck, resplendent in Brownstone Metallic paint, heated and cooled Cocoa/Dune perforated leather seating and tasty details like chrome recovery hooks, and engine block heater and LED cargo box lighting, rang up $57,285 at the candy store.

They'll be on dealer lots sometime this summer, so now's a good time to start practicing your box-checking.

Want a V8 on the cheap? Buy a work truck

Thu, Aug 3 2017In case you didn't notice, V8 cars have gotten pretty expensive. If you want a modern muscle car like the Dodge Challenger R/T, Ford Mustang GT, or Chevy Camaro SS, you'll need between $34,000 and $38,000 for a stripped out example of one. The cheapest of those is the Challenger, and the priciest is the Camaro. These are also the cheapest V8 cars the companies offer. But if you absolutely have to have a V8 for less, there is an option, work trucks. As it turns out, all of the Big Three offer their most basic work trucks with V8s. And because they're so basic, they're pretty affordable, especially when sticking with the standard two-wheel drive. A Ram 1500 Tradesman with a V8 can be had for as little as $29,840, which is a little more than $4,000 less than a Challenger R/T. For a bit more at $30,275, you can have a Chevy Silverado W/T, almost $8,000 less than a Camaro SS. The most expensive is the V8 Ford F-150 starts at a starting price of $30,670, which is a bit over $5,000 less than the Mustang. Of course you'll be in an ultra bare bones vehicle with few comforts, and the price will go up if you add stuff, but we're bargain hunting here, and sacrifices are sometimes necessary. Besides, what you lose in comfort, you gain in loads of cargo space and towing (try to look at the bright side). Also, as a side note, all three trucks are available with optional electronic locking rear differentials. At the discounted price of these trucks, you still get a heaping helping of power. The most potent of the trio is the Ram 1500 Tradesman with 395 horsepower and 410 pound-feet of torque generated by a 5.7-liter V8. Compared with the Challenger R/T, the Ram is up by 20 horsepower and they're tied for torque. The value proposition is even more stark between the two vehicles when looking at the price per horsepower. Each pony in the Ram costs $75.54, while the Challenger charges you $90.91. The Challenger is also more expensive per horsepower than its close competitors. The F-150's 5.0-liter V8 is just barely behind the Ram with 395 horsepower and 400 pound-feet of torque. That's still more power than the Challenger, and it matches the torque of the 2017 Mustang GT. On the down side, it still would be down 20 horsepower on that same 2017 Mustang, and it's behind by 60 horsepower and 20 pound-feet on the new 2018 Mustang GT. The F-150 also just edges out the Mustang in the dollar per horsepower measure.