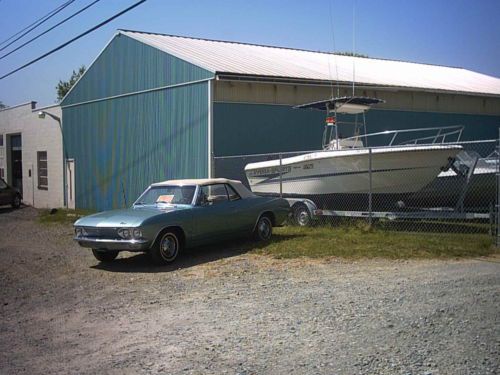

2 Door Silver Covertible With White Soft Top And Red Interior on 2040-cars

Uniontown, Pennsylvania, United States

|

1964 Corvair Spyder Convertible Silver with original Red Interior (new carpet). 66,228 original miles. 4 speed manual. Turbo has been rebuilt, all seals replaced last year. New white top and boot. Original AM/FM radio and wheels. Runs great and in very good condition.

|

Chevrolet Corvair for Sale

1965 chevrolet corvair corsa convertible with videos

1965 chevrolet corvair corsa convertible with videos 1962 chevy corvair monza 900(US $5,000.00)

1962 chevy corvair monza 900(US $5,000.00) Collectable corvair convertible car 1965(US $10,900.00)

Collectable corvair convertible car 1965(US $10,900.00) 1964 chevy corvair spider(US $13,000.00)

1964 chevy corvair spider(US $13,000.00) 1963 chevrolet corvair 900 monza 4-door

1963 chevrolet corvair 900 monza 4-door 1964 corvair monza convertible survivor original barn find turbo spyder

1964 corvair monza convertible survivor original barn find turbo spyder

Auto Services in Pennsylvania

Yorkshire Garage & Auto Sales ★★★★★

Willis Honda ★★★★★

Used Car World West Liberty ★★★★★

Usa Gas ★★★★★

Trone Service Station ★★★★★

Tri State Preowned ★★★★★

Auto blog

Super Bowl LVII car commercial roundup: Watch them all here

Mon, Feb 13 2023Fewer automakers than usual spent money advertising during Super Bowl LVII. In total, there were only five traditional ad spots from three big OEMs. A number of car-adjacent ads aired during the Big Game, too, and we’ll bring you those ads in this roundup alongside the more obvious ones. WeÂ’ve compiled all of the automotive-related commercials for you here in this post so you donÂ’t have to go searching for them elsewhere. Read on below to see what aired as the Kansas City Chiefs defeated the Philadelphia Eagles. Ram's Super Bowl spot offers a cure for 'Premature Electrification' This commercial revealed the new electric Ram Rev pickup, and itÂ’s themed like a prescription ad for an antidote to "Premature Electrification.” A concerned narrator in the Ram spot asks if you're afraid that going electric too soon will mean "you might not be able to last as long as you like," and there's a guy on a pier who's going to need some new equipment if he wants to catch fish. We're also told there are "options being designed to extend range in satisfying ways," so if this truck isn't right for you, you have choices. All the commercial's missing is a silly medical marketing name and six seconds of speed-reading gibberish about side effects like intestinal bleeding and death. Which are two more good things. Jeep 4xe Super Bowl commercial highlights modern version of 'Electric Boogie' JeepÂ’s “Electric Boogie” commercial follows the Wrangler 4xe and Grand Cherokee 4xe in a variety of simulated off-road situations. Though fun, the soundtrack is the real star of the show. The songÂ’s original artist, Marcia Griffiths, was joined by Grammy winner Shaggy, Jamila Falak, Amber Lee, and Moyann on the track. The modernized re-recording celebrates 40 years since GriffithsÂ’ original track, and Jeep says the track is available for streaming now. Kia returns to the Super Bowl with the tale of 'Binky Dad' This year, Kia follows the adventure of "Binky Dad" in his quest to fetch his daughter's lost pacifier, which naturally takes him over just about every bit of terrain you might encounter upon leaving the civilized confines of Southern California for the not-so-civilized mountains of ... probably also California. It features the refreshed 2023 Kia Telluride, which probably doesnÂ’t need much advertising to see these days, but Kia went for it with the strong three-row SUV anyway.

Anti-purist 1963 Ferrari GTE sports hot rod Chevy V8

Thu, Oct 8 2015I remember reading a story around the time Fast and Furious: Tokyo Drift came out. It focused on one of the star cars of that film, a 1967 Ford Mustang fastback that started the film as a shell, and in a pinch, was transformed into a modified masterpiece, complete with the RB26DETT engine from a Nissan Skyline GT-R (which started the film under the hood of an S15 Silvia). There was a genuine (and in our minds, absurd) fear in the article that taking a piece of classic American iron and fitting a twin-turbocharged JDM engine would result in some awful trend in the classic car community. If you thought a GT-R-powered classic Mustang was sacrilege, though, this car will probably make you vomit. For the rest of us, it's a neat piece of engineering. Shown above is a 1963 Ferrari 250 GTE, and yes, that's a 302-cubic-inch, small-block Chevrolet V8 under the hood. On top of that, it uses the six-speed manual transmission from a Viper, a nine-inch Ford rear end, and Mitsubishi-sourced paint. So yeah, it's a FrankenFerrari. Check out Road Heads' interview with this custom GTE's owner, which is followed by a brief test drive. And of course, head into Comments afterwards, and let us know what you think. Is this Yankee-powered 250 GTE blasphemous or badass?

GM applies for LT5, LTX trademarks... are new small block variants coming?

Mon, 29 Apr 2013Recently discovered General Motors trademark applications for LT4, LT5, LT88 and LTX have observers wondering what kind of high-performance offerings could be on their way. A new LT4 would mark a return of the engine designation first used on the Corvette Grand Sport, SLP Pontiac Firehawk and SLP Chevrolet Camaro SS from 1996 and 1997. Supposition at Corvette Forum - which provided advance intel on the C7 like these leaked images - believes a new LT4 could go into the high-performance trim of the next-gen, 2015 Camaro that would be more powerful than the 580-horsepower Camaro ZL1.

Seeing an LT5 again would also be déjà vu - in its former life it was a 5.7-liter V8 for the C4 Corvette ZR-1 from 1990-1994 designed by Lotus, producing from 370 hp to 405 hp. A mix of rumor and hope is that the new LT5 will be a supercharged evolution of the 6.2-liter LT1 (pictured) placed in the new C7 Corvette, and that it will go into the C7 version of the ZR1 pumping out something like 700 hp.

The LTX trademark is, as with that last letter, a complete mystery. If the "X" isn't a generic way to denote the whole LT family, it's wondered if it LTX could refer to a crate motor offering like the LSX.