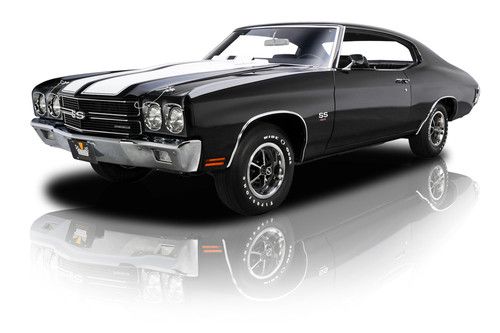

Documented Restored Chevelle Ss Ls6 454 M20 4 Speed on 2040-cars

Charlotte, NC, United States

Engine:454 LS6 V8

Body Type:Other

Vehicle Title:Clear

Exterior Color: Black

Make: Chevrolet

Interior Color: Black

Model: Chevelle

Mileage: 53,546

Sub Model: Super Sport

Number of doors: 2

Chevrolet Chevelle for Sale

Auto Services in North Carolina

Wilburn Auto Body Shop-Mooresville ★★★★★

Westover Lawn Mower Service ★★★★★

Truck Alterations ★★★★★

Troy Auto Sales ★★★★★

Thee Car Lot ★★★★★

T&E Tires and Service ★★★★★

Auto blog

NHTSA closes 4-year GM investigation, issues common sense advisory [w/video]

Thu, Apr 9 2015Since January 2011, the National Highway Traffic Safety Administration has been investigating a possible problem with corroding brake lines in General Motors' GMT800-platform models, like the Chevrolet Silverado and Suburban and GMC Sierra, in states with salt on their roads in the winter. However, as opposed to launching a full recall of millions of vehicles, the government is issuing a common-sense safety advisory to all drivers in snowy states to keep their vehicle's undercarriage clean. It even has a video explaining things. "Older-model vehicles, often driven in harsh conditions, are subject to corrosion over long periods of time, and we need owners to be vigilant about ensuring they, their passengers, and others on the roads are safe," said NHTSA Administrator Mark Rosekind in the announcement of the end of the investigation. The agency was clear in its report that "brake line corrosion seen in the GM vehicles was not unique," and the government "has not identified a defect that would initiate a recall order." Instead NHTSA is advising drivers, especially those of vehicles from before 2007, to wash their vehicle's undercarriage in the winter and spring to remove salt or other de-icing chemicals. It also recommends regular checks by a mechanic to make sure everything is in proper order. According to the investigation documents, for just the GMT800 platform models, NHTSA found 3,645 complaints of brake line corrosion, which included allegations of 107 crashes and 40 injuries. The issue was found to be more common in vehicles over 10 years old. GM has released a statement (embedded below) that the company "supports the consumer advisory from NHTSA urging regular maintenance and care of brake lines on older vehicles." NHTSA Closes Investigation into Brake-Line Failures NHTSA 13-15 Thursday, April 9, 2015 Agency issues safety advisory on preventing undercarriage corrosion WASHINGTON – The Department of Transportation's National Highway Traffic Safety Administration (NHTSA) today issued a Safety Advisory and consumer video encouraging owners of model year 2007 and older trucks, SUVs and passenger cars to inspect brake lines and thoroughly wash the underside of their vehicles to remove corrosive salt after the long winter in order to prevent brake-line failures that increase the risk of a crash.

GM now finishing and shipping pickups it had parked for lack of chips

Fri, Oct 22 2021DETROIT — General Motors is more than halfway through shipping newly-assembled pickups that it had parked due to a shortage of semiconductor chips, a top executive at the No. 1 U.S. automaker said on Friday. "We've made great progress," Steve Carlisle, GM's North American chief executive said at the Reuters Events Automotive Summit. "We're a bit better than halfway through that at the moment and our goal would be to clear out our '21 model years by the end of the year. We'll have a bit of a tail of '22 model years into the new year but not for too long." The global chip shortage has forced automakers like GM to idle production or in some cases mostly build vehicles and then park them until the necessary chips can be installed, allowing those vehicles to be then shipped to dealers. Last month, GM Chief Financial Officer Paul Jacobson cautioned that GM's third-quarter wholesale deliveries could be down by 200,000 vehicles because of chip shortages. He did not break out what share of that was trucks. To expedite transportation of newly-built vehicles to dealers, Carlisle said GM bought a number of car haulers to deliver them from factories or distribution centers. The Detroit automaker has also allowed dealers to pick the vehicles up themselves in some locations. Carlisle said new vehicle inventories have shrunk to below 20 days in the United States due to the supply chain disruptions, but the company wants to get that back up to 30 to 45 days with some getting to 60 days depending on the product line. GM sees sales of gasoline-powered vehicles being steady over the decade and real growth opportunity in electric vehicles and software, with one not undermining the other, he said. Â

Weekly Recap: The implications of strong new car sales

Sat, Jun 6 2015New car sales are on a roll in the United States this year, and analysts are optimistic the industry will maintain its torrid pace. Sales increased 1.6 percent in May and reached an eye-popping seasonally-adjusted selling rate of 17.8 million, the strongest pace since July 2005, according TrueCar research. That positions the industry for one of its strongest years ever, as consumer confidence, low interest rates, low fuel costs, and an influx of new products propel gains. In addition to the positive economic factors, May also featured warmer weather across much of the US, an extra weekend, and it came on the heels of relatively weak April sales. Analysts suggest income tax refunds and the promise of summer driving and vacations also traditionally help May sales. "While 2015 will be one of the best years in the history of the US industry, in some ways it may be the very best ever," IHS Automotive analyst Tom Libby wrote in a commentary. "Not only are new vehicle registration volumes approaching the record levels of the early 2000s, but now registrations and production capacity are much more closely aligned so the industry is much more healthy." Capacity, an indicator of the auto sector's health, is also expected to grow. Morgan Stanley predicts it will eventually hit at least 20 million units per year, as many companies, including General Motors, Ford, Tesla, and Volvo are investing in new or upgraded factories. "The best predictor of US auto sales is the growth in capacity, and frankly, we're losing count of all of the additions – there's literally something new and big every week," Morgan Stanley said in a research note. Transaction prices, another telling indicator, also continue to show strength. They rose four percent in May to $32,452 per vehicle, and incentives dropped $10 per vehicle to $2,661, TrueCar said. "New vehicle sector and segment preference indicates consumers are confident about the economy and their finances," TrueCar president John Krafcik said in a statement. Still, Morgan Stanley noted the robust sales did little to immediately impact automaker stock prices and suggested it might be a prime time to sell if sales reach the 18-million pace. "Perhaps the biggest reason may be that investors have seen this movie before," the firm wrote.

1971 chevelle wagon

1971 chevelle wagon 1972 chevelle malibu 350 original family owned one owner yellow repainted clean

1972 chevelle malibu 350 original family owned one owner yellow repainted clean 1970 chevelle malibu

1970 chevelle malibu 1968 chevrolet chevelle ss l35 396 ci fully restored numbers matching big block!

1968 chevrolet chevelle ss l35 396 ci fully restored numbers matching big block! 1970 chevelle ls6

1970 chevelle ls6 1974 chevy chevelle laguna

1974 chevy chevelle laguna