Chevrolet Corvette for Sale

1989 chevrolet corvette no reserve!!! won't last

1989 chevrolet corvette no reserve!!! won't last Only 5,900 miles! automatic, fully loaded, removable tops, absolutely immaculate(US $24,999.00)

Only 5,900 miles! automatic, fully loaded, removable tops, absolutely immaculate(US $24,999.00) 1985 corvette coupe

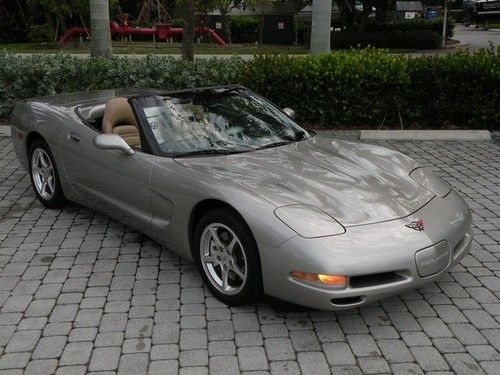

1985 corvette coupe 02 corvette convertible automatic bose leather sport seats polished wheels hud(US $25,900.00)

02 corvette convertible automatic bose leather sport seats polished wheels hud(US $25,900.00) 2003 chevrolet corvette z06 coupe 2-door 5.7l(US $27,500.00)

2003 chevrolet corvette z06 coupe 2-door 5.7l(US $27,500.00)

Auto blog

Recharge Wrap-up: Phoenix Cars delivers ZEUS to Navy, Volt saves gas compared to i-MiEV

Thu, Apr 23 2015Phoenix Cars has delivered its first Zero Emissions Utility Shuttle (ZEUS) flatbed truck to the US Navy. The electric flatbed will be used to transport maintenance materials around Naval Base Ventura County Port Hueneme. The Phoenix ZEUS features a 100-mile range, and can charge in just three hours. It also features vehicle-to-grid technology and direct power capability, allowing it to function as a mobile power station. ZEUS customers enjoy an eight-year/300,000-mile battery warranty and round-the-clock technical support from Phoenix. Phoenix launched an electric passenger shuttle last year, and years ago worked on an electric sport utility truck before shifting over to larger vehicles. Read more in the press release from Phoenix Cars. A man found that he used less gas by trading in his Mitsubishi i-MiEV for a Chevrolet Volt. Ben Rich saved fuel in part by using his Volt for road trips rather than needing to rent cars. Rich also found other benefits to driving a Volt, including more comfort, more freedom of movement and less range anxiety. Rich often had to turn off the heat in the winter to eke out precious miles in the Mitsubishi, which he needn't do in the Chevy, though he did have a gripe about the Volt using the gas motor to warm the car. Read more at Green Car Reports. EV drivers using the ChargePoint network have traveled over 196 million miles without gasoline. ChargePoint has tallied over 9 million charging sessions for a total of 65 gigawatt hours of energy. Based on national efficiency averages of three miles per kWh and 23.9 miles per gallon, this has saved 8.2 million gallons of gasoline and 60 million pounds of CO2. This accounts for what ChargePoint calls a "huge environmental impact." Read more in the release from ChargePoint below. The Environmental Impact of ChargePoint Drivers Campbell, Calif.– We all know electric vehicles (EV) have enormous environmental advantages over gas vehicles. Plug-in EVs reduce carbon-based greenhouse gases, improve air quality and reduce our dependence on fossil fuels. EV drivers on the ChargePoint network have had a huge environmental impact. With over 9 million charging sessions delivering 65 gigawatt hours of energy, EV drivers have avoided over 60 million pounds of CO2 and 8.2 million gallons of gasoline, and driven over 196 million gas-free miles. *Based on national averages: EV efficiency of 3 miles per kWh, gas efficiency of 23.9 mpg and a net savings of 0.924 pounds of CO2 per kWh.

GM recalls full-size truck, SUVs and vans over faulty shifter mechanism

Mon, 07 Jan 2013Twelve different General Motors vehicles from the 2013 model year, up to 54,686 units in total, are being recalled over two potential issues with their steering columns. The models in question, all full-size trucks, SUVs or vans, are the: Cadillac Escalade, Escalade ESV, Escalade EXT, Chevrolet Avalanche, Express, Silverado, Suburban, Tahoe, and GMC Savana, Sierra, Yukon and Yukon XL.

The affected vehicles were built with a fractured parking lock cable or "a malformed steering column lock actuator gear in the lock module assembly." As a consequence, they could shift out of park without the brake pedal being applied or with the key removed or in the off position.

A bulletin from the National Highway Traffic Safety Administration indicates that the recall should begin on January 17. GM will notify owners, at which time they can take their vehicles to their dealers for repair free of charge. Have a look at the bulletin below for more information.

Buick Encore, Chevy Trax earn Top Safety Pick from IIHS [w/video]

Thu, Feb 12 2015The Buick Encore has been a massive sales success practically from the moment it debuted, and Buick recently decided to increase production to keep up with demand for the premium compact crossover. The Insurance Institute for Highway Safety recently put one to the test again, and the Encore earned a Top Safety Pick award. It's the first model from the brand to score the nod since 2013, according to the IIHS, and the rating also carries over to the 2015 Chevrolet Trax. The 2015 Encore scored a Good rating in all of the IIHS' evaluations, including the 40-mile-per-hour, small overlap front crash test. That was a big improvement over the previous model the institute tested, which scored a Poor result in the overlap test. In the first test, about 13 inches of the lower door hinge pillar came into the passenger compartment, and the steering wheel airbag moved too far to protect the dummy's head. Improvements for the latest model year showed six inches of intrusion this time, and the airbags caught the dummy's head well. The dummy's sensors also indicated a low risk of injury. The two CUVs missed out on the full Top Safety Pick+ because the IIHS scored the Encore as only having a basic front crash prevention system, and there was no such equipment for the Trax. To earn the highest mark, models need at least an advanced rating by the institute for this technology. Buick Encore, Chevrolet Trax earn 2015 TOP SAFETY PICK award ARLINGTON, Va. - A small SUV is the first vehicle from the Buick brand to qualify for a TOP SAFETY PICK award from the Insurance Institute for Highway Safety since 2013. The Buick Encore's newly introduced, lower-priced twin, the Chevrolet Trax, also qualifies for the honor. The Encore's award follows improvements to the SUV's structure for better small overlap front protection. The 2015 model earns a good rating in the small overlap test. In contrast, the 2013-14 Encore rated poor in the test. The driver's space was seriously compromised with intrusion measuring as much as 13 inches at the lower door hinge pillar. The dummy's head barely contacted the front airbag before sliding off the left side, as the steering column moved to the right. The side curtain airbag deployed too late and didn't have sufficient forward coverage to protect the head. In the latest test, the driver space was maintained reasonably well, with maximum intrusion of 6 inches at the door hinge pillar and instrument panel. The dummy's movement was well-controlled.